While Apple’s (

AAPL) shares were up and down on Thursday on news that

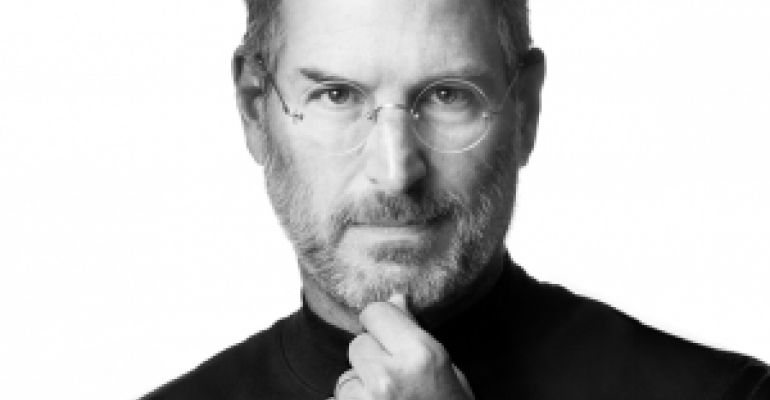

Steve Jobs passed away at the age of 56, confidence in the company seems to have outweighed any fears. Several prominent analysts reiterated their buy recommendations on Apple’s stock, banking on the talent and corporate culture that Jobs left behind.

While Apple’s (

AAPL) shares were up and down on Thursday on news that

Steve Jobs passed away at the age of 56, confidence in the company seems to have outweighed any fears. Several prominent analysts reiterated their buy recommendations on Apple’s stock, banking on the talent and corporate culture that Jobs left behind.

Ticonderoga Securities’ Brian White acknowledged in his report that Jobs would be missed, but said that he left behind a company that will stand the test of time:

Steve Jobs' acceptance of nothing but the highest quality work has been thoroughly ingrained in the Apple culture during his tenure, creating a team that we believe will continue to thrive. Clearly, there is no one like Steve Jobs in the tech world and Apple will never have another Steve Jobs at the helm, however, we believe he has created an incredibly talented team with Tim Cook as CEO that can lead Apple to continued success for many years to come. As Steve Jobs wrote in his August 24 resignation letter: "I believe Apple’s brightest and most innovative days are ahead of it." We agree.

White set a 12-month price target of $666. It’s currently at around $382.

AAPL is still a top pick for T. Michael Walkley and Matthew Ramsay of Canaccord Genuity, based on strong earnings potential going forward and anticipated demand for iPhone, iPad and Mac products. They also believe the company will continue to deliver innovative products:

We believe Tim Cook is well qualified for his new role as CEO and has at his disposal a deep and talented executive team in the areas of supply chain management, hardware/software design and product marketing. We view Apple’s latest product launches of iPhone 4S, iCloud, and iOS 5 as examples of the innovative products we expect Apple to continue to bring to market despite the leadership change. Please see our note from Tuesday entitled “Apple launches iPhone 4S” for further details on our unchanged Apple thesis.

Wedgewood Partners has a 9.5 percent weighting to AAPL in its large-cap growth mutual fund (RWGIX). CIO David Rolfe said there's no question Jobs was a technology zeitgeist, but he also built a significant team around him and a fortress balance sheet. He continues to believe the company's earnings will smash expectations and its growth will shock even the most ardent bull on this company. "Even with the absence of Steve Jobs, is there any other company out there" in terms of its competitive attributes, balance sheet, global reach and depth and scale of product line?

Morningstar analyst Michael Holt also acknowledged Jobs’ accomplishments in the world of technology, but he also expressed confidence that the company will continue to deliver products that attract new customers in the short term:

The questions that loom today over Apple's future are the same questions that existed yesterday. Steve Jobs was instrumental in carving out Apple's economic moat, but the competitive advantages Apple now enjoys are structural, and will remain intact for many years to come.

But Jobs is irreplaceable, Holt said, and long-term—15 years out—the company will not be able to deliver the same visionary insight and operational excellence. “Momentum, and a pipeline full of Steve-approved products, will mask the transition for a few years.”

While it looks as though Apple will enjoy the fruits of its successes for a few more years, we’ll be waiting with bated breath to see if the innovation can continue in the long term.