Despite the ubiquitous emphasis on the need to plan for retirement, few actually put it in writing. More than half of retirees have a retirement strategy, but only 10 percent have it committed to paper or pixels, according to a study released by the Transamerica Center for Retirement Studies. The majority of those with a plan factored in Social Security and Medicare benefits, living expenses, healthcare costs and investment returns. But according to the 118-page survey, few considered the impact of inflation, taxes, long-term care insurance or the need for funds to pursue retirement "dreams," like travel or pursuit of a hobby. A mere 7 percent have a contingency plan for retiring sooner than expected or running into a savings shortfall. Even more troubling, while two out of five full or partial retirees over 50 have a financial advisor, 80 percent of those say that their advisor picks investments for them; Less than half say their financial advisor consults with them on retirement savings and spending.

Inflation has been feared for so long that it's causing an almost irrational anxiety in nearly all age groups, according to a study by Allianz Life, even though the impact is more benign than many think. The study found that 47 percent of those surveyed say they're worried that rising costs would mean they won't be able to afford the lifestyle they want in retirement. One in 10 also describe their fear as panic. This is all while the average annualized inflation rate in the past 20 years has been 2.24 percent; consumer prices rose only 0.1 percent this past March. While inflation has been low, the cost of health care has not, and that's adding to Americans' concerns, according to Bankrate.com.

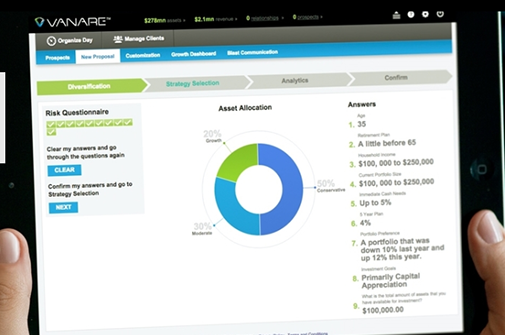

Advisors using a custom-built digital wealth management platform from Vanare Nest Egg can now aggregate client data thanks to a new partnership with Quovo. The partnership lets advisors bring client risk assessments, asset-class models and investment portfolios onto Vanare to help manage all of a client’s finance, from checking account transaction, to loan and insurance payments, to reporting on held-away assets. Vanare CEO Rich Cancro called Quovo’s data “clean and consistent,” while Quovo CEO Lowell Putnam called Vanare a “one of the most ambitious platforms in the industry.”