This report is one of a series on the adjustments we make to convert GAAP data to economic earnings.

Reported earnings don’t tell the whole story of a company’s profits. They are based on accounting rules designed for debt investors, not equity investors, and are manipulated by companies to manage earnings. Only economic earnings provide a complete and unadulterated measure of profitability.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivalled due diligence on 5,500 10-Ks every year for the past decade.

In the reports we’ve done so far, we’ve gone through several of the adjustments we make to reveal a company’s core operating profit, or NOPAT. It’s important to understand, however, that the removal of income and expenses has an effect on the true taxes a company pays as well. Without removing the tax impact of non-operating items, one still gets a distorted picture of a company’s operating profitability.

Due to its high number of non-operating expenses, United Parcel Service (UPS) had a low reported income tax expense of only $167 million, and a tax rate of 17.1%. To find its true operating tax rate, we removed the tax benefit (pre-tax value minus post-tax value) of non-operating items where the pre and post-tax values were disclosed (see an example). Removing the tax benefits from the income tax expense and adding the non-recurring expenses back to income gave UPS an effective cash tax rate of 34.8%. Multiply that tax rate by UPS’s pre-tax operating profit of $11.5 billion, and you see its true operating taxes are just over $4 billion.

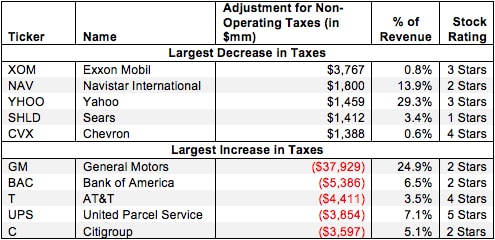

Figure 1 shows the five companies with the largest (gross value) non-operating tax adjustment toNOPAT for 2012.

Figure 1: Largest Positive/Negative Non-Operating Tax Adjustment

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

These companies are far from the only ones affected by non-operating tax adjustments. In the last fiscal year, 2013 companies had negative adjustments to NOPAT totaling $189 billion as a result of increases in their operating tax rates (relative to their reported tax rates), while 655 companies had positive adjustments to NOPAT totaling $21 billion. Our database contains 32,270 non-operating tax adjustments for a total adjustment value of $1.2 trillion in losses from NOPAT and $325 billion in gains to NOPAT.

A large non-operating tax adjustment can sometimes be a contrary indicator, as in the case of UPS above. UPS had a large negative tax adjustment to NOPAT, but this was primarily because of large non-operating expenses, the removal of which resulted in a net positive adjustment to NOPAT. As a result, UPS still earns our Very Attractive rating.

General Motors (GM), on the other hand, has by far the largest negative tax adjustment to NOPAT, and it earns our Dangerous rating. Due to a variety of issues, GM actually had a total tax benefit (income) of nearly $35 billion in 2012. Removing the impact of major non-operating items, like a$27 billion goodwill impairment charge, gives GM a cash operating tax burden of $3.1 billion.

No company is going to have a $35 billion tax benefit long-term. Valuing GM based on that distorted tax number is a recipe for disaster. Due diligence in the footnotes is required to remove the distorting effects of non-operating items and reveal a company’s true tax burden.

Sam McBride contributed to this report

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.