Aequitas Capital Management, the Lake Oswego, Ore.-based alternative investments firm that made a bad bet on student loans, was charged by the Securities and Exchange Commission for concealing its “rapidly deteriorating financial condition” while still raising more than $350 million from investors. The SEC alleges the firm and its three top executives, CEO Robert Jesenik, Executive Vice President Brian Oliver and CFP and Chief Operating Officer Scott Gillis, were operating a Ponzi-like scheme, using some money from new investors to pay earlier ones. The firm defrauded 1,500 investors nationwide, the SEC claims. The trouble started in January 2014 when it made a big bet on student loans from for-profit college Corinthian Colleges, according to OregonLive. But in May 2015, Corinthian Colleges filed for bankruptcy. Meanwhile, Aequitas continued to raise money from investors through its promissory notes, touting rates of return as high as 10 percent, the SEC says. “Top executives knew they weren’t using money raised from investors like they said they would. But they refused to disclose the true financial condition, continued to draw lucrative salaries, and roped even more unknowing investors into a losing venture,” said Jina L. Choi, director of the SEC’s San Francisco regional office.

Clients are supposedly demanding more information around the environmental and social impact of their investments, but definitions around what that means can be hazy and differ from investor to investor. And despite the noble purpose, there have been scant ways to really rate the risk or opportunities for a fund through the lens of environmental, social and governance factors. Yet recent separate initiatives from Morningstar and index-provider MSCI are an attempt to put some quantifiable numbers around the concept. MSCI just launched its MSCI ESG Fund Metrics, a sustainability measurement for over 20,000 mutual funds and ETFs, meant to benchmark the underlying holdings based on close to 100 metrics, factors like their carbon footprint, sustainable impact and governance issues. It’s available from MSCI ESG Research now, but will roll out to third-party platforms over the course of the year. Their announcement came on the heels of Morningstar's recent unveiling its own ESG metrics for funds, as well as broader sectors.

Financial Literacy Declines With Age

Financial literacy among Americans declines after they reach retirement age, according to a new study by Department of Personal Financial Planning professors and published in the journal Management Science, but their confidence in their ability to make good financial decisions does not, leading to potential issues. The study by Texas Tech University professors Michael Finke and Sandra Huston and University of Missouri professor John Howe found that the ability to answer basic financial questions decreases with age at nearly the same rate as that of gradual erosion of memory and problem solving. This is an issue, according to the researchers, because households aged 60 and older control more than half the wealth in the United States. They added that because fewer employers provide pensions, more people are left to depend solely on their own retirement savings. “As we get older, our ability to answer basic financial questions that include knowledge, and the ability to apply that knowledge, gets worse,” Finke said. “But we have no idea this is happening. It’s very similar to the research on driving skills. Since it happens so gradually, we’re not aware our abilities are getting worse over time.”

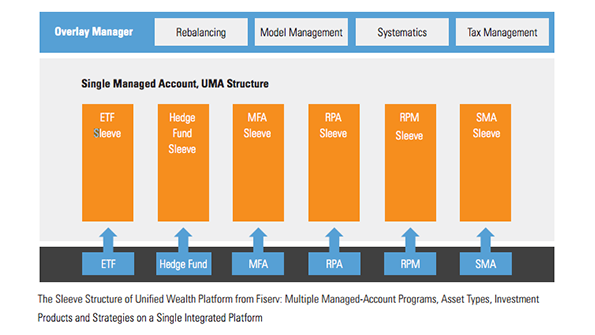

Fiserv Adds Tech to Unified Wealth Platform

Fiserv added new portfolio management and trading technology to its Unified Wealth Platform for advisors supporting rep as portfolio manager (RPM) or rep as advisor (RPA) programs. The company said the additions would help advisors streamline workflows and manage full-discretion and nondiscretionary accounts on a single platform while providing new options for customization, configurability and visual data displays. Fiserv added that the enhancements would give broker/dealers great operational efficiency across their managed account business, and asset managers increased distribution opportunities thanks to an integrated model-portfolio management tool that puts all their investment models in one location. Cheryl Nash, the president of investment services at Fiserv, said 5,000 RPM and RPA advisors have migrated to the new platform already and have experienced “steady growth, largely due to their ability to provide enhanced services that are in step with investors’ evolving needs.”