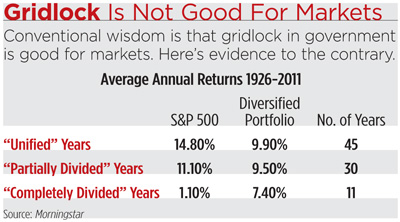

Conventional wisdom tells us that political gridlock is good for markets. With gridlock the two parties will wrestle each other to a standstill, making any sweeping changes more difficult. If you believe in the “politicians-are-idiots” theory, you’ll love gridlock. But new data by Morningstar proves the theory wrong. Gridlock, in fact, is not good for markets, not by a long shot.

According to Morningstar, the S&P 500 and a diversified portfolio (60/40 allocation) averaged the highest returns in years where the U.S. government was “unified,” which is years when the Senate, House of Representatives and the White House were all controlled by the same party. There were lower returns in the “partially divided” years, when the House and Senate were controlled by the same party but the White House was under a different party. The lowest returns were in “completely divided” years, when the two houses of Congress were divided.

“Most investors believe that a divided White House and Legislative Branch is good for equities but the data shows otherwise,” said Thomas Dowling, managing director of wealth management at Aegis Capital.

Of course, we don’t know how the Nov. 6 elections will shake out, and whether gridlock will be in the cards next year. As it is now, the House is leaning towards the Republicans, while the Senate is leaning slightly towards the Democrats, according to RealClearPolitics.com. Of course, things change, and there are many toss-up seats. According to national polls aggregated by RealClearPolitics.com, Romney is currently leading Obama for the White House by 0.4 percent, a slim margin.

Based on that, we can’t come to any real conclusions about whether gridlock will rear its ugly head. But if I’m playing devil’s advocate and the numbers stay where they are, then we could end up with a completely divided government, with the lowest returns!

One fund manager, Eric Singer, has studied the concept of “the Congressional effect” on stocks since the ‘90s, a theory that equities typically perform better when Congress is in recess. In fact, Singer launched a mutual fund—the Congressional Effect Fund (CEFFX)—based on that very theory. “Basically, whenever a new law is proposed it has a price. And that price is usually regulation that affects one industry or another,” Singer told REP. in 2006. (It’s a fine concept, but the strategy has not held up over the years. Year to date, the fund has returned 3.54 percent, versus 15.69 percent for the S&P 500. Over the last three years, Singer was up 3.1 percent, while the S&P was up 13.22 percent.)