Alternative investment strategies continue to offer the potential for increasingly unique sources of enduring diversification. Alternative investments totaled $13 trillion in assets in 2021, according to the market research firm Preqin. The total dollar value in these classes has more than doubled between 2015-2021 and is forecast to reach $23 trillion by 2026.

Real estate, infrastructure and natural resource investments (real assets) have increasingly played a critical role in the success of some of the largest endowments and foundations worldwide, with Harvard, Stanford and Yale allocating north of 25% of their overall funds toward real assets.

Alternatives Assets are Growing

It may be helpful to examine the growth of alternatives, as illustrated below in the 2023 NACUBO-TIAA Study of Endowments. The chart demonstrates that endowments allocated on average 58.64% of assets under management to alternative strategies.

According to the report, “Compared with FY21, the most notable asset allocation difference is that, across all participating endowments, allocations to private equity and venture capital slightly exceeded those of public equities (U.S., non-U.S. and global).

Portfolio allocations as of June 30, 2022, were 28 percent in public equities (U.S., non-U.S. and global), 30 percent in a mix of private equity and venture capital, 17 percent in marketable alternatives, 11 percent in fixed income, 12 percent in real assets, and just under 3 percent in other assets.

Private energy and infrastructure were the strongest-performing assets for endowments, driven by spiking oil and natural gas prices caused by the Ukraine/Russia conflict, and increasing demand for commodities as the global economy continues to recover from the COVID-19 pandemic. Private equity, venture capital, private real estate, and other private real assets all posted strong returns in FY22 as well.” (Percentages are dollar-weighted averages for all 678 colleges, universities and education-related foundations completed the FY2022. $807 billion of endowment assets represented in the FY2022 survey)

The report’s conclusion states, “We believe that there is clear academic and empirical evidence that alternative investment strategies have contributed significantly to portfolio returns over the last 20 years... Allocations to alternatives should be reserved for the investor that can access top-tier managers, since the distribution of returns among alternative managers is far greater than it is among traditional managers.”

Alternative investment strategies are included in a portfolio to enhance returns, reduce risk, or may achieve a dual mandate. They are fundamental to the structure of the so-called endowment model of investing, which concludes that long-term asset pools can outperform investors with shorter-term time horizons by providing capital to less efficient, more complicated and illiquid sectors of the capital markets.

Building Successful Portfolios

Real assets have increasingly played a critical role in the success of some of the largest astute endowments and foundations worldwide, with some of the top-performing endowments allocating 20% to 25% to real assets. With many financial advisers seeking to emulate the endowment model with their individual clients, they are asking the question, “What is the proper manner in which to allocate to real assets, through liquid or illiquid real assets?”

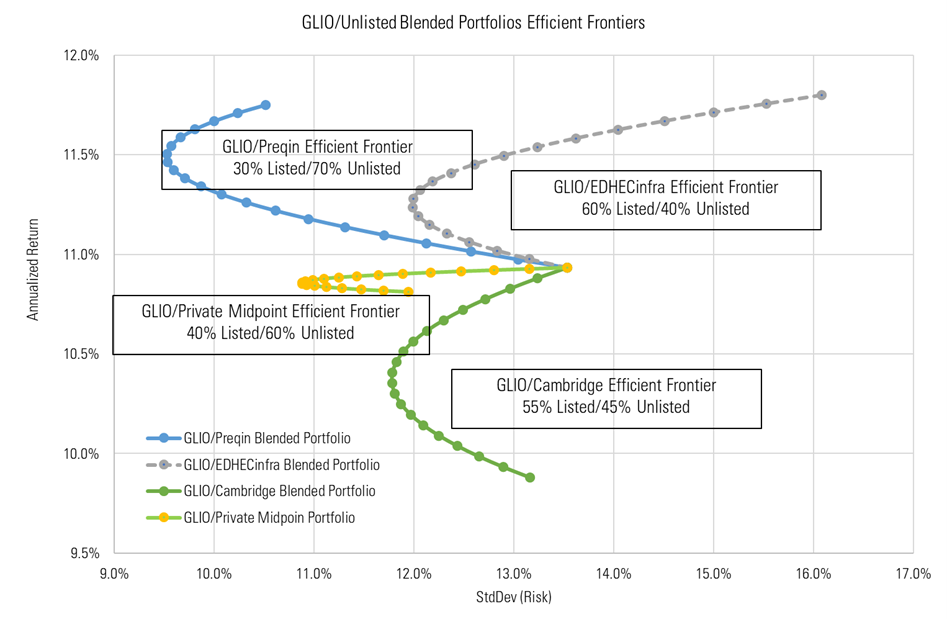

Let’s take a look at a specific class: infrastructure. According to The Global Listed Infrastructure Organization (GLIO), the optimal infrastructure portfolio incorporates 30% listed infrastructure and 70% unlisted (private markets) infrastructure to achieve the portfolio that generates the highest return while maintaining the lowest standard deviation which can be seen in the efficient frontier chart below. (Chart: Source - Source: Global Listed Infrastructure Organization https://www.glio.org/journal issue 13)

Ultra-high net worth individuals and large institutions typically make their infrastructure investments through private infrastructure funds, where they can benefit from the funds’ diversification and the infrastructure investment expertise of the managers. However, these funds typically require large minimum investment amounts (ranging from $5 million to more than $25 million for each fund), far beyond the means of most individual investors. Assembling a diversified portfolio requiring multiple funds is even more challenging for individuals and typically involves committing several hundred million dollars to diversify across primaries, secondaries and co-investments.

What options are available to gain exposure to this unique asset class?

With many financial advisers and brokers seeking to emulate the endowment model with their individual clients, infrastructure and other real asset strategies have flourished in the past few years, aided by unique structures that democratize access to these asset classes through interval funds and non-traded REITs.

Interval funds offer individual investors access to an actively managed diversified portfolio of public and private investments with low investment minimums. This enables individuals to invest alongside pension funds, endowments and other astute institutional investors.

There are challenges

Mass affluent investors gaining access to illiquid alternatives creates both challenges and opportunities for all parties involved. Financial advisors and broker dealers must fully disclose the risks introduced with these types of investments to clients. This will ensure clients truly understand the investment opportunity from every aspect. Subsequently, education and training are required for advisors/brokers and their clients, including asset quality, suitable type and potential liquidity limitations with various products.

A Challenging Financial Environment

Global events such as COVID, monetary policy, inflation and country-by-country economic repercussions have created challenging capital markets for global investors. The evidence is mounting that this is leading to liquidity issues in the capital markets. As history has shown, there can be increasing volatility and complexity in public and private markets.

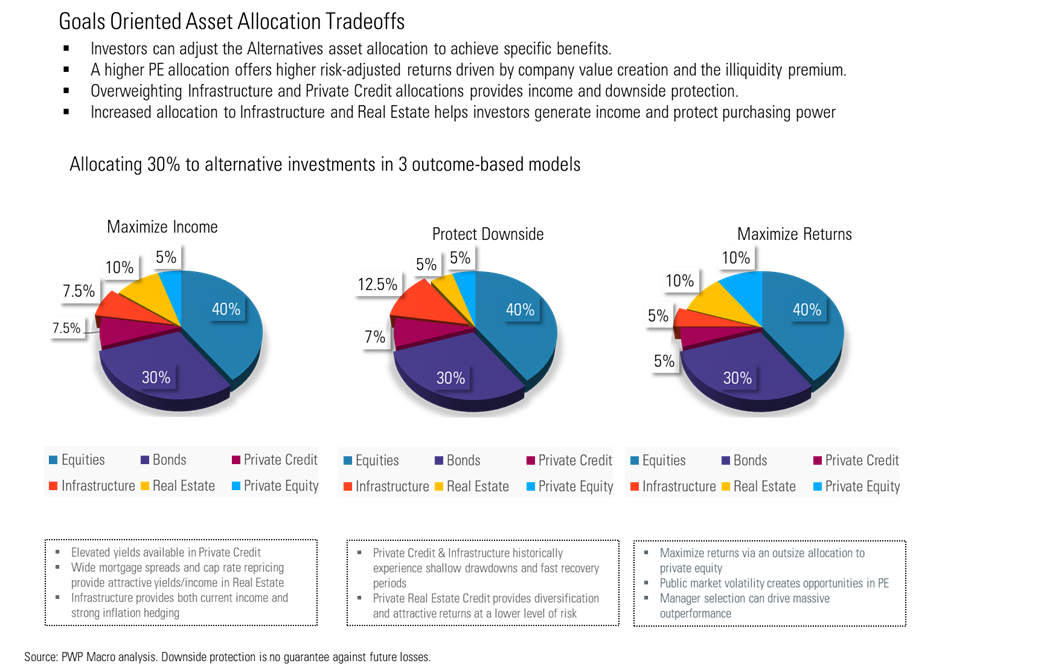

The recent attention drawn to alternatives has been focused on headline grabbing issues such as liquidity and redemptions. There is no digging into the fundamental issues such as asset type, portfolio management inadequacies and asset liability that are causing the problems. Every investment should require due diligence to determine if it will correctly align with each investor’s goals and portfolio objective. Using real assets requires the same due diligence and more fundamental understanding of potential risks vs rewards. As the chart below illustrates, there are asset allocation trade-offs offered with alternatives.

The investing public has been told that investing in real assets carries more risk and not as much potential return as traditional investment offerings. Further exacerbating the opportunity is the concern of liquidity for these investments. However, as has been demonstrated, endowments, foundations and ultra high net worth individuals have been enjoying significant financial success with this asset class and over time have been allocating more of their assets into this space. We see an opportunity for the mass affluent investors to gain more exposure to this asset space because it can potentially improve portfolio returns, provide diversification away from traditional financial products, possibly improve portfolio risk management and enhance access to a large portion of the investment universe. The result could be a more balanced playing field for all investors and an improved structure for successful financial outcomes.

Michael Underhill is President of ADISA. Underhill is also founder and chief investment officer of Capital Innovations LLC. Underill is responsible for overseeing global investment strategies and leads Capital Innovations’ Investment Policy Group, a forum for analyzing broader secular and cyclical trends that Capital Innovations believes will influence investment opportunities.