This report is one of a series on the adjustments we make to convert GAAP data to economic earnings. This report focuses on an adjustment we make to convert the reported balance sheet assets into invested capital.

Reported assets don’t tell the whole story of the capital invested in a business. Accounting rulesprovide numerous loopholes that companies can exploit to hide balance sheet issues and obscure the true amount of capital invested in a business.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivalled due diligence on 5,500 10-Ks every year for the past decade.

Asset write-downs are reductions in the book value of an asset that occur when the fair value of an asset has declined significantly below its carrying value. The value of the asset is reduced on the balance sheet, and the write-down is charged against income.

For debt investors, which GAAP was primarily designed for, write-downs are analytically helpful. They provide a more accurate assessment of the liquidation value of a company’s assets. For equity investors, on the other hand, write-downs are not helpful because they distort the return on invested capital (ROIC) of a company.

Write-downs allow management to erase equity from the balance sheet, which inflates any return on asset/capital metric. So, we add back asset write-downs (after tax) to our measure of invested capital. And we keep those write-down in invested capital to ensure our measure of invested capitalholds companies accountable for all the capital invested in their business over their operating lives.

We also remove the write-down expense (after tax) from net operating profit after tax (NOPAT).

Without careful footnotes research, investors would never know that reported assets exclude a significant portion of invested capital due to asset write-downs for nearly 3,000 companies.

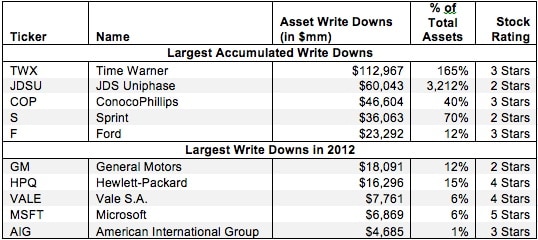

Figure 1 shows the five companies with the largest accumulated write-downs added back in ourinvested capital calculation and the five companies that wrote down the most amount of assets in 2012.

Figure 1: Companies With the Largest Write-Downs Added Back to Invested Capital

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

These ten companies are far from the only companies that are affected by asset write-downs. In 2012 alone, we found 4,442 write-downs totaling over $184 billion. Our database contains 43,176 write-downs found in 21,971 different Form 10-Ks resulting in nearly $1.6 trillion in adjustments to invested capital.

All five companies with the largest aggregate write-downs earn Neutral-or-worse ratings. Such large accumulated write-downs suggest a troubling pattern of management failure. On the other hand, three of the five companies with the largest write-downs in 2012 earn Attractive-or-better ratings. Those businesses are strong enough to overcome the impact of the after-tax value of write-downs being added back to invested capital.

Vale S.A. (VALE) earns our Attractive (4 Star) rating despite its nearly $7.8 billion in write-downs in 2012. A closer look at these write-downs, however, reveals the situation might not be as bad as it appears. Nearly $3 billion is attributable to damage to furnaces at one of VALE’s mines, while a further$1 billion is attributable to declining aluminum prices decreasing the value of VALE’s investment in Norsk Hydro. While both of these issues are unfortunate, the relatively small amount of write-downs (less than 4% of total assets) prior to 2012 suggests these were unusual one-time events rather than indicators of management failure.

Vale’s write-downs also cause reported earnings to significantly understate its true profitability. Removing write- down expenses, as well as other adjustments, brings NOPAT to $14.8 billion for 2012 compared to GAAP net income of $5.4 billion.

Other companies with large write-downs do not look so rosy. Adding back write-downs increases invested capital, therefore, companies with significant accumulated write-downs will have a meaningfully lower return on invested capital (ROIC) after we make this adjustment. Sprint Nextel Corp (S) has a whopping $36 billion in accumulated write-downs added back to invested capital. Most of these write-downs occurred in 2007, when Sprint recorded $29.7 billion in goodwill impairment, mostly related to its merger with Nextel Partners.

Even if one ignores these write-downs, Sprint has a dismal return on invested capital of only 0.8%. Adding back these write downs, however, increases Sprint’s invested capital to $83 billion and decreases its ROIC to 0.4%.

Investors who ignore write-downs are not holding companies accountable for all of the capital invested in their business. By adding back the after-tax value of write-downs to invested capital, one can get a truer picture of the value that management is creating for shareholders. Diligence pays.

Sam McBride and André Rouillard contributed to this report.

Disclosure: David Trainer owns MSFT. David Trainer, Sam McBride, and André Rouillard receive no compensation to write about any specific stock, sector, or theme.