This report is one of a series on the adjustments we make to convert GAAP data to economic earnings.

Reported earnings don’t tell the whole story of a company’s profits. They are based on accountingrules designed for debt investors, not equity investors, and are manipulated by companies to manage earnings. Only economic earnings provide a complete and unadulterated measure of profitability.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivalled due diligence on 5,500 10-Ks every year for the past decade.

Non-operating items in operating income are unusual gains that don’t appear on the income statement because they are bundled in other line items. Without careful footnotes research, investors would never know that these non-recurring income items distort GAAP numbers by artificially raising operating earnings. Examples of hidden non-operating income include: gains on plan assets, gains on sale of assets, income from legal settlements, and gains from consolidation of property.

Our models remove this distortion to reveal a company’s recurring, core, net operating profit after tax: NOPAT.

JPMorgan Chase (JPM) is a good example of the inflating effect of hidden non-operating income. Buried on page 73 of JPM’s 350+ page 2012 Form 10-K, the company reveals it gained $1.1 billion from Washington Mutual’s bankruptcy settlement. Removing this non-recurring income, along with many other adjustments, revealed JPM’s 2012 NOPAT to be $18.9 billion, about $1 billion less than its GAAP income.

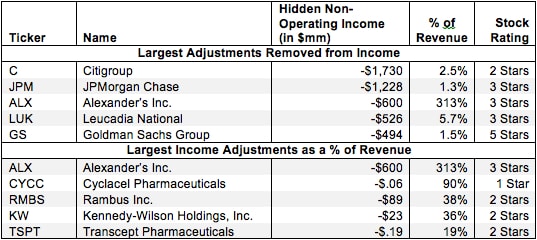

Figure 1 shows the five companies with the largest (gross value and as a % of revenue) of non-operating income adjusted out of NOPAT for 2012.

Figure 1: Biggest Offenders for Non-Operating Income Hidden in Operating Earnings in 2012

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

The ten companies in Figure 1 are not the only offenders. In the last fiscal year, New Constructs found 1,803 non-operating expenses hidden in operating earnings. Our database contains over 9,569 non-operating expenses that we have removed from reported operating earnings for a total adjustment value of over $160 billion.

Though the removal of non-operating income can decrease NOPAT, it does not always mean the company’s stock will earn an unfavorable rating. For instance, four of the five of the companies in Figure 1 with the highest gross levels of adjustments get a 3-star or above rating. One firm, Goldman Sachs, even earned a 5-Star Very Attractive rating. And despite our removal of large amounts of income, all five of those companies still had a positive NOPAT in 2012.

In other cases, however, non-operating expenses can artificially inflate reported earnings and make a stock look like a better value than it truly is. Case in point: Alexander’s Inc. (ALX), per both sections of Figure 1, had a total of $600 million (or 3045% of its economic earnings) in non-operating income in 2012 due to gains on a property sale. Since ALX is a REIT, we would normally include that revenue in NOPAT, but this sale was so much larger than its normal operations that we classified the sale as a non-recurring item. Removing this unusual income brought Alexander’s NOPATdown to $121 million versus its unusually high GAAP net income of $674 million in 2012.

ALX’s GAAP net income grew by nearly 750% in 2012, while itsNOPAT declined by 7%. Investors just looking at reported earnings might see ALX as a hugely undervalued stock. In truth, however, ALX’s share price of ~$301.72 implies that the company will grow NOPAT by 9% compounded annually over the next 11 years. Compare that to ALX’s 1% compounded annual growth rate for NOPAT over the past seven years, and it becomes clear that ALX is valued a bit optimistically.

Without careful analysis of footnotes and the MD&A, investors do not get the complete picture of ALX and its modest operating profitability. Diligence pays.

Sam McBride and André Rouillard contributed to this report.

Disclosure: David Trainer, Sam McBride and André Rouillard receive no compensation to write about any specific stock, sector, or theme.