Hearsay Social revealed a new user interface Wednesday meant to help compliance teams better review advisors' social media and web-based content.

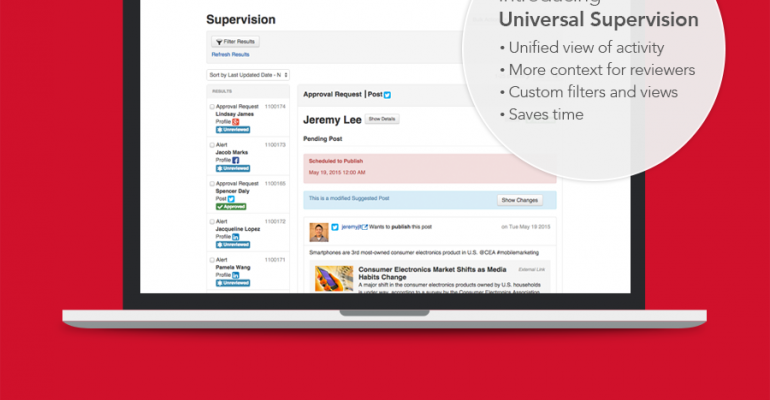

The new Universal Supervision design gives supervisors a complete view of an advisor’s social activity and digital content in a single dashboard. Filtering options let users customize the view to only show the most relevant information for their firm’s compliance policies and procedures. These customizations can be saved and reactivated in the future, and Universal Supervision can detect a user’s role and permissions within the company to only display information they have access to.

Previously, "someone would have to go into the application and click around to get multiple views; that’s the type of thing we’re trying to help them avoid,” said Meagan Hency, Hearsay Social's director of product marketing. “We made it easier for them to save views and activities they want ... all in once place.”

Hearsay Social’s engineers worked with its customers to identify where users spend the most time on its platform and what was slowing down the supervision and approval process. Hency said static content, like social media profiles, was a particular area that bogged compliance teams down.

Now, if an advisor wants to change their social media profile, the supervisor can switch on a saved “static content” view in Universal Supervision and see what was previously approved, the requested change, and any notes from the compliance team all on one screen.

The goal is to streamline the customer's workflow, saving time and effort, said Steve Garrity, CTO and founder of Hearsay Social.

Universal Supervision is also designed to help review longer pieces of content like blog posts. Instead of having to review the entire article again if it's been changd, Universal Supervision will highlight any additions, deletions or edits the advisor made.

Hency said the company hopes that by making the compliance process easier, Universal Supervision will remove some of the barriers keeping financial services firms from adopting social media.

“We are of the belief that [social media] can be a really valuable way for advisors to connect with their clients and prospects,” Hency said. “It is a real-time platform and does depend firm by firm on what their policies and procedures are, but I do think there is great value.”