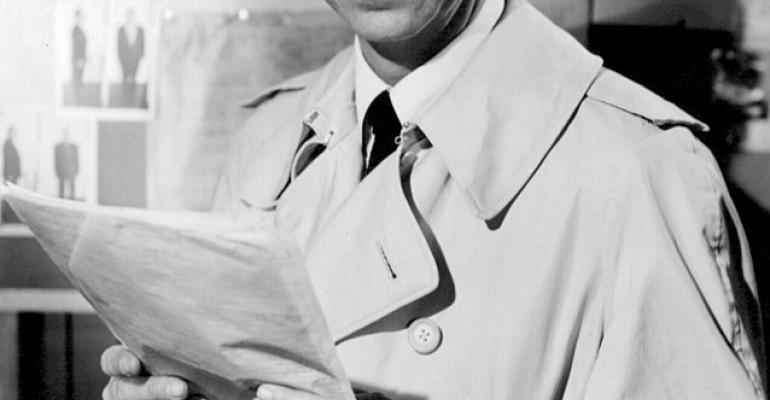

If Joe Friday, the fictional detective in the TV series “Dragnet,” was still alive he would love ADVs because they present just the facts about all RIA firms. The March 30 deadline to file your ADV has passed and the comprehensive information from these filings is now available to the public on the Investment Advisor Public disclosure website. The story you are about to read is true. I examined 20 ADVs from firms I know well, their names are not included to protect the guilty, BUT as a believer of the mantra “People who live in glass houses shouldn’t throw stones,” I will include my firm’s name when necessary.

Guide

The ADV data can be overwhelming because much of the filing is boilerplate information. One of the ADVs I examined was 491 pages. Don’t be disheartened because similar exhaustive information is also common in corporate filings found on the SEC Edgar website. There is helpful information on both websites if you know where to look. The ADV is broken into two parts, the ADV and ADV Part 2, also called the brochure.

You should start on the main ADV at Item 5, which breaks down the assets of the firm—discretionary and nondiscretionary. It also lists the number of accounts in each category. Your next stop should be Schedules A and B, which detail the Direct and Indirect Owners and Executive Officers. This section provides the ownership percentage of each listed person.

Finally, similar to SEC corporate filings, someone needs to sign and verify the information in the ADV. That person is an important check and balance.

The ADV Part 2 is where the gold is found. Great investors find gold in the footnotes of SEC filings. ADV gold starts at Item 2, which details any material changes since the last ADV filing. Item 5 details the fees charged and how the professionals are compensated. Item 10 details any affiliations such as other money management firms the RIA owns. Wonder if the DOL has an opinion on this section?

Observations

The ADV facts can reveal lower assets than marketing materials, sales pitches or interviews. Sanctuary is guilty here as our assets as a platform provider are not all listed on our ADV. They are listed on our network firms’ ADVs, and I combine them and share them with reporters when asked about our assets. Seven of the 20 ADVs I examined listed their detailed fee schedule and the remaining 13 listed a range. Sanctuary lists a range.

The big and oftentimes shocking news is recorded in the Material Changes Item. One of the ADVs I examined shared that their CEO had recently resigned. That information was not covered by the press and not listed on the company’s website.

The Facts

ADV facts can be helpful to current and prospective clients and to firms seeking information on their competition. For both groups, perceptions are not always realities. Your firm isn’t as far behind your competitors as you might think. For breakaway brokers, ADVs can replace the internal production rankings of their old firms. For clients, if there are items in the ADV that you weren’t aware of, ask your advisor about them. There may be a good explanation, or if the explanation is lacking, it might be a good time to find a new advisor—this is just good risk management.

Using ADV facts can be very helpful when considering new advisors too; ask each firm the following questions about their ADVs: Start with the number of accounts the firm services; a high account total could impact service and oversight. Fees and assets can help define financial stability. Concentrated ownership can create a risk of the owner being “bussed”.

Jack Welsh, the acclaimed ex-CEO of GE, required his managers to make decisions using the Six Sigma tool Management by Fact (MBF). ADVs allow you to manage your personal finances using the same process. Cut down the noise of the marketing pitches and make your decisions based on just the facts, ma’am. Joe would be proud of you.

Jeff Spears is Founder and CEO of Sanctuary Wealth Services, champion of the independent advisor and author of the acclaimed blog, Wealth Consigliere. Follow Jeff on Twitter and Facebook.