This report is one of a series on the adjustments we make to GAAP data so we can measure shareholder value accurately. This report focuses on an adjustment we make to our calculation of economic book value and our discounted cash flow model.

We’ve already broken down the adjustments we make to NOPAT and invested capital. Many of the adjustments in this third and final section deal with how adjustments to those two metrics affect how we calculate the present value of future cash flows. Some adjustments represent senior claims to equity holders that reduce shareholder value while others are assets that we expect to be accretive to shareholder value.

Adjusting GAAP data to measure shareholder value should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

For most companies, we estimate the required amount of cash for normal business operations to be around 5% of sales. However, many companies hold cash or other liquid investments above and beyond this amount. We refer to this extra amount as excess cash. This surplus cash can be used for any number of purposes, including acquisitions, research and development, and cushioning the company against economic downturns. Excess cash is immediately available for distribution to shareholders, so we add a company’s excess cash to our calculation of shareholder value.

Excess cash can also affect a company’s invested capital calculation. We covered that adjustment in an earlier report.

Apple (AAPL) is one of the most dramatic examples of excess cash’s effect on shareholder value. In 2012 AAPL held over $121 billion in cash and cash equivalents. We estimate that AAPL requires only ~2% of its cash for business operations, making its excess cash total $118 billion. Adding this amount to shareholder value raised AAPL’s economic book value from $615 billion to $733 billion. More details on our rating on AAPL are here.

Without careful footnotes research, investors would never know that excess cash increases the amount of future cash flow available to shareholders due to its bundling with the rest of a company’s cash and liquid investments in multiple line items on the balance sheet.

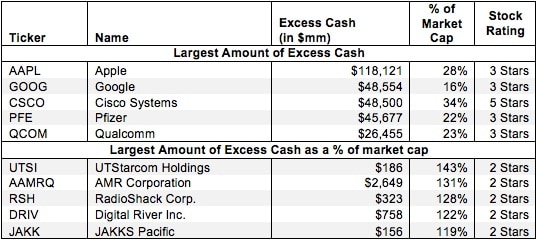

Figure 1 shows the five companies with the largest amount of excess cash added to shareholder value in 2012 and the five companies with the largest amount of excess cash as a percent of market cap.

Figure 1: Companies With the Largest Excess Cash Added To Shareholder Value

Sources: New Constructs, LLC and company filings. Companies with market caps under $100 million are excluded.

Sources: New Constructs, LLC and company filings. Companies with market caps under $100 million are excluded.

Highly profitable tech companies populate most of Figure 1. However, they are far from the only companies that are affected by excess cash. In 2012 alone, we found 1490 companies with excess cash totaling over $1 trillion.

Since excess cash increases the amount of cash available to be returned to shareholders, companies with significant pools of excess cash will have a meaningfully higher economic book value when this adjustment is applied. For example, Digital River (DRIV) had over $758 million in excess cash added to shareholder value in 2012. This adjustment brought the company’s economic book value up from -$251 million to $507 million. It also raised DRIV’s economic book value per share from around -$7/share to ~$14/share.

Investors who ignore excess cash are not getting a true picture of the cash available to be returned to shareholders. By adding in excess cash, one can better understand the value of the stock to shareholders. Diligence pays.

André Rouillard contributed to this report.

Disclosure: David Trainer and André Rouillard receive no compensation to write about any specific stock, sector, or theme.