With up to 226 mutual funds in any given sector and at least 653 across all 10 sectors, picking from the wide variety of mutual funds can be a daunting task.

The number of mutual funds has little to do with serving investors’ best interests. There are so many because they make money for the fund providers. Below are three red flags investors can use to avoid the worst mutual funds:

- Inadequate liquidity

- High fees

- Poor quality holdings

I address these red flags in order of difficulty. Advice on How to Find the Best Sector mutual funds is here.

How To Avoid Mutual Funds with Inadequate Liquidity

This is the easiest issue to avoid and my advice is simple. Avoid all mutual funds with less than $100 million in assets. Low levels of liquidity can lead to a discrepancy between the price of the mutual fund and the underlying value of the securities it holds. This makes it difficult to predict future performance.

How To Avoid High Fees

Mutual funds should be cheap, but not all of them are. First we measure what is cheap and expensive.

The difficulty with mutual funds is that there are multiple costs in any given fund. The expense ratio is the most obvious, but many funds also have significant transaction costs and front-end load costs. Less apparent fees can drive the cost of a fund to far higher than its expense ratio. My measurement of total annual costs reflects the all-in cost of a minimum investment in a fund for three years (the average holding period for mutual funds).

To ensure you are paying at or below average fees, invest only in mutual funds with total annual costs below 2.53%, which is the average total annual cost of the 653 US equity sector mutual funds I cover. Weighting the (TAC) by assets under management, the average expense ratio is lower at 1.54%. The lower weighted-average TAC is a good sign that investors are putting money in the cheaper mutual funds.

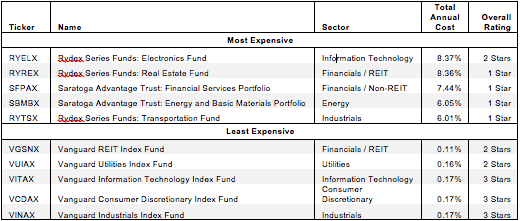

Figure 1 shows the most and least expensive sector mutual funds in the US equity universe based on total annual costs. Unsurprisingly, Vanguard’s index funds comprise all five of the cheapest sector funds. Rydex Series Funds, provided by Guggenheim Investments, comprise three of the five most expensive sector funds.

Figure 1: Most and Least Expensive Sector Mutual Funds

Sources: New Constructs, LLC and company filings

Unlike ETFs, where costs are generally consistent, mutual fund costs are all over the map. The high costs of the most expensive mutual funds make it much harder for them to perform as well as the cheapest funds.

Figure 1 shows that the cheapest five funds are almost all better rated than the five most expensive. However, the least expensive fund, VGSNX, and the most expensive, RYELX, both get the same 2 Star (Dangerous) rating. This is because VGSNX allocates over 81% of its assets to Dangerous-or-worse rated stocks, while RYELX allocates only 24% to Dangerous-or-worse stocks. A case in point of how holdings matter more than costs.

Investors need to look beyond the fees when choosing mutual funds. High fees can destroy value, but not as much as underperforming holdings.

How To Avoid Mutual Funds with the Worst Holdings

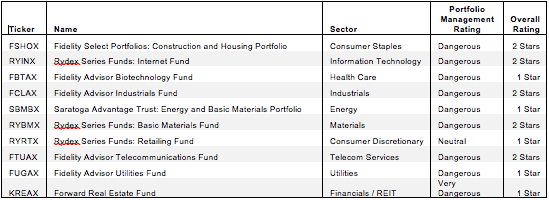

This step is by far the hardest, but it is also the most important because a mutual fund’s performance is determined more by its holdings than its costs. Figure 2 shows the mutual funds within each sector with the worst holdings or portfolio management ratings. The mutual funds are listed in descending order by sector per my sector ratings, detailed in my 1Q Sector Rankings report.

Figure 2: Sector Mutual Funds With The Worst Holdings

My overall ratings on mutual funds are based primarily on my stock ratings of their holdings. My firm covers over 3000 stocks and is known for the due diligence done on each stock we cover.

Fidelity’s mutual funds appear more often than any other provider in Figure 2, which means they offer the most mutual funds with the worst holdings. Only one fund appears in both Figure 1 and Figure 2. SBMBX has the worst holdings of all Energy funds and is one of the top five most expensive sector mutual funds out there, earning it my Very Dangerous (1-Star) rating.

Do Not Trust Mutual Fund Labels

Labels only provide the tip of the iceberg of insight need to understand its content or holdings. Based on the labels, one might think that Frost Natural Resources Fund (FNRFX) and Thrivent Natural Resources Fund (TREIX) hold roughly the same stocks. However, the two funds actually have only one stock (SLB) in common out of their top five holdings.

Just looking at the provider does not give much clarity either. In the Information Technology sector, Fidelity offers the highest rated mutual fund—Fidelity Select Portfolios: Computers Portfolio (FDCPX)—and one of the lowest rated ones—Fidelity Advisor Electronics Fund (FELAX).

Looking at providers and labels is no substitute for doing the hard work (i.e. due diligence) of examining the holdings of a mutual fund.

The Danger Within

Buying a mutual fund without analyzing its holdings is like buying a stock without analyzing its business and finances. As Barron’s says, investors should know the Danger Within. Put another way, research on mutual fund holdings is necessary due diligence because a mutual fund’s performance is only as good as its holdings’ performance.

PERFORMANCE OF MUTUAL FUND’s HOLDINGs = PERFORMANCE OF MUTUAL FUND

Note that no mutual funds with a dangerous portfolio management rating earn an overall rating better than two stars. These scores are consistent with my belief that the quality of a mutual fund is more about its holdings than its costs. If the mutual fund’s holdings are dangerous, then the overall rating cannot be better than dangerous because one cannot expect the performance of the mutual fund to be any better than the performance of its holdings – no matter how cheap it may be.

Find the mutual funds with the worst overall ratings on my free mutual fund screener. More analysis of the Best Sector mutual funds is here.

Dangerous Stocks make up Dangerous Funds

Prologis Inc. (PLD) is one of my least favorite stocks held by KREAX and earns my Very Dangerous rating. This is a company that has not managed to sustain long-term profit growth despite a valuation that indicates otherwise. Its after tax profit (NOPAT) in 2012 is actually 7% less than its 2002 NOPAT. There have been peaks and valleys in the interim, but a decline in profitability over the course of the past decade is troubling. One would think this downward trend would be reflected in the stock price, but that is not the case for PLD. The current market price of ~$40.14/share implies 24% growth in NOPATcompounded annually over the next 11 years. Betting on any company to achieve that level of growth is risky. Heavy allocation to Dangerous-or-worse rated stocks like PLD help to explain why KREAX is one of the worst rated mutual funds I cover.

Sam McBride contributed to this report.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.