Investors could be forgiven for thinking that now is the time to cash out on Western Digital (WDC). After all, the stock is up 49% year-to-date and 112% over the past 12 months. Such dramatic gains might lead some to believe that the stock has run out of steam.

Such thinking, however, ignores the fundamentals of the company. WDC is more profitable than ever and remains significantly undervalued.

High Profitability

As I wrote last year, cloud computing is a good thing for WDC as it will increase the overall demand for storage. I highlight WDC because of its top quintile return on invested capital (ROIC) of 40% and the intelligent capital allocation capabilities exhibited by its management team to achieve that high an ROIC.

In an industry with high growth potential, capital allocation is critical to creating shareholder value.

It is hard to find a better example of intelligent capital allocation than WDC’s acquisition of Hitachi Global Storage Technologies (HGST) in 2012. I am often critical of “earnings accretive” acquisitions because they show misleading earnings growth, but WDC created real value with HGST.

Many companies are guilty of overpaying for cash flows, shelling out billions of dollars for relatively small profits and reducing ROIC. WDC, on the other hand, increased its ROIC from 22% in fiscal year 2011 to 40% in 2012. WDC more than doubled its after-tax profit (NOPAT) while increasing average invested capital by less than 50%. Even better, this highly profitable acquisition was completed without wrecking the balance sheet, as WDC still has more excess cash than debt.

High ROIC acquisitions are especially shareholder friendly when they result in new cutting edge products. WDC just unveiled and shipped the thinnest (7mm) 1 terabyte hard drive ever.

Attractive Valuation

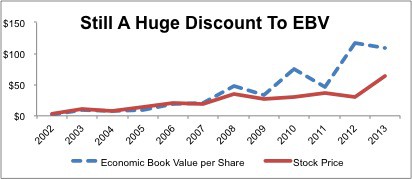

Even with the stock trading near its all-time high, WDC remains remarkably cheap. The stock has a price to economic book value ratio of 0.6, implying that the market expects WDC’s NOPAT to permanently decline by 40%. The no-growth value of this business is over $100/share.

Figure 1: Stock Price Looking up at No-Growth Value

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

Back in December I wrote that WDC is highly undervalued at anything below $70/share, and I’m sticking by that statement. Investors that missed WDC’s 50% gain this year need not beat themselves up. At ~$63.80/share, WDC has plenty of room to keep going up.

Institutional investors aren’t recognizing the value in WDC, as there are no ETFs or mutual funds with sufficient liquidity that allocate significantly to WDC and earn an Attractive-or-better rating. No wonder so many active managers underperform.

The only way to get this stock is to buy it directly – and you don’t have to pay any management fees.

Sam McBride contributed to this article.

Disclosure: David Trainer owns WDC. David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.