Critics of factor investing, and there are many, often claim the results of back-tested studies used to prove the worth of strategies built around a stock’s momentum, size or value are really just “mining the data” to make their point. The thesis shouldn’t hold up in other data sets. “If a researcher discovered an empirical result only because she tortured the data until it confessed, one would not expect it to work outside the torture zone,” writes AQR Founder Cliff Asness on his blog. But these “cynics are supping on thin gruel.” Asness looked at returns based on Eugene Fama and Ken French's three factors in a so-called “out of sample” period (roughly the time since they published their groundbreaking paper on the topic) and finds it still holds. “If at the end of 1991 you invested in these factors and achieved the above results you would be ecstatic without reservation," he writes.

Who Do the “Futurewealthy” Prefer to Work With?

You may not be able to be all things to all HNW people. The “futurewealthy”—those with an average net worth of $2.7 million today—prefer to work with a relationship manager over a product specialist by at least a factor of two to one when it comes to making most financial decisions, according to a new study by SEI. This group of up-and-coming high-net-worth investors would rather work with a relationship manager when it comes to financial planning (56 percent), help in selecting investment funds (53 percent) and in making direct investments in stocks and bonds (51 percent). But they preferred a specialist to help them get a loan or a mortgage. To conduct the survey, SEI polled 3,113 Americans who will likely make up the ultra-high-net-worth investors of the future.

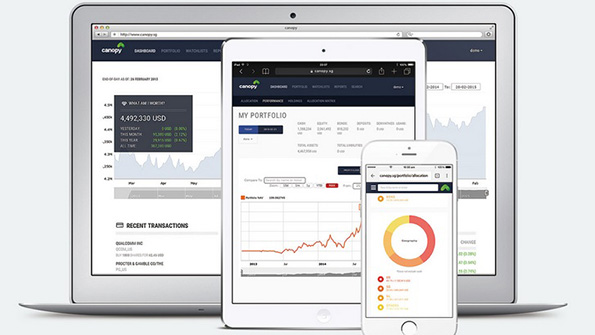

Mesitis, the maker of Canopy, a wealth management app that aggregates financial data from multiple banks, currencies and asset types into a single portfolio, has raised $3 million in Series A venture capital funding, Tech in Asia is reporting. The firm, based in Singapore, launched Canopy in 2014. The app now tracks more than $800 billion in assets. It is accessible via the web and includes alerts that notify users of significant prices changes.

What Is The Ideal Financial Advisor?

Part man, part machine, according to U.S. News and World Report. Mass affluent investors want custom, hands-on advice from real advisors to go along with the automated algorithms of the robos. And financial advisory firms are starting to offer a range of services based on those preferences. For the high-net-worth investors, there's still the bespoke model, while younger generations just building their wealth prefer to a DIY path. “Smart firms are realizing that this is a way for me to get a foot in the door with clients that are building assets," said Stuart DePina, group vice president for Envestnet.