Riskalyze announced Tuesday a new partnership with Morningstar that lets data flow freely between the two tech products.

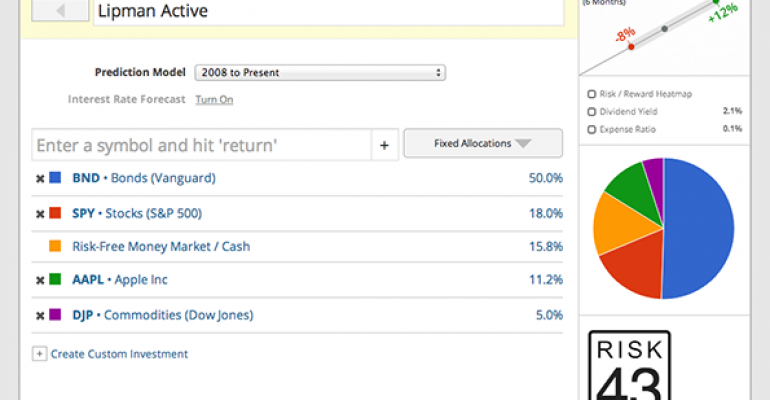

Advisors can now access client information from Morningstar Office within the Riskalyze platform. Each night, clients’ holdings update automatically to show an advisor how much risk a client holds at any given time and recalculate their “Risk Number.”

“The asset allocation decision is one of the most important investing decisions an advisor can make for a client,” said Tricia Rothschild, head of global advisor solutions for Morningstar. “Advisors need to carefully balance an investor’s capacity to take on risk with his or her tolerance for it when designing an optimal portfolio.

“This integration with Riskalyze will allow our advisor clients to easily assess the suitability of an investor’s current portfolio in terms of risk and conduct ongoing monitoring to help ensure the portfolio aligns with the goals and preferences of the investor over the long term.”

Aaron Klein, the CEO of Riskalyze, said customers using AutoPilot, the automated asset management platform from Riskalyze and CLS Investments, would also be able to sync current account balances for their clients using the integration with Morningstar.

Riskalyze and Morningstar will host a joint webinar on the integration on July 22.