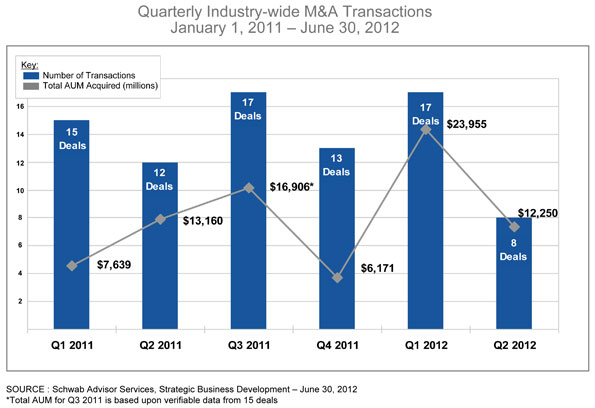

Merger and acquisition activity among registered investment advisors fell off sequentially in the second quarter, Schwab Advisor Services said today, even excluding a major deal in the first quarter that skews comparisons.

Schwab said there were eight deals last quarter with acquired assets under management of $12.3 billion, compared with 17 deals with $24 billion in AUM in the first quarter. That quarter included the AMG Wealth Partners equity stake in Veritable LP, a top RIA with assets of more than $10 billion.

M&A has seen better times: There were 70 deals in 2010 that accounted for $62.7 billion in AUM.

“I think the M&A activity is tracking a little bit of the psyche of the market with the economy,” said Jon Beatty, senior vice president, sales and relationship management at Schwab Advisor Services. “Q2 tends to be a slower quarter among the four-quarter pattern. I think it has something to do with advisors caught up in tax season and paying attention to their clients.”

The first half of this year was flat against the first half of 2011, he noted.

Private equity firms garnered some of the headlines about second-quarter deals. Lincoln Peak Capital took a minority stake in London Company of Virginia, and Lee Equity Partners said it would take Edelman Financial Group private.

Schwab’s data focuses on investment advisory firms that chiefly serve high-net-worth retail investors, firms with a minimum AUM of $50 million, and wirehouse breakaway brokers who received consideration for joining an RIA.