Just over a third of advisors say they have a succession plan, but how viable is it and where are they getting the money to fund it? A new survey shows hitting up friends and family is still one of the more popular financing avenues to explore, but most are banking on their broker/dealers.

About 38 percent of advisors have a succession plan according to a new Aité Group study commissioned by Live Oak Bank. It’s much more common for an advisor to have a contingency plan in place—the survey found 75 percent of advisors with independent broker/dealers and 69 percent of advisors with RIAs had these stopgap measures in place.

But Live Oak’s Jason Carroll, managing director of the bank’s investment advisory division, says the question popping up most often in succession planning discussions with advisors is whether that plan is legally executable.

One of the first steps to making sure the plan is successful is finding financing—which is murky territory for many advisors. “In a vast majority of calls we get, the advisor is just starting to build a plan now, but is not sure how to do it,” says Mike McGinley, a senior loan officer with Live Oak.

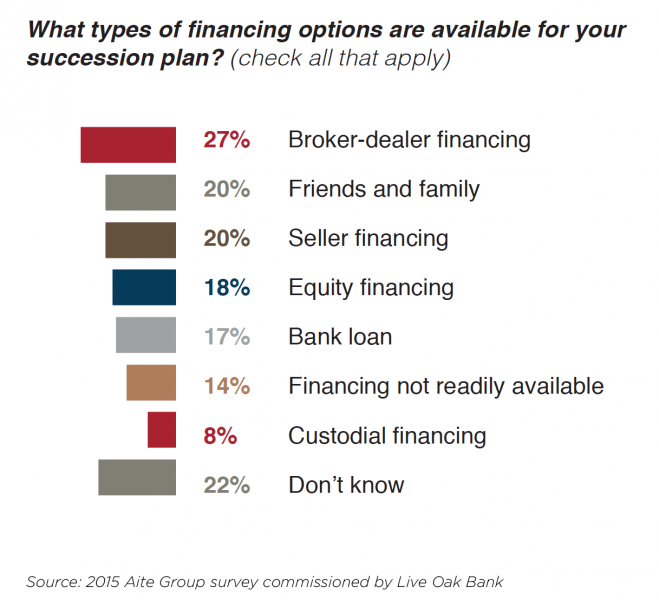

While broker-dealer is the most popular financing route (27 percent of advisors cited this method), about 20 percent of advisors who have succession plans say they plan to use financing from friends and family. Only 17 percent say they’ll use bank loans.

Additionally, Carroll says custodians are lending less, especially when it comes to deals around succession planning. “They want to spend to attract assets, not to retain assets,” he says. The data supports this, with only 8 percent of advisors saying that custodial financing is an option available to them.

The survey, which was circulated in Spring 2014, asked 375 financial advisors on their plans for transitioning their practices to a new generation of owners. Aité Group surveyed 100 advisors with RIAs, 73 with self-clearing firms and 52 affiliated with IBDs.