This report is one of a series on the adjustments we make to GAAP data so we can measure shareholder value accurately. This report focuses on an adjustment we make to our calculation of economic book value and our discounted cash flow model.

We’ve already broken down the adjustments we make to NOPAT and invested capital. Many of the adjustments in this third and final section deal with how adjustments to those two metrics affect how we calculate the present value of future cash flows. Some adjustments represent senior claims to equity holders that reduce shareholder value while others are assets that we expect to be accretive to shareholder value.

Adjusting GAAP data to measure shareholder value should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

Deferred tax assets (DTAs) arise when reported income on a financial statement is less than taxable income, and deferred tax liabilities (DTLs) come about when reported income is greater than taxable income. DTAs are accounts set aside for the reduction of future taxes while DTLs are accounts for the payment of taxes in the future. Both of these items are a result of differences between GAAP accrual accounting and tax policy. We’ve already covered how DTAs and DTLs affect invested capital in a separate report. However, these accounts affect a company’s discounted cash flow model as well.

We subtract net deferred tax liabilities (DTLs minus DTAs) from our calculation of shareholder value as they are real future cash obligations that limit the amount of money available for distribution to shareholders.

For example, Exxon Mobil (XOM) had over $31 billion in net DTLs in 2012 after netting out its $52 billion in DTLs and $23 billion in DTAs. This information was found on page 95 of XOM’s 2012 10-K, deep in the financial footnotes. This amount lowered XOM’s economic book value from $451 billion to its true value of $420 billion.

Without careful footnotes research, investors would never know that net deferred tax liabilities decrease the amount of future cash flow available to shareholders. DTAs and DTLs can often only be found in the footnotes as they are frequently bundled in the “other assets/liabilities” line items on the balance sheet.

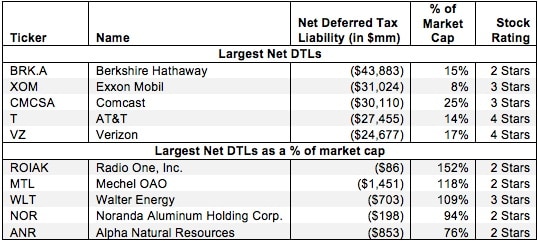

Figure 1 shows the five companies with the largest net deferred tax liabilities removed from shareholder value in 2012.

Figure 1: Companies With the Largest DTLs Subtracted from Shareholder Value in 2012

Sources: New Constructs, LLC and company filings. Excludes stocks with market caps of under $100 million.

Sources: New Constructs, LLC and company filings. Excludes stocks with market caps of under $100 million.

Energy, and mining companies like Exxon Mobil, Mechel OAO (MTL), Walter Energy (WLT), and Alpha Natural Resources (ANR) dominate figure 1. However, they are far from the only companies that are affected by net DTLs. In 2012 alone, we found 1032 companies with net DTLs subtracted from shareholder value totaling over $728 billion.

Since deferred tax liabilities decrease the amount of cash available to be returned to shareholders, companies with significant DTLs will have a meaningfully lower economic book value and shareholder value when this adjustment is applied. Comcast (CMCSA) is a good example with its $30 billion in net DTLs . Without removing these real cash obligations from shareholder value, CMCSA’s economic book value would have been $86 billion. After making this adjustment, however, we calculated CMCSA’s economic book value at $56 billion. This adjustment also lowered CMCSA’s economic book value per sharefrom ~$33/share to ~$21/share.

Investors who ignore net DTLs are not getting a true picture of the cash available to be returned to shareholders. Diligence pays.

André Rouillard contributed to this report.

Disclosure: David Trainer and André Rouillard receive no compensation to write about any specific stock, sector, or theme.