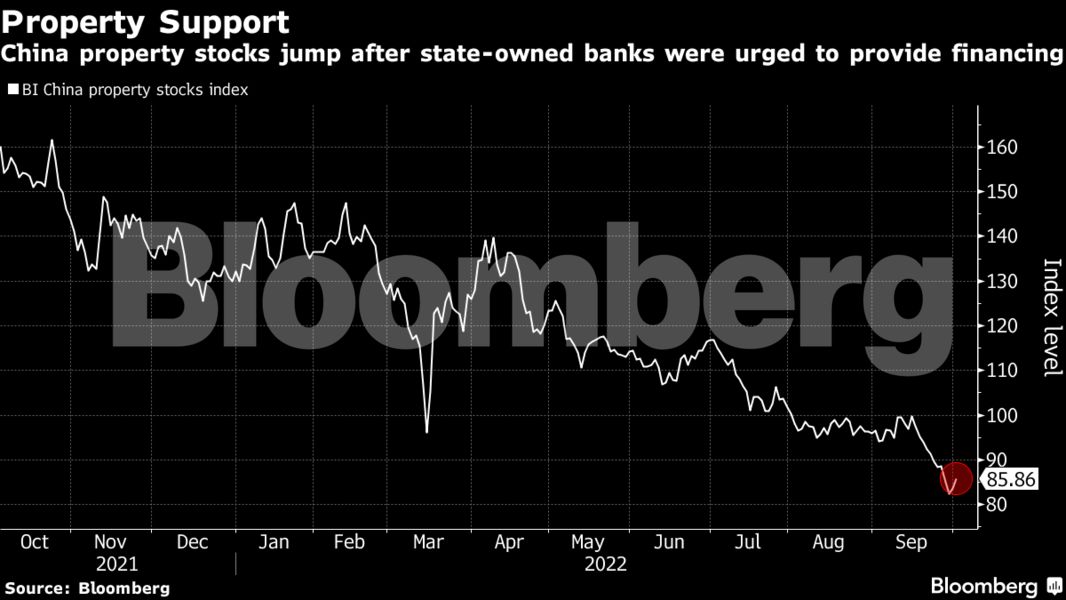

(Bloomberg) -- Optimism that the worst of China’s property slump is over boosted markets after Bloomberg reported that regulators told the biggest state-owned banks to provide financing worth at least $85 billion to the embattled sector.

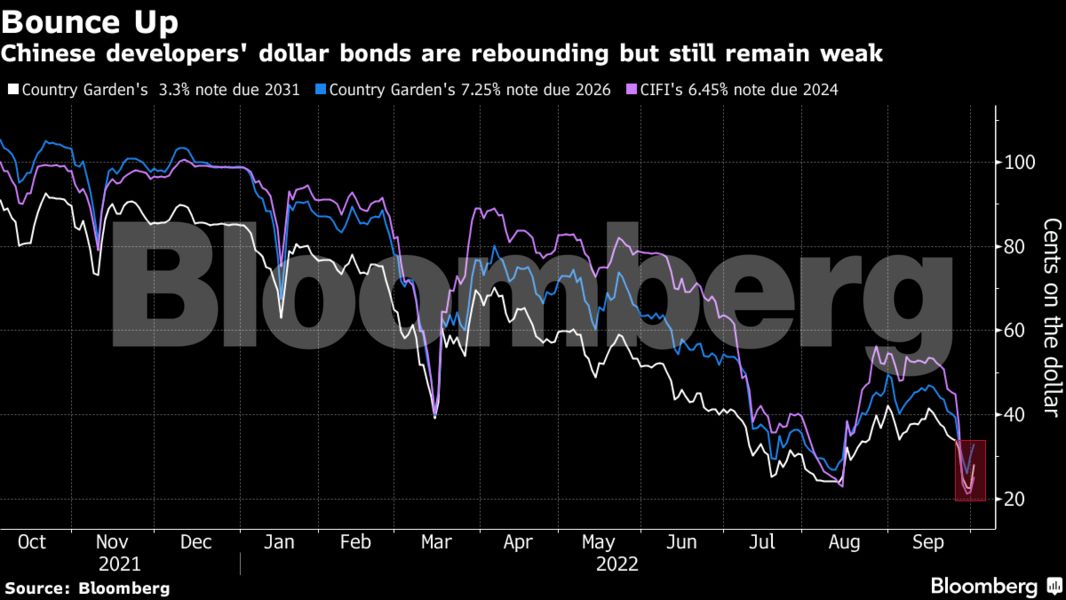

KWG Group Holdings Ltd. and Country Garden Holdings Co. shares jumped more 8% on Monday, helping lift a gauge of real estate stocks by as much as 2.6%. Meanwhile, higher-rated developer dollar bonds rebounded, with some notes snapping a two-week losing streak. Mainland markets are closed this week for a holiday.

The buying spree comes after the People’s Bank of China and the China Banking and Insurance Regulatory Commission told the six largest banks to each offer at least 100 billion yuan ($14.1 billion) of financing support, including mortgages, loans to developers and purchases of their bonds, people familiar with the matter told Bloomberg News.

Read more: China Tells Banks to Provide $85 Billion in Property Funding (1)

Bets are growing that authorities will take more action to stem a property slump ahead of the twice-a-decade Communist Party congress mid-October. A slowdown in China’s vast real estate sector, along with Covid Zero restrictions, has weighed on the world’s second-largest economy for more than a year.

“We believe this adds weight to the long list of ongoing easing measures for the property sector, and suggests the worst time of property tightening is likely behind us,” Citigroup analysts including Judy Zhang wrote in a note.

Among measures already announced, policymakers have encouraged local governments to ease curbs on homebuying and asked lenders to meet reasonable financing needs of developers. More recently, China also unveiled a rare tax incentive for homebuyers on Friday, while the nation’s central bank lowered interest rates on housing provident fund loans for first-home buyers.

For other key Asian markets stories:

- Yen Weakens Past 145 Per Dollar, Nears Prior Intervention Levels

- Blackstone, KKR Defy Global Private Debt Slump With Bets on Asia

- Goldman Sachs Sees ‘Historic Value’ in Singapore Rate Premiums

Analysts expect property stocks to be the key beneficiaries from the outcome of the leadership gathering, where Xi Jinping is expected to solidify an unprecedented third term and set the stage for new economic policies.

The timing could not be soon enough. Economists are turning more bearish about China’s economy, downgrading their growth forecasts given lingering risks from the property market as well as sporadic Covid lockdowns. Some doubt whether the measures announced so far will be sufficient enough to reverse the property slump.

The funding news is in line with policies announced via various regulators in the past six to nine months to support the sector, according to Zhi Wei Feng, a senior analyst at Loomis Sayles Investments Asia. “The intention is good, but the effectiveness is uncertain as the market is getting from bad to worse since the beginning of 2022 and there is no sign of any recovery.”

Here is what other analysts are saying:

Chang Shu, chief Asia economist for Bloomberg Economics:

- China’s latest measures aimed at stoking housing demand will reduce the tail risk of a market crash but doesn’t alter the “underlying misalignment between supply and demand that’s driving the property rout”

- While measures reinforce that policy is turning more supportive, “developers remain distressed with broken business models. The latest policies won’t change that, nor stop the long-term decline in housing demand”

Steven Leung, executive director at UOB Kay Hian Ltd:

- “The market is focused on the Party Congress later this month and policies on the property market will be the most important to judge on whether this crisis is coming to an end.”

- The size of the loan is big compared to the level in the first half, which is vital and helps developer cash flow.

Create Lee, investment manager at Monmonkey Group Asset Management Ltd.:

- The news may ease investor worry because of further policy relaxation expectations and can boost sentiment in the short term. However, longer term prospects still depend on buyer confidence.

Leonard Law, senior credit analyst at Lucror Analytics:

- “The financing support is likely to have a greater benefit for SOE developers, in the absence of any explicit language that the policy is targeted at private developers.”

- Banks would be remain keen to control their risk exposure to the property sector and only lend to the stronger names

- “For private and distressed developers, we expect the main focus is still to ensure housing delivery, rather than directly supporting their bonds.”

--With assistance from Catherine Ngai and Alice Huang.

© 2022 Bloomberg L.P.