Last week, S&P Dow Jones Indices released its annual U.S. S&P Indices Versus Active Funds (SPIVA) Scorecard, showing that 66 percent of large-cap equity managers underperformed their benchmark in 2015. This week, American Funds, the darling of the mutual fund world, has come out with its own Active Scorecard showing that certain active funds do outperform their benchmarks consistently.

But the fund family’s analysis looks at a select group of funds from Morningstar’s mutual fund database. The group includes U.S. and foreign large-cap equity funds in the quartile with the lowest net expense ratios and the quartile with the highest manager ownership; this includes nine American Funds.

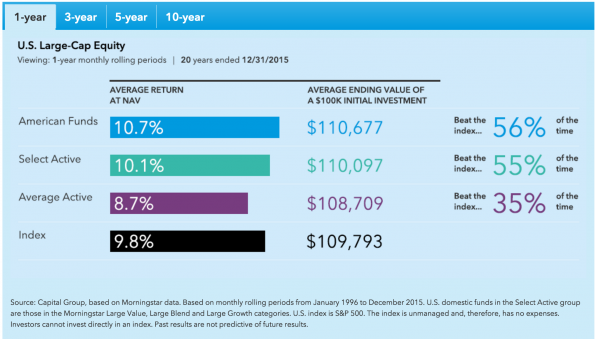

The firm found that this select group outperformed their benchmarks 55 percent of the time on a rolling one-year basis, 64 percent of the time on a rolling three-year basis, 77 percent of the time on a rolling five-year basis, and 95 percent of the time on a rolling 10-year basis.

“I think they could be data mining,” said Aye Soe, senior director of global research and design at S&P Dow Jones Indices and author of the SPIVA Scorecard. “They’re not looking at a large universe.”

“You could retrofit anything to suit your conclusion—whatever you want to put forth.”

Soe agrees that fees do play a role in funds underperforming the benchmark, but it really depends on the asset class. In equities, for example, if you add the fees back in, they won’t drastically change the conclusion. But in fixed income, adding fees back in would change the outcome.

“Our research does not rely on past performance or cherry-picking data to identify the Select Active group of funds that beat their benchmarks,” said Steve Deschenes, head of the client analytics and research team at American Funds. “Quite the opposite. We used two criteria—lowest quartile fees and highest quartile manager ownership in the fund—that have been validated by Morningstar and by our own published research as durable and predictable characteristics for selecting the best active managers now and in future.”

Of course, some active funds do outperform their benchmarks. Last year 75 percent of all domestic funds underperformed, according to the SPIVA Scorecard; that leaves 25 percent of funds that outperformed.

Deschenes said American Funds made efforts to make the analysis more robust, including hiring an outside consulting firm to comb through more than 20,000 SEC filings to find 10-year data for funds’ manager ownership.

The firm said it used rolling periods to better measure how investors build wealth over longer periods of time.

“Proponents of shorter time horizons try to tell us the score of the baseball game after each inning,” Deschenes said. “It’s the score at the end of nine innings that matters.”