(Bloomberg Opinion) -- Bon Jovi fans may have been aghast at seeing guitar hero Richie Sambora dressed as a giant baked potato on The Masked Singer TV show in February, gamely running through hits by Fleetwood Mac and The Pretenders.

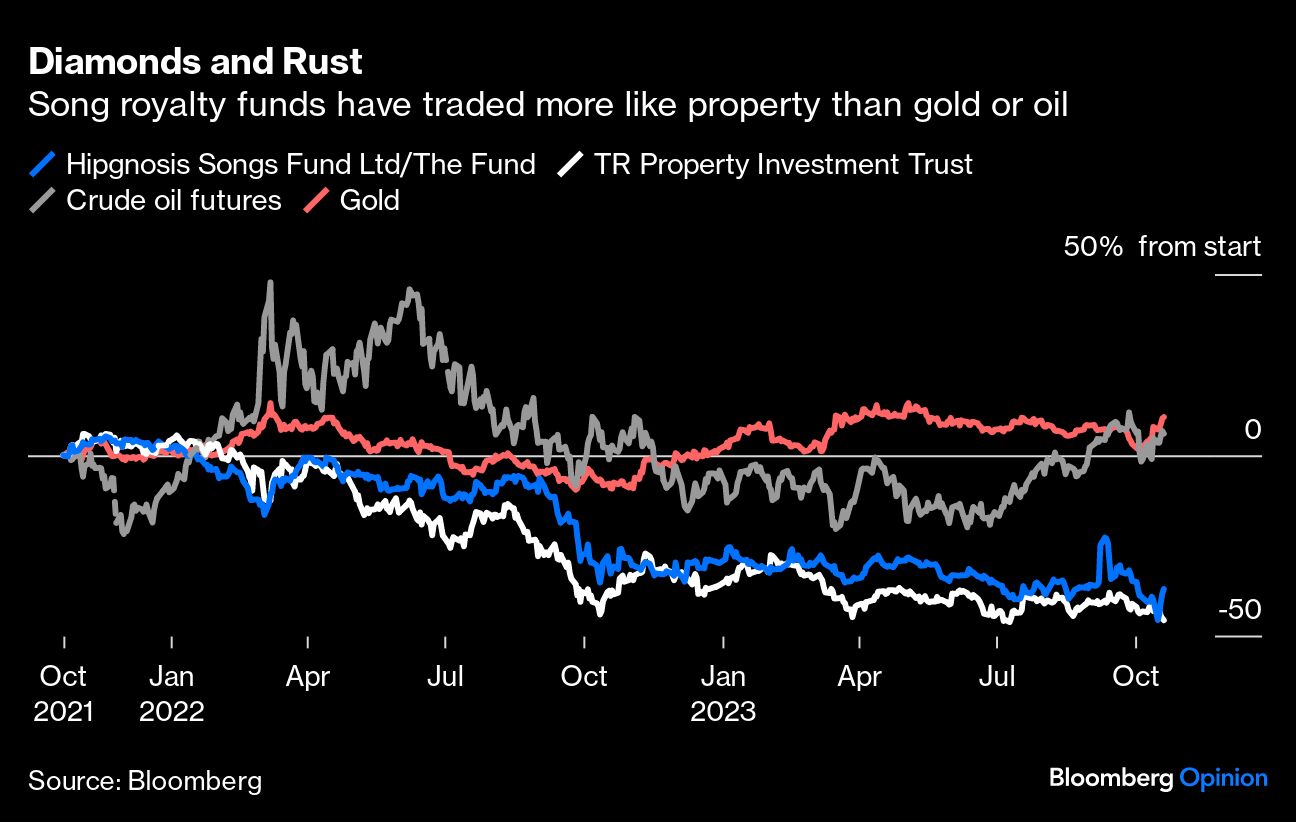

Investment fund Hipgnosis Songs Fund Ltd. was thrilled, though. The holder of the rights to Sambora’s own hits and some of those he played makes money from getting musical nudges on TV and generating new interest in old tunes. This, combined with growth in streaming platforms such as Spotify Technology SA, is why Hipgnosis splashed $2 billion between 2018 and 2021 on music catalogs from Neil Young to Chrissie Hynde, saying songs were “as good as gold or oil.” It wasn’t alone: Blackstone Inc., KKR & Co., BlackRock Inc. and other financiers also helped to fund mega-purchases of the rights to hits from the likes of Bruce Springsteen and Bob Dylan.

But the times are a-changin’, and not for the better. Hipgnosis trades at a whopping 50% discount to net asset value after scrapping a dividend payment earlier this month; it faces a bruising shareholder rebuke this week over perceived self-dealing via attempts to lift its share price by selling $440 million in assets to a sister fund owned by Blackstone. Rival Round Hill Music Royalty Fund Ltd. is in a healthier position, trading at a 10% discount after a takeover offer from Concord, backed by fresh funding from Apollo. Private equity looks to be in a position to be picking up music rights for a song — albeit after Springsteen and many of his peers have shown finance who’s boss by getting paid at the top of the market.

How did we get here? The big picture is that music rights have traded more like commercial property than oil or gold, as the above chart shows: Frothy in the good times of easy money, depressed in the bad days of rising interest rates. The post-pandemic climb in borrowing costs has eroded the value of illiquid assets such as music as investors demand a higher yield to compensate for extra risk. As per Hipgnosis’ own annual report, a 0.5% increase in the discount rate theoretically results in a chunky $222 million hit to the value of its $2.8 billion catalog. Citrin Cooperman, which is responsible for valuing the portfolio, has kept its discount rate flat this year, but investors aren’t reassured.

The problems go beyond the economic environment. It also looks like musical cash flows have been less dependable than expected. Net revenue at Hipgnosis fell 12.5% and losses widened in the year ending in March 2023; its scrapped dividend reflects overly optimistic royalty payout expectations and the need to keep a lid on debt. The fact that Hipgnosis overestimated royalty payments relating to a US copyright decision to the tune of almost $12 million — having promoted such payout uplifts as “directly” leading to higher revenue — suggests shaking money out of streaming is more complex than following consumers’ predictable attachments to childhood hits or Christmas songs.

Music consumption does follow patterns, but not all rights are equal — and not all are worth multiples of 20 times net publishing revenue (double 2013 levels). Publishing rights mask the sharing of spoils in percentage terms between songwriters, while recording rights are also divided between performers and producers. Some rights might be a passive right to receive payment, which is fine in theory but won’t necessarily put you in prime position when the John Lewis ad campaign is looking for a seven-figure song. This is headache-inducing stuff reminiscent of niche investments like stamps and wine. Yet somewhat like WeWork’s Adam Neumann, Hipgnosis’s charismatic figurehead Merck Mercuriadis tended to understate the risk — and like other one-hit wonders showed signs of overconfidence and downplayed the effect of luck.

What happens next? Investors are rightly furious and are ready to oppose Hipgnosis’ proposed deal and may even vote this week for the company to be eventually wound up. Still, the omens might be quite good for the kind of investor that can handle illiquid, poorly valued assets — private equity. Hipgnosis has run out of time to prove its stock-market model works, and now has to show that it can apply a realistic valuation to its catalog and sell to the highest bidder — even the good stuff it’s holding onto. A return to healthier valuations and some kind of industry roll-up is likelier than a self-destruction of music publishing, which has survived all sorts of boom-bust cycles and musical disruption.

The niggle is that even for broad-shouldered financiers, squeezing more value out of songs has a lot of future unknowns to contend with. “There is a high risk of betting on the wrong metrics,” warned consultancy MIDiA Research last year. Music streaming growth is slowing, even as bullish forecasts expect music revenue to double by 2030. Generative artificial intelligence could boost the value of royalties by creating new rights, or crush them by making music that’s better than the real thing. And the strange habits of social media means I’ve spent more time on YouTube listening to rock stars talk about their music than hear them play it on Spotify. I may not be alone.

Hats off to Bruce Springsteen, then, for selling at the top — and good luck to the new music-rights bosses cheering on the next baked-potato show.

More From Bloomberg Opinion:

-

Katy Perry’s $225 Million Payday Began in 1908: Stephen Mihm

-

Dining Out When the Music Is Distasteful: Howard Chua-Eoan

-

AI Gets a Key to Spotify's Songwriting Fortress: Lionel Laurent

Want more from Bloomberg Opinion? OPIN

To contact the author of this story:

Lionel Laurent at [email protected]