The financial advice industry is highly focused on client service. Ambitious advisors typically seek to provide an exceptional service experience right out of the gate to gain their new clients’ trust. And most aim to maintain, or even exceed, that high level of attention throughout the relationship to limit client turnover.

But evidence Herbers & Company has gathered from working with thousands of advisory firms over nearly two decades strongly suggests that over time, this approach can backfire. Don’t get us wrong; client service is critically important. However, sustaining high-touch service after a relationship’s first two years creates diminishing returns in terms of client retention. Perhaps more importantly, it limits firms’ ability to respond to client requests immediately. In fact, the firms that earn the highest client trust and enjoy the strongest organic growth are those that deliberately lower their level of client service after the first two years of a client relationship, in favor of more on-demand service to the client.

Now, this idea is counterintuitive and when we present this science to most advisory firms, they reject it. Most advisors are surprised or skeptical. To understand the logic of deliberately paying less attention to clients over time, let’s look at a hypothetical financial advice client.

This is a satisfied client, in the third and fourth years of his advisor engagement. He fully trusts his advisor. He understands the process for achieving his goals. He feels secure and stable. This client is as sticky as they come.

The client expects, and receives, regular articles and newsletters from his advisor, annual portfolio reviews, and, most important, quick and immediate responses when he calls the office with a need. He knows his advisor (or team of advisors) will be there to steer him through any challenges that arise, and all he has to do is call. This client knows he won’t hear from his advisor every quarter to check in. He doesn’t expect his advisor to invite him to lunch. He doesn’t get pestered about whether he’s satisfied. There is deep trust.

In this scenario, the advisor has long since pulled back on the high-touch service that marked the beginning of the relationship. Together, client and advisor are doing the ongoing work of executing the client’s financial plan, rebalancing the portfolio, diligent asset allocation, and savings and tax plans. All is well. Having established trust with this client has gotten him on track, and the client is happy.

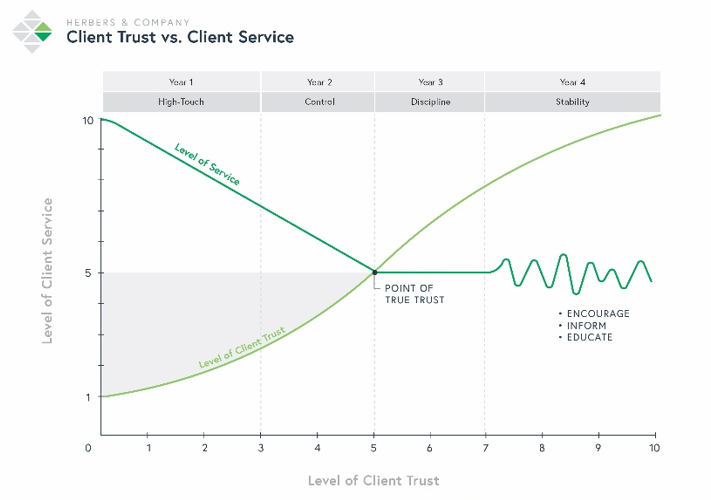

The firms with the highest client retention and the strongest new-client growth use the client experience model described above: They systematically move clients from high-touch to a stable baseline of service, freeing bandwidth for an advisor to be available in a moment’s notice. Figure 1 below shows how this client experience unfolds over time:

Year one: Maximum high-touch attention. From careful discovery to helping the client track down all her account information, to building the financial plan and investment portfolio, the advisor delivers the highest level of service in this first year. On average, five-plus meetings and all of this work establish confidence and trust in the client as she gains an understanding of who her advisor is, what he provides and how together they will achieve her goals.

Year two: Sharing control. In the second year of a relationship, a baseline level of trust has been created, the client has bought into the plan, and now she feels ownership and control over its execution. The advisor begins to transition from a maximum level of service to a maintenance level of service. In this phase of the relationship, the advisor is guiding and teaching the client how to communicate when she really needs help and the service an advisor continues to provide. Starting at the end of year one, the advisor has gradually lowered his level of attention, culminating at the end of year two, when the point of true trust occurs. After that point, this less intensive level of client service becomes the new baseline.

Year three: Settling into a rhythm. Year three is the most important year; the client has confidence in her advisor and feels empowered to create the financial future she has helped design. In the third year of the engagement, clients want to experience a sense of consistent execution of things like an annual meeting, quick returned phone calls and emails, all unfolding in a predictable rhythm. This is also the year in which the advisor begins to shift his communication with the client. Though communications remain consistent, less of them are personal. He might include firmwide market commentaries and educational blog posts along with information that’s of distinct interest to his particular client.

Year four and beyond: Stable and on track. This is the stability stage of the client’s journey; she is confidently on her way to her chosen destination. The advisor is communicating but not overcommunicating. Time-sensitive requests are addressed quickly, of course. The advisor is monitoring and rebalancing the client’s investment portfolio and reviewing it with the client every year. But this stage of the relationship is mostly about predictable, low-friction execution and maintenance of the plan.

That’s not to say the advisor in this scenario is on autopilot. He knows the trust he’s worked hard to establish can be lost if he’s not responsive to the client’s needs. And his high-touch service will kick in if and when she faces a divorce, windfall, market volatility or other disruption. During those periods, the advisor will educate, encourage, and provide guidance and perspective. He will restore the client’s sense of control, and soon the client will be back into a confident routine. At this point the advisor, comfortably fulfilling his duties, will have plenty of bandwidth for meeting the needs of the client when they call or email.

So what about the advisor who can’t seem to find enough time to care for existing clients and pursue new ones? In many cases, if not most, the problem is that the advisor is keeping client service near maximum, early-relationship levels—even if trust has been successfully established.

Not only is this unnecessary, but it is generally counterproductive. Clients are most confident and content when they’ve achieved a sense of empowerment and independence. Applying a year-one level of support and service undermines that achievement, regressing the relationship to an earlier stage that actually locks the advisor into a cycle of high service.

Advisors fall into this trap again and again, and the reason is that they misinterpret their clients’ silence. Once the early work that establishes trust and confidence has been completed and clients are following their plan and feeling confident, they won’t feel the need to interact with the advisor as much. Rather than interpreting that change in behavior as signaling satisfaction, the advisor takes it as a reason to worry: If a client is out of touch, could their loyalty be wavering? Concerned that they’re not doing enough to keep the client’s business, the advisor cranks up the high-touch service undermining client trust.

What advisors forget is that they’re always delivering value, even years into a relationship. They’re monitoring the market, updating financial plans and, as discretionary investment managers, taking on professional risk. They are there when clients need them, for matters large and small, simple and complex.

This is why we challenge advisors to rethink the relationship between client service and trust. In client relationships, the overriding goal is to earn and maintain trust. To do that, service levels must be high in the first year of a relationship, then they must moderate in the second year, and, with true trust having been achieved, they must stay at that new and consistent baseline from that point on, leaving much space to reply instantly to client requests.

Once you’ve achieved trust, use it to be available to clients when they need you most. Some days might be slower than others, but if advisors create the space to respond immediately, trust will keep the client better served.

Angie Herbers is the founder and CEO of Herbers & Co., and Brandon Moss is chief marketing officer and senior consultant at Herbers.