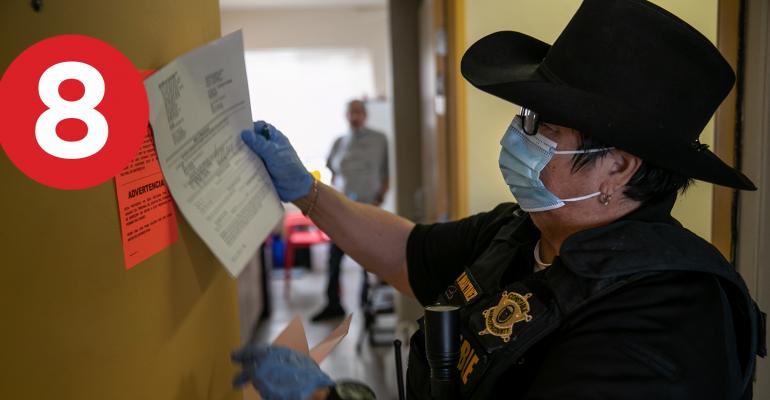

- States Grapple with Next Steps on Evictions as Crisis Grows “Ryan Bowser looked somber as he sat in his cramped Oregon apartment, worried whether he, his pregnant girlfriend and her 10-year-old daughter would have a roof over their heads in the new year. It may well depend on state lawmakers. The family is three months behind on the $1,165 in rent they pay for their two-bedroom unit in the college town of Corvallis. Bowser, a custodian at Oregon State University, took eight weeks off because he was sick and couldn’t afford child care.” (Associated Press)

- Private Equity Giant KKR Expects 2021 Economy Will Be Stronger Than Anything Seen Before “In its annual global macroeconomic trends report published Thursday morning, a team of KKR economists led by Henry McVey, head of global macro and asset allocation, foresees a favorable cocktail of economic factors unlike anything seen in decades. As the world becomes inoculated from the Coronavirus and many businesses reopen and recover, KKR expects governments and central banks around the world to remain committed to stimulus measures. Put together, the firm predicts a post-pandemic recovery that could dramatically outperform its disappointing 2008 counterpart.” (Forbes)

- Building Permits Rise 6.2% in November Despite Pandemic “The number of newly issued permits to build fresh housing rose 6.2% in November on a seasonally adjusted basis. Housing starts rose 1.2%, and are 12.8% higher than a year ago, the Commerce Department reported Thursday, to an annualized rate of 1.547 million. Building permits totaled 1.64 million annualized units. The figure remains up 8.5% from a year earlier, as the housing market remains one the strongest parts of the U.S. economy despite the widespread pandemic and increased lockdowns.” (Associated Press)

- Five Ways the Coronavirus Pandemic Is Reshaping the Future of Retail Stores “In coming years, retailers that want to survive and thrive in this new era of commerce should rethink their store layouts and make features like curbside pickup permanent, to meet shoppers’ changing needs, according to a report released Thursday from CBRE, a commercial real estate services firm.” (CNBC)

- NYC Seeks Partner to Vet Proptech Tools for its Real Estate “One of the biggest property owners in the tri-state area wants to add more proptech to its real estate.” (Commercial Observer)

- NMHC’s Bibby: This Too Shall Pass “We are almost 10 months into the pandemic and resulting economic downturn. It’s been a year for the history books with its unprecedented challenges for the multifamily industry and our residents. However, in this time, a few things have become clear. Some segments of our industry are dealing with some serious hurdles today, and the outlook remains cloudy, at least in the near term, for the apartment market at large. But the silver lining is that the industry continues to adapt and innovate to meet the demand that is in the market, in every way, shape, and form.” (Multifamily Executive)

- These Brooklyn Businesses Survived the Pandemic’s First Nine Months. But January Looks Bleak without Another PPP Loan “The Garage, which specializes in shooting TV commercials for food and beverage companies, has seen business bounce back since the economy reopened. But it has not booked a single job for January. Sahadi Fine Foods, a wholesale and retail imported food business, is once again bustling with customers at its stores in Industry City and on Atlantic Avenue in Brooklyn. But its restaurant clients are having trouble paying their bills and 10% of them closed permanently even before the recent suspension of limited indoor dining.” (The City)

- Hudson Pacific, Macerich Create Program for Los Angeles Artists Impacted by COVID-19 “Hudson Pacific Properties, Inc. and Macerich announced they will fast-track more than $650,000 to artists in Los Angeles impacted by COVID-19 through the creation of the Vibrant Cities Arts Grant. The funds are associated with the One Westside project, a joint venture between Hudson Pacific and Macerich, which is converting the former Westside Pavilion mall into Google’s newest Los Angeles campus. The City of Los Angeles Department of Cultural Affairs’ (DCA) Private Arts Development Fee Program requires owners to pay an arts fee associated with private development projects.” (Nareit)

1 comment

Hide comments