Now that the Federal Reserve has finally begun raising interest rates, the European Central Bank (ECB) is headed in the opposite direction. And as a result, the contrasting monetary policies are causing a divergence in the global marketplace that is creating both risks and opportunities for investors.

As the U.S. digests its first rate hike in nearly a decade, the economy (led by 2015’s performance as the second-best year for American workers since 1999) is signaling that higher interest rates will not shock the recovery and moderate growth should continue, lending support for U.S. dollar strength.

The Eurozone, on the other hand, is dealing with a much different situation. Slow growth, deflation worries, high unemployment and concerns over Greece are pressuring the ECB to push rates further into negative territory and institute its own version of quantitative easing. While cheaper borrowing costs and an influx of cash into the monetary system is intended to spur spending and inflation, it may also weaken the euro.

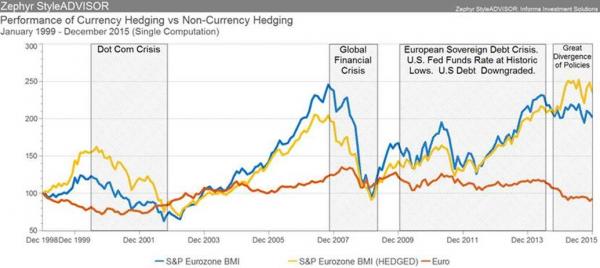

These diverging policies increase currency risk, which can be minimized through hedging. It is therefore vital for global investors to be mindful of how exchange rates and protection strategies affect assets. Using history as a guide, we can see how adding currency hedging strategies to a mix of assets performs during periods of a weak or strong currency.

Euro Depreciates: 1999–2002

In the above illustration, the first period of euro weakness started in 1999 and ended mid-2001 (red line). January 1999 also marked the birth of the euro, and the uncertainty surrounding the new currency may have accelerated depreciation. During this time period, the percent change month-over-month for the euro-USD exchange rate decreased steadily. Notice that currency hedging strategies, represented by the S&P Eurozone BMI Hedged index (yellow line), outperformed non-hedging strategies, represented by the S&P Eurozone BMI index (blue line). This trend continued until the euro strengthened at the beginning of 2002.

Euro Appreciates: 2002-2008

Starting in the first quarter of 2002, the euro strengthened against the dollar, and as a result, investing in Eurozone companies without currency hedging worked well. The gap between the hedging strategies (yellow line) and non-hedging strategies (blue line) shrunk. Confidence in the euro gained support, and by the end of 2003, we see that the euro recovered and non-hedging strategies become favorable. A strong euro continued until mid-2008 when the ECB followed the Fed’s lead amid the financial crisis and started its own stimulus plan.

Euro Maintains Relative Strength Through Unprecedented Global Events: 2009-2014

The European sovereign debt crisis began to take hold in 2009. During this time, the federal funds rate was locked in at historically low levels as the U.S. recovered from recession and the creditworthiness of long-term U.S. debt was downgraded (August 2011), all of which resulted in a relatively narrow euro-USD exchange rate range.

The Great Divergence: 2014-Present

This brings us to the current environment of diverging policies. Amid the first quarter of 2014, the U.S. continued its recovery while the Eurozone confronted its own obstacles. This has led to a weakened euro, resulting in the S&P Eurozone BMI Hedged Index that reduces currency risk exposure, becoming more favorable and displaying the benefits to hedging currency risk.

It’s impossible to know if this weakened euro trend will continue, and if so, for how long. Betting on foreign exchange is a very difficult game to play, as there are many factors that determine currency fluctuations. Using hedging strategies can help reduce portfolio risk.

Ryan Nauman is a Market Specialist for Informa Investment Solutions.