What do you think are the top fears of Americans today? It’s not public speaking, heights, spiders, snakes or even terrorism. Not even close—today’s top fears are much more practical.

I thought it might be interesting to veer off slightly from the prototypical financial articles (marketing, sales, practice management, teams, etc.) and take a peek into the psyche of Americans today. For the past five years, Chapman University has been conducting research into the fears of everyday Americans. The topics covered the gamut from the environment, the government, terrorism, finances, health, disasters, technology, guns and more.

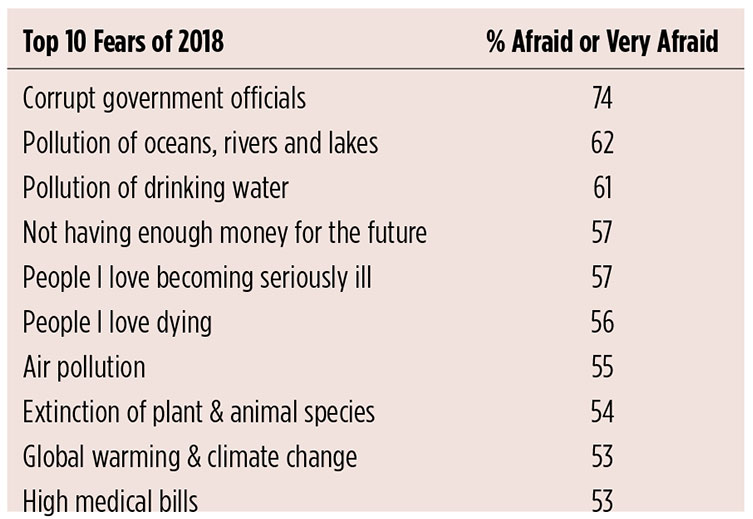

As you peruse the “Top 10 Fears of 2018,” it’s important to keep in mind that you’re looking at fears that the “highest percentage of Americans reported being afraid or very afraid of (you could also translate this into being worried about). Which is why you need to be thinking of how all of this information relates to your role in overseeing the multidimensional aspects of your clients’ financial affairs (what Oechsli Institute research says your affluent clients want).

Apparently, government corruption has been the top fear for the past four years, and it’s risen from 60.6% in 2016. However, to put this in context, the researchers have seen a trend in which fear in general has been rising.

Let’s examine some of these fears and discuss their financial advisor implications.

Not having enough money for the future

The fact that Americans worry about running out of money is not a new phenomenon; we’ve known for years that most don’t have a financial plan and don’t save enough. It speaks to the need for financial advisors to reassure clients when they are on track and to offer course corrections when they are not. This is yet another differentiator between a true financial advisor and an automated advice platform, or so-called robo advisor, solution.

People I love becoming seriously ill and/or dying

Now we’re entering the realm of generational transference, which highlights the importance of conducting family financial summits. This is where you, as the family’s financial advisor, lead meetings between all family members: parents, children and even grandparents. If you’re not directly involved in creating your client’s estate plan, you want to be organizing the process, attending all the meetings and offering guidance.

This fear of illness and death also highlights the importance of succession planning within your financial business. Not only are baby boomers retiring, many have had their personal physician, their dentist and other service providers retire. And just because you might not be thinking about retiring, the odds are that your clients are having conversations about that very possibility within their families. All of which provides an opportunity for financial advisors who’ve prepared themselves to address these issues, actively positioning their younger advisor(s) on the team as topical experts and making certain clients have met them and understand their value.

Pollution of oceans, rivers and lakes

The fact that environmental fears have become so prominent (five of the top 10) is another future indicator. Your clients are concerned about the lifestyles of their children and grandchildren. Are you well-versed in the environmental, social and governance (ESG) investing options available? For some clients this is becoming as important, if not more so, than how the stock market’s been performing of late.

A useful exercise might be to simply sit down with each client (you could even do a series of lunch-and-learns) and share these top 10 fears and then have a discussion.

Do be careful with the corruption of government officials fear, as this is not a partisan issue, it’s about a corrupt political system, and there’s enough blame to go around for both parties. It’s best to position yourself as a political atheist regarding this issue. Your challenge, if you wish to accept it, is to help your clients address the future while simultaneously mitigating any of their fears.

Matt Oechsli is author of Building a Successful 21st Century Financial Practice: Attracting, Servicing & Retaining Affluent Clients. www.oechsli.com