This report is one of a series on the adjustments we make to convert GAAP data to economic earnings.

Reported earnings don’t tell the whole story of a company’s profits. They are based on accounting rules designed for debt investors, not equity investors, and are manipulated by companies to manage earnings. Only economic earnings provide a complete and unadulterated measure of profitability.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivalled due diligence on 5,500 10-Ks every year for the past decade.

When a company designates a portion of its business as held for sale, the company is required under GAAP to account for any income/loss from these divisions or from the sale of these divisions as income/loss from discontinued operations. Because this data is included on the income statement and in net income, investors receive a distorted view of a firm’s operating profitability by only looking at GAAP earnings.

We remove all income and losses from discontinued operations in calculating operating profit because this income/loss will not recur in the future, and we are looking for the true profitability of the continuing and core operations of a company.

For example, in 2012, Pfizer (PFE) recorded income of $297 million and gains on sale of $4.8 billion from discontinued operations, primarily their Nutrition business. These $5.1 billion total gains from businesses that no longer belong to PFE inflate GAAP net income and don’t reflect the current profitability of the company. In calculating net operating profit after tax (NOPAT), we removed this gain to uncover a more accurate picture of the value-generating ability of Pfizer’s central business operations.

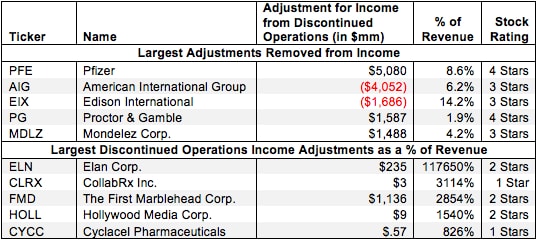

Figure 1 shows the five companies with the largest (gross value and as a % of revenue) income/loss from discontinued operations adjusted out of NOPAT for 2012.

Figure 1: Largest Income/Loss from Discontinued Operations in Operating Income in 2012

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

However, these companies are far from the only ones affected by income from discontinued operations. In the last fiscal year, removals of income and losses from discontinued operations occurred for 497 different companies. Our database contains over 5258 discontinued operations adjustments for a total adjustment value of $222 billion of gains from NOPAT and $129 billion in losses from NOPAT.

Though the removal of income due to discontinued operations can decrease NOPAT relative to GAAP earnings, it does not always mean the company’s stock will earn an unfavorable rating. For instance, Proctor & Gamble (PG) still has an Attractive or 4-star rating despite its $1.6 billion adjustment out of GAAP earnings. Likewise, American International Group (AIG) had $4 billion in losses added back to NOPAT, but still only received a 3-star Neutral rating.

In other cases, however, income from discontinued operations can artificially boost reported earnings and make a stock look overvalued. Case in point: The First Marblehead Corp. (FMD) from Figure 1. FMD had a total of $1.1 billion in adjustments due to after-tax income from discontinued operations. This was caused in large part by a non-cash gain from the deconsolidation of $6.6 billion in assets and $7.8 billion in liabilities from its own National College Student Loan Trust.

First Marblehead’s GAAP net income was $1.1 billion in 2012, up substantially from a loss of $221 million in 2011. In fact, in terms of GAAP earnings, 2012 was FMD’s best year by a wide margin. However, when this one-time non-operating gain was removed from FMD’s income, its NOPAT showed a loss of $44 million, its fifth consecutive year of losses in my model. First Marblehead’s deconsolidation of its holdings in its own trust may have boosted its accounting earnings in 2012, but the business still has a basic inability to turn a profit through its core operations and generate any consistent value for investors. This is why FMD earns my Dangerous rating.

One caveat: This adjustment is not performed for REITs (Real Estate Investment Trusts). The reason for this is that a REIT’s core business centers around buying and selling property. While sales of property and gains from property marked for sale will appear under the discontinued operations line item, they are representative of a REIT’s ability to conduct its business effectively and profitably, so they are included in NOPAT.

Sam McBride and André Rouillard contributed to this report

Disclosure: David Trainer, Sam McBride and André Rouillard receive no compensation to write about any specific stock, sector, or theme.