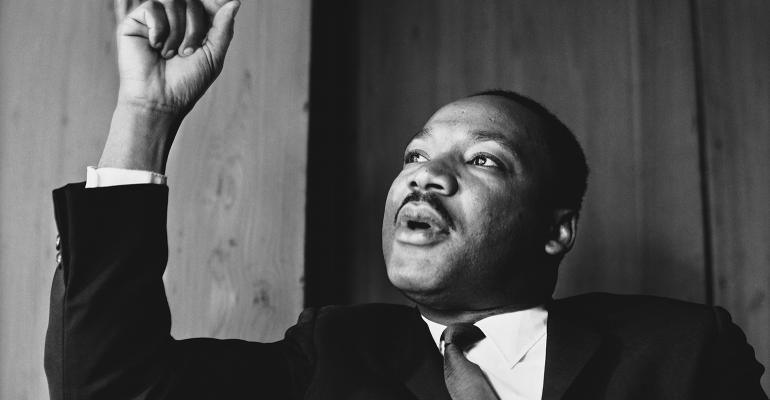

On April 3, 1968—the day before he was assassinated, Dr. Martin Luther King Jr. delivered a speech in Memphis, Tenn., that is poignantly relevant today: nonviolence and economic guard rails are effective methods of leaning toward justice:

We don't have to argue with anybody. We don't have to curse and go around acting bad with our words. We don't need any bricks and bottles, we don't need any Molotov cocktails, we just need to go around to these stores, and to these massive industries in our country, and say, "God sent us by here, to say to you that you're not treating his children right. And we've come by here to ask you to make the first item on your agenda fair treatment, where God's children are concerned. Now, if you are not prepared to do that, we do have an agenda that we must follow. And our agenda calls for withdrawing economic support from you."

Excerpt from Dr. Martin Luther King, Jr.’s “I Have Been to the Mountaintop” address delivered at Bishop Charles Mason Temple

I encourage you to read the whole speech, as the single excerpt is only a small paragraph of a powerful message.

Dr. King outlined a clear, powerful, and peaceful pathway for everyday people to use their financial resources to invest in social justice: establish investment guard rails to keep your money from flowing to companies and organizations that exacerbate social injustice.

Dr. King goes on to outline a clear example that is still relevant today: consider depositing a portion of a cash position in a Black-led bank or credit union. Financial advisors may explore online resources like Mighty Deposits to search for banks or credit unions that best match a social justice investor’s dual objectives of sustainable financial earnings coupled with social justice returns.

For example, Hope Credit Union is the only depository institution in Itta Bena, a small, majority Black Mississippi Delta town with a poverty rate of 42% and a median household income of $20,400. Working within areas of persistent poverty, Hope Credit Union must import capital from beyond its local geography to finance small businesses, housing, healthcare and other vital needs. With its successful track record, Hope Credit Union has expanded beyond Itta Bena to drive non-predatory capital to communities across America’s Deep South. To facilitate widespread investor interest in its vision, Hope Credit Union offers Transformational Deposits available to investors outside its footprint in the Deep South.

On this Martin Luther King Jr. Day, Americans remember the powerful and effective messages of nonviolence and justice. Though Dr. King was assassinated more than half a century ago, his practical advice of establishing investment guard rails remains relevant today.

With the rising tide of millennial investors demanding products and strategies that align with their values, financial advisors have the resources they need to build an investment pathway that connects Dr. King’s teachings with investment products available to today’s investors.

Andrea Longton, CFA, is the founder of The Social Justice Investor. You can follow Andrea on LinkedIn and Twitter.