Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

Beware Fund Company Marketing Claims

MOAT is a perfect example of why investors need to do their own diligence. MOAT tracks Morningstar® Wide Moat Focus IndexSM (MWMFTR). The website and fact sheet for MOAT state:

“Moat = Sustainable Competitive Advantage: Morningstar equity analysts use a time-tested proprietary process to determine if a company has an economic moat”

The MWMFTR index is intended to “offer exposure to the 20 most attractively priced companies with sustainable competitive advantages according to Morningstar’s equity research team.”

Most investors assume that a big, well-respected company like Morningstar (MORN) has an equity research team that knows how to perform the appropriate analysis to identify the traits detailed above. Why would the firm claim to do so if it didn’t have those capabilities? Beware: this line of reasoning got many investors in trouble by trusting Wall Street research during the tech bubble.

The problem is that investors really have no way of validating the claims that Morningstar or Wall Street make about the rigor of their research. The subjective nature of stock research means there is no official standard methodology for measuring “moats” or competitive advantage. Anyone can use those words to lead investors to believe that they do research like Warren Buffett and Charlie Munger, the guys who coined the term moat as it relates to stocks. Maybe Morningstar hopes that using the same terminology can convince investors that their research is like Warren Buffet’s.

After reviewing MOAT’s holdings, I question Morningstar’s “moat” measurement and the rigor of their stock research. In my opinion, MOAT may not actually hold wide moat stocks.

Digging Into the Holdings

When analyzing MOAT’s holdings, one of the tools I use is my dynamic discounted cash flow model, which is designed to measure the “moat” by quantifying market expectations for a company’s competitive advantage period. Of course, I am subjectively asserting that my “moat” model is better than Morningstar’s model, which is a bit of the pot calling the kettle black. The key difference in my assertion is that I will back it up by showing you my model and invite you to see the inner workings of my analysis so that you can judge its rigor for yourself. Morningstar’s ratings are based on a “proprietary process” that is not as open to investors.

Of the 20 stocks in MOAT, only seven get my Attractive or better rating. Five earn my Dangerous or Very Dangerous rating.

Holes in MORN’s Models?

To highlight where I think MORN’s models could be inaccurate, I point to Express Scripts (ESRX). Per myApril 1, 2013 Danger Zone call, ESRX gets my Very Dangerous rating because the company exploits funky merger accounting to artificially boost earnings while burying several hidden liabilities in the footnotes

Conversely, Morningstar has a bullish opinion on ESRX as detailed in this article and calculates a fair value of $89/share for the stock. It seems to me that Morningstar’s research overlooks details in the financial footnotes or, worse, does not incorporate them into their analysis. I cannot be sure.

Relying on reported accounting values, as Morningstar appears to do, is dangerous and can lead to inaccurate conclusions like the one I think Morningstar has for ESRX.

My fair value for ESRX is closer to $14/share and is based on the firm’s economic book value (EBV). You can review my EBV calculation here– see the “Current” column. My model also shows the impact of hidden liabilities we unearth from footnotes on the valuation of the stock.

With the current share price at ~$62.54, ESRX trades at a price to economic book value ratio of 4.5, which implies the company will develop a huge moat. Specifically, my discounted cash flow model shows that ESRX would have to grow NOPAT by 11% compounded annually for the next 14 years to justify its current valuation. Here is my DCF model showing how I derive the NOPAT CAGR and duration of growth implied by the current price.

I don’t see ESRX meeting those lofty expectations. More importantly, I do not see why investors would want to own the stock and so, by definition, bet that the company will beat those expectations. There are too many other stocks with more attractive valuations and superior track records of generating cash flow.

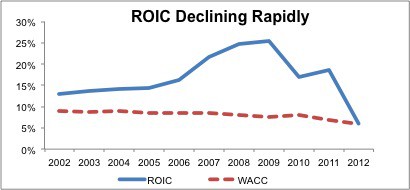

NOPAT growth at the rate and for the duration implied by the stock price is usually achievable only by companies increasing their returns on invested capital (ROIC) or widening their “moat”. ESRX’s ROIC has actually been declining over the past few years. Figure 1 plots ESRX’s ROIC against its weighted average cost of capital (WACC). This decline indicates that the “economic moat” around ESRX’s business is gone.

Figure 1: ROIC vs WACC: The “Moat” Has Eroded

MOAT’s stated goal is to hold “the 20 most attractively priced companies with sustainable competitive advantages.” What I’m seeing here is a company with a declining competitive advantage (shrinking moat) and a stock with a valuation pricing in creation of an unusually large and long-lasting moat. The disconnect between the underlying economics of the business and the stock’s valuation make ESRX a dangerous stock. It is hard for me to understand how Morningstar’s analysts calculate a fair value above the current market value for this stock.

The Value of Transparency

In case you missed them, the links to my fair value model and DCF models are here and here. I make a point of highlighting the fact that all of my research and models are transparent for two reasons:

- So clients can trust my research

- To challenge my competitors to be equally transparent.

At the very least I think my findings above call into question the diligence Morningstar has done on ESRX and other holdings. By what measure are they determining it to be attractively valued? How are they determining competitive advantage? Fair value? Can we see their models? It’s hard for me to understand how MORN decided that ESRX belongs in MOAT.

How many other Morningstar ratings are affected by analysis similar to that of ESRX?

MOAT is more dangerous than it appears. Don’t trust marketing claims. Do your own diligence.

Sam McBride contributed to this article

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.