This report is one of a series on the adjustments we make to convert GAAP data to economic earnings.

Reported earnings don’t tell the whole story of a company’s profits. They are based on accounting rules designed for debt investors, not equity investors, and are manipulated by companies to manage earnings. Only economic earnings provide a complete and unadulterated measure of profitability.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivalled due diligence on 5,500 10-Ks every year for the past decade.

Change in total reserves is the year over year difference in a company’s loan loss and/or inventory reserves. The change in reserves is positive (increased operating profit (NOPAT) vs net income) whenever the loss provisions exceed actual charge-offs or LIFO reserves increase. It is negative (lower NOPAT vs net income) when loss provisions are less than actual loan charge-offs or LIFO reserves decrease.

Loan loss provisions can be manipulated to boost a company’s earnings by bleeding off reserves. Or they can cause problems when companies need to “catch up” and take big provisions to raise reserves to more appropriate levels.

Fannie Mae (FNMA) had the largest change in total reserves of any company for the fiscal year 2012. FNMA decreased its loan-loss provision from $72 billion in 2011 to $59 billion in 2012, despite increasing its total amount of loans outstanding. Under GAAP rules, FNMA is able to boost earnings by the amount of decrease in reserves as income. Meanwhile, the 2012 loan loss provision was $9.4 billion less than actual charge-offs.

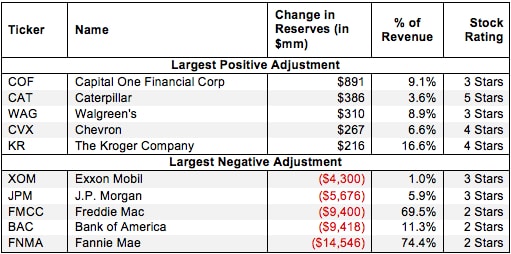

Figure 1 shows the five companies with the largest increase in total reserves and the five with the largest decrease in total reserves.

Figure 1: Companies Most Affected By Change in Total Reserves

The ten companies in Figure 1 are not the only offenders. In the last fiscal year, New Constructs found 496 companies with positive changes in reserves totaling over $5.5 billion and 476 companies with negative changes in reserves totaling nearly $61.3 billion. Our database contains positive changes in reserves found in 6,960 10-Ks for a total adjustment of over $369 billion and negative changes in reserves found in 3,863 10-Ks for a total impact of over -$224 billion.

Five of the ten companies in Figure 1 are large financial institutions. Lots of changes in reserves are to be expected given their exposure to the recent credit crisis. However, financial companies are far from the only ones to be impacted by a change in reserves. Case in point: Caterpillar Inc. (CAT). The construction and mining equipment manufacturer added to its reserves in 2012, increasing inventory reserves by $328 million and loan-loss allowances by $57 million. Investors not reading the footnotes would underrate CAT’s 2012 profits by $386 million … and that’s not counting the other adjustments we make. In total, CAT’s true after tax profit (NOPAT) for 2012 was $1.8 billion more than its $5.7 billion GAAP earnings. Perhaps that is why the stock has a price to economic book value ratio of only 0.8, implying that the market expects CAT’s NOPAT to permanently decline by 20%. Only through close examination of the footnotes does CAT’s true profitability become apparent.

Sam McBride contributed to this report

Disclosure: Sam McBride owns CAT. David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.