Okay, so retail investors did not totally miss this wild bull market (S&P up about 30% from Oct.4, 2011, lows). Again, retail investors have been yanking cash from U.S.-focused equity funds in favor of hybrid funds, bond funds, and, smartly, indexed ETFs.

An interesting observation from Leuthold. (As I wrote recently I have been wading through Leuthold's monthly gi-normous Green Book, 78 pages of heavy quant research but also surprisingly funny, where possible. For an institutional research periodical, the researchers have personality!)

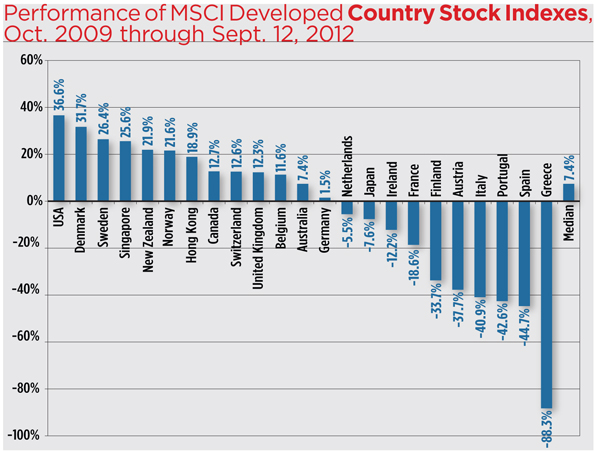

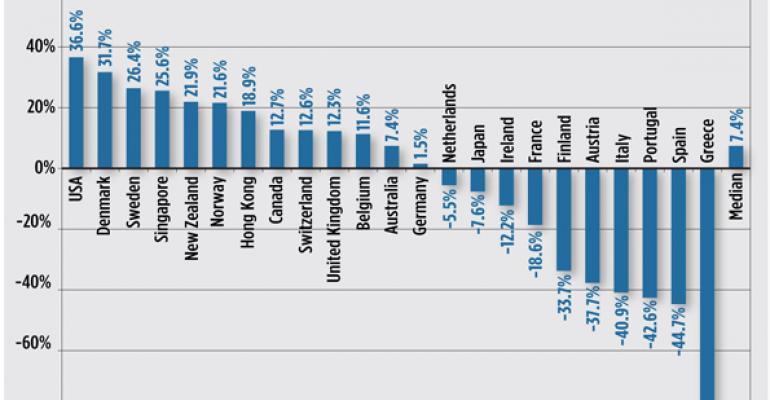

Senior Researcher Doug Ramsey writes in the October Green Book: the S&P is up by 30%--“a rally that surely ranks among the least enjoyable and least exploited gain of that magnitude in history. Neither the average U.S. stock nor many professionally managed portfolios have kept pace with these gains. Overseas stocks have fare even worse.

“We have generally referred to the 3.5-year-old bull market as a global one, but the U.S. did the heavy lifting over all but the first six months of the bull. The MSCI Worled ‘Ex USA’ Index is down 1.3% in the last three years and the MSCI Emerging Markets Index is up only 9.7% over the same period.

“. . . our disciplines have us tactically bullish on stocks globally . . . with the emphasis on ‘global.’”