By Sammy Suzuki, Kent Hargis and Christopher Marx

Though stable stocks are expensive and look vulnerable to rising interest rates, we still see ways to build a winning defensive portfolio. But it’ll take some unconventional thinking.

The need for smoother-ride equity strategies is as acute as ever, in our view. Though stocks have been remarkably resilient since the surprising results of the U.S. election, the markets are likely to remain jittery as they continue to absorb unfolding economic and geopolitical repercussions. And, let’s not forget, stable stocks have an impressive track record. Thanks in part to their shock-absorbing qualities, they’ve outperformed the market over full cycles—even, on average, when they’ve been expensive.

Today, however, traditional safe haven stocks are selling at hefty premiums, just as yields look ripe for a reversal after 30 years of steady declines. This is a dramatic break with the past, calling for new terms of engagement. As we see it, safeguarding against downside risks will require far more creativity than in the past—and mechanical, passive approaches just aren’t up to the task.

The Past Is Not Prologue

Looking at history, hard-core low-volatility investors may say, so what’s the big deal?

Here’s the problem: When stable stocks are expensive, their performance becomes far more dependent on the subsequent macroeconomic outcome. Consider the following: In the middle of 2008, before the global financial crisis, investors dived into steady earners like cereal-maker Kellogg amid growing fears of various looming crises. Then their worst fears came true. At that juncture, investors wanted safety at all costs, and pricey Kellogg went on to hugely outperform economically sensitive names like, say, Ford.

Now, imagine if the global financial crisis hadn’t happened after that period of nervousness. Relieved investors would have rushed out of high-priced Kellogg—and steadier names broadly—and into the far brighter opportunities in cheaper, racier beneficiaries like Ford.

Here’s another issue: Rate sensitivity intensifies when rates are extremely low. Bond investors call this convexity: If yields are at 6% and move up or down by 1%, bond prices will rise or fall by a certain amount. But if yields are closer to zero—say 2%—the effect of a 1% move on bond prices will be bigger.

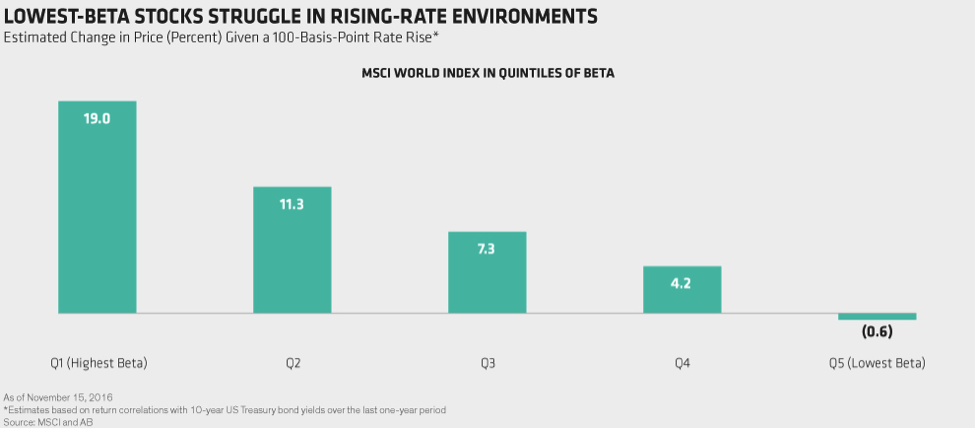

Given their bond-like nature, stable stocks are also prone to convexity. That means they will be more vulnerable to rising rates—and improving risk appetites—than they have been in the past. And their elevated valuations only amplify the risks.

Normal No More

Under normal conditions, stable stocks are not especially reliant on the eventual macroeconomic fundamentals. But these aren’t normal times. So, the question is: how do you build a defensive portfolio when stability is expensive and hypersensitive to macro shifts?

One idea would be to barbell the portfolio by adding some of the riskiest, most cyclical stocks. But that’s no answer. Under current conditions, these volatile stocks are just as macro dependent as their even-tempered peers—but in the opposite direction. If rates rise along with an improving economy, then these high-octane stocks will perform spectacularly. But if rates fall because the economy is souring, investors could get wiped out. That’s like buying a bank stock pre-crisis.

The Solution: Be Rate Agnostic

A better solution is to preserve the solid defenses of stable, high-quality companies while staying rate agnostic. How? By steering clear of the quintessential bond proxies in real estate, utilities, telecom and certain portions of the consumer-staples sector. They are the most expensive and the most rate sensitive (Display).

Instead, scale up to the next level of stability. This group includes companies with high and sustainable profitability and healthy balance sheets. These companies may also be a bit more cyclical or controversial than their more placid peers. Examples are banks and insurers in countries where these industries are highly concentrated, or specialty chemical and software companies with strong pricing power. As these descriptions suggest, hunting in this territory is research intensive.

There’s a tradeoff. These names won’t provide as much downside protection in an Armageddon scenario. On the other hand, they are less pricey than their more bond-like counterparts, and less susceptible to a rate reversal. As such, they should perform well regardless of the macro outlook.

Passive low-volatility approaches look especially defenseless in the face of these massive macro shifts. Two-thirds of the MSCI World Minimum Volatility Index is in the most bond-like 20% of global stocks, currently trading at an 8% premium to the market. Indeed, so far this quarter, the index has trailed the broad market downturn by 3.7%.

This is no time to give up on defensive investing, in our view. But conditions on the ground are changing, and smoother-ride equity strategies must change with them. Merely focusing on measures of volatility will no longer work in the current environment, in our view. Hamstrung passive index trackers appear especially vulnerable. For long-term, outcome-oriented investors, we think a thoughtful, fundamentals-driven approach that can tap opportunity and avoid risk is the better solution for the times ahead.

Sammy Suzuki is Portfolio Manager of Strategic Core Equities at AllianceBernstein.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.