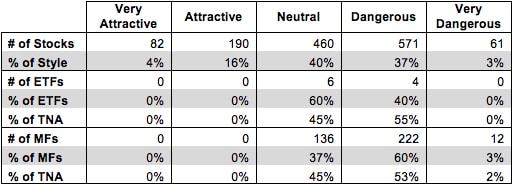

The Mid-cap Growth style ranks eighth out of the twelve fund styles as detailed in my Style Rankings for ETFs and Mutual Funds report. It gets my Dangerous rating, which is based on aggregation of ratings of 10 ETFs and 370 mutual funds in the Mid-cap Growth style as of May 2, 2013. Prior reports on the best & worst ETFs and mutual funds in every sector and style are here.

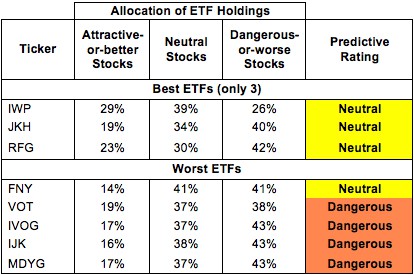

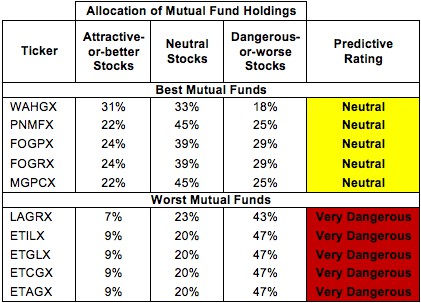

Figure 1 ranks from best to worst the eight mid-cap growth ETFs that meet our liquidity standards and Figure 2 shows the five best and worst-rated mid-cap growth mutual funds. Not all Mid-cap Growth style ETFs and mutual funds are created the same. The number of holdings varies widely (from 19 to 461), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the Mid-cap Growth style, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings.

My fund rating methodology is detailed here.

Investors should not buy any Mid-cap Growth ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this style, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

Get my ratings on all ETFs and mutual funds in this style on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

ProShares Ultra Russell MidCap Growth (UKW) and PowerShares RAFI Fundamental Pure Mid Growth Portfolio (PXMG) are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

14 mutual funds are excluded from Figure 2 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

iShares Russell Midcap Growth Index (IWP) is my top-rated Mid-cap Growth ETF and Wasatch Heritage Growth Fund (WAHGX) is my top-rated Mid-cap Growth mutual fund. Both earn my Neutral rating.

iShares S&P Midcap 400 Growth Index Fund (IJK) is my worst-rated Mid-cap Growth ETF and Mutual Fund Series Trust: Eventide Gilead Fund (ETAGX) is my worst-rated Mid-cap Growth mutual fund. IJK earns my Dangerous rating and ETAGX earns my Very Dangerous rating.

It is astonishing to me that no ETFs or mutual funds in the Mid-cap Growth style earn an Attractive rating, as Attractive-or-better rated stocks make up 20% of the market value in the style.

The takeaways are: mutual fund managers allocate too much capital to low-quality stocks and Mid-cap Growth ETFs hold poor quality stocks.

Figure 3: Mid-cap Growth Style Landscape For ETFs, Mutual Funds & Stocks

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering Mid-cap Growth ETFs and mutual funds, as 55% Dangerous-or-worse rated ETFs and mutual funds hold 55% of the total net assets in the style. No Mid-cap Growth ETFs or mutual funds allocate enough value to Attractive-or-better rated stocks to earn an Attractive rating, so investors should focus on individual stocks instead.

The Buckle, Inc. (BKE) is one of my favorite stocks held by Mid-cap Growth ETFs and mutual funds and earns my Very Attractive rating. BKE has a top-quintile return on invested capital (ROIC) of 33%. It has grown after tax profit (NOPAT) by over 15% compounded annually for the past 14 years, and has grownNOPAT in each of the past 10 years. That kind of consistency is hard to find from a clothing retailer. Despite its impressive track record, BKE has a comparatively modest valuation. At its current share price of ~$47.04, BKE has a price to economic book value ratio of 1.1, implying that the market expects BKE to grow its NOPAT by no more than 10% from its present value for its remaining corporate life. Such a low expectation seems out of line with BKE’s history of profitability. Such a low valuation combined with strong fundamentals makes BKE a low risk/high reward prospect for investors.

XL Group PLC (XL) is one of my least favorite stocks held by Mid-cap Growth ETFs and mutual funds and earns my Dangerous rating. XL advertises themselves as “the risk specialists”, which is ironic as XL has historically been an extremely risky stock for investors. Over the course of two years from 2004-2006, itsNOPAT went from positive $1 billion down to negative $1.1 billion and then back up to positive $1.8 billion. However, the long-term trend for XL is downward. Its 2012 NOPAT ($550 million) was 10% lower than in 1998. Investors may be focusing too much on the profit growth in XL’s recent past or the strong rise in its share price over the last year. Too few investors mistake a rising share price as a good thing. Riding the momentum of a stock only works if you know then the music is going to stop. When I see how high the valuation of XL is, I think the music will stop soon. To justify its current valuation of ~$30.89/share, XL would need to grow NOPAT by 7% compounded annually for 14 years. Those expectations are quite high, high enough that investors should look elsewhere.

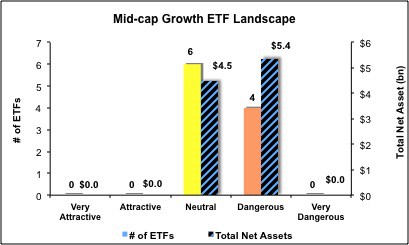

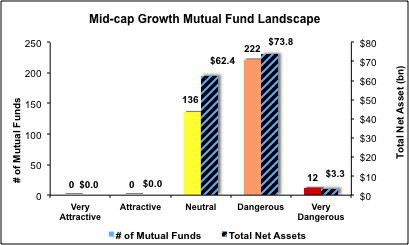

Figures 4 and 5 show the rating landscape of all Mid-cap Growth ETFs and mutual funds.

My Style Rankings for ETFs and Mutual Funds report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst Funds

Figure 5: Separating the Best Mutual Funds From the Worst Funds

Review my full list of ratings and rankings along with reports on all 10 ETFs and 370 mutual funds in the Mid-cap Growth style.

Sam McBride contributed to this report.

Disclosure: David Trainer owns BKE. David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style or theme.