Phoenix: "It seems to me that clients are more loyal than your research indicates," said Jim during the Q&A following my speech. "Why aren't clients changing advisors if they're so dissatisfied?"

As I told the audience, Jim was asking a great question and one that I'm frequently asked. But my answer is a lot more direct as I outlined the realities of today regarding affluent investors and financial advisors. All of which points directly towards advisors working diligently to make certain they are becoming New World Advisors. Jim's question was addressing two components of our New World Advisor: affluent loyalty and business development.

Although this newsletter is focused on affluent loyalty, it's important to understand how closely linked business development and affluent loyalty have become. The reason more affluent clients haven't switched advisors is because they have yet to discover a better alternative. In the aggregate, financial advisors have done an abysmal job of marketing their services to today's highly skeptical and demanding affluent investor. This simple fact has afforded advisors a window of opportunity to strengthen the loyalty of their affluent clients.

Nothing can destroy an affluent client relationship more quickly than a financial advisor’s failure to deliver on all promises. Typically, when an advisor is courting a client he or she will make a number of promises, many of them having little or nothing to do with the portfolio's performance. This is a dangerous approach if the advisor is not sure he can follow through. As I explained to Jim's group, our research tells us that 8 of 10 affluent clients are dissatisfied enough that they would consider changing advisors if they knew of a better option.

This highlights an opportunity on two fronts:

1. First, advisors can be confident that the majority of affluent households in their market are viable prospects.

2. Second, the best advisors are constantly and feverishly working on developing loyalty among their affluent clients, because only loyal clients will allow an advisor to contact their centers of influence.

Affluent Loyalty Factors

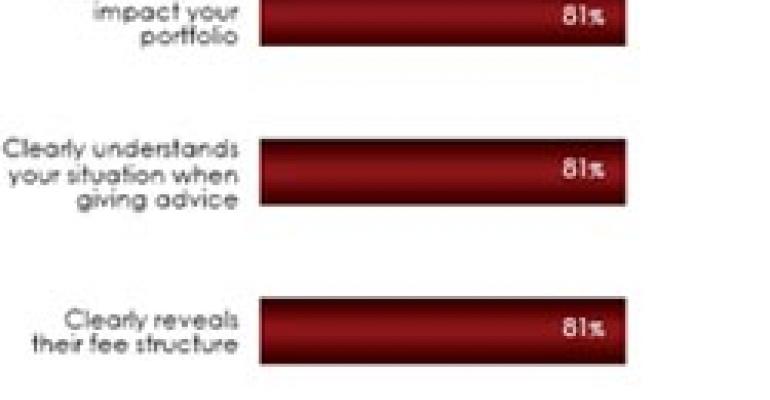

The best advisors, what I like to call “New World Advisors,” understand the importance of developing loyal affluent clients and realize that affluent loyalty must be earned over time. It is important to understand the difference between loyalty and satisfaction. Loyalty is a long-term behavior that is earned, while satisfaction is a short-term emotional response. Loyalty transcends client satisfaction, which is merely the minimum requirement for earning affluent loyalty. Our research has identified 7 criteria that directly impact affluent loyalty. Let me share them with you...

The seven criteria should not be viewed in isolation, they must be considered along with the 16 criteria today's affluent consider to be important (Wealth Management Component) and the statistically significant performance gaps within each. If advisors are not able to perform up to expectations in areas that are considered important to their affluent clients, the loyalty of these clients is further diminished.

Loyal Team Members

It should come as no surprise that in addition to loyal clients, New World Advisors have also earned the loyalty of their personnel. Whether it's a personal assistant, a junior advisor, a subject expert, or referral alliance with an outside professional, these relationships are built to last. Elite advisors understand the fact that having loyal personnel can lead to loyal clients. The affluent do not like change and a revolving door of team members raises a red flag. It also makes it difficult to deliver first class service.

To earn the loyalty of their affluent clients, New World Advisors embrace the concept of Kaizen (ongoing improvement) in every aspect of their business. This involves all team members, not only do they have clear roles and responsibilities (practice management component), they share common work values. There is no bickering over work ethic. As the graph below illustrates, 36 percent of those who didn't lose any clients over the past year rated "exceptionally well" in this category.

Loyalty is a two-way street; your behavior impacts the behavior of others—in this instance, your affluent clients or and personnel. So much of it revolves around building relationships, clearly explaining what you will do and then doing what you've said, maintaining clear an open communication within a healthy working environment and going beyond expectations. A simple activity that many New World Advisors engage in is "surprising and delighting" their affluent clients. They have discovered a relationship secret—small personal touches go a long way. None of this is rocket science, but it requires commitment and work.

If you want to learn more about how elite advisors "surprise and delight" their affluent clients and prospects - you can sign up for our FREE teleconference.

When I write about the Business Development component of our New World Advisor model, you will discover how inextricably linked affluent loyalty and rainmaking have become.

Once again, we want to thank all of you who have emailed comments and questions to us. We will continue to do our best to answer each one.

If you have any topic suggestions or special requests, please contact Rich Santos, publisher of Registered Rep. and Trust & Estates magazines, at [email protected].