One of the chief attractions of private equity is its ability to outperform public equity markets: On a net basis (after deducting all fees, including carried interest), private equity has outperformed major public indices over 10-, 15-, and 20-year periods.

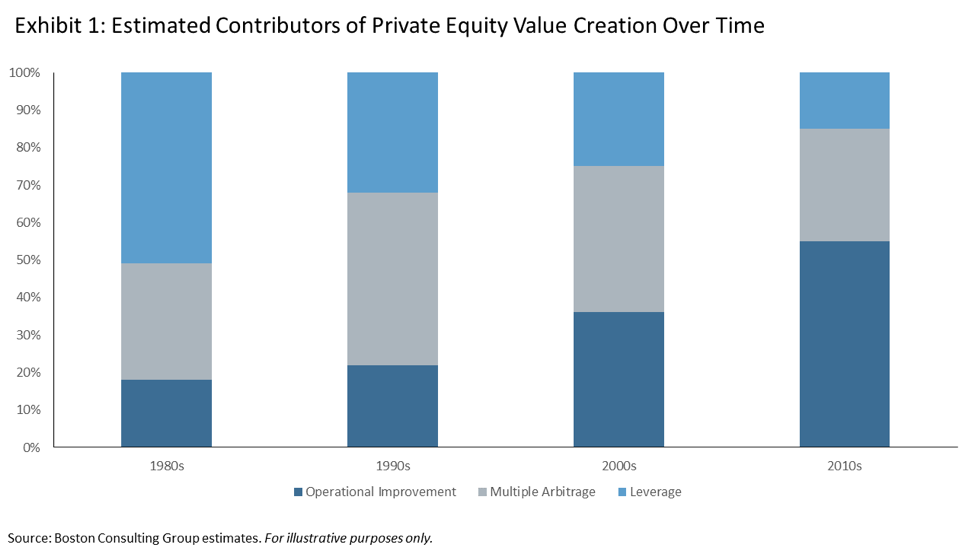

The source of this outperformance has shifted over time. Back in the late 1980s and 1990s, PE firms relied heavily on leverage and valuation arbitrage. There was less emphasis on operational improvement to generate returns. Since then, the contribution of leverage to value creation in private equity has declined while the importance of operational improvements has increased (Exhibit 1). The current environment is largely responsible. Buyout deals today are pricing at a relatively expensive 11x EBITDA on average and they’re competitive, requiring managers to put up more capital than was standard in decades past.

At these high valuations, the margin for error is thin in today’s market. PE managers can’t expect to generate similar levels of outperformance versus public equities based solely on valuations continuing to rise. In fact, most private equity managers that we interact with report flat or declining valuation multiples in in their portfolios. Hence, many PE managers have shifted their focus to identifying and executing initiatives that improve their companies’ revenue and EBITDA trajectory.

Sector expertise is key

To truly generate operational improvements, PE managers have to understand and develop an investable thesis for the trends in target sectors. This focus can help managers win deals: High-quality companies have many financing options today and the management teams of these companies prefer investors who not only understand sector trends but also have the resources to execute on those trends. To this end, many PE managers have developed internal investment teams organized by sectors, coupled with internal teams of executives with deep domain expertise in these sectors developed through prior work experience. This structure enables PE firms to source investment opportunities proactively, engage in deeper due diligence and identification of key risks, earn the trust of target companies’ management teams, and develop relevant business plans (e.g., 100-day plans) to unlock long-term value.

PE managers have significant control to execute value creation strategies

Many traditional PE transactions are control buyouts, in which the buyer takes majority control of a firm. This comes with a significant benefit, in that the new PE owners can focus on driving significant value creation in portfolio companies by adopting long-term strategies that they can oversee and closely monitor. In fact, experienced private equity managers are almost obsessively engaged in these three- to six-year strategic plans (the typical length of PE ownership). In contrast, investors in public companies usually hold very small positions and have little influence at these companies.

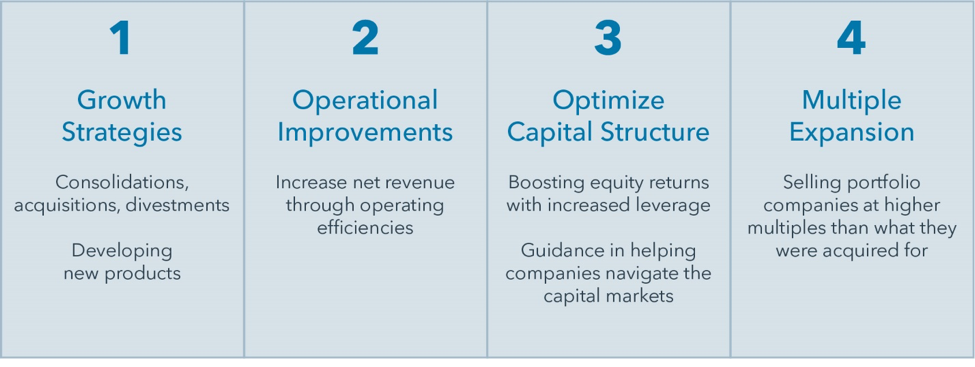

As part of this process, PE managers spend a significant amount of time with the senior executives running their portfolio companies. Together, they focus on long-term plans such as expanding into new markets, making add-on acquisitions, selectively consolidating a fragmented sector by acquiring smaller companies at lower entry multiples, and/or improving operations by streamlining costs and selling non-core assets. These are all levers that help drive value, and therefore the ultimate valuation at which a portfolio company is sold. Common strategies that PE managers use to create value in portfolio companies include:

1) Implementing growth strategies, both organic and via acquisitions;

2) Improving operating and profit margins by identifying cost synergies;

3) Optimizing the capital structure through leverage or debt restructuring; or

4) Sell a company at a higher revenue or EBITDA multiple than the multiple at which the fund manager originally acquired it (commonly referred to as “multiple expansion”).

Exhibit 2: Main Strategies to Add Value

Most managers use a combination of these strategies to add value. Successfully executing growth strategies and operational improvements can take several years. It is worth noting that certain value creation strategies that increase long-term value require an increase in short term costs. These types of strategies are far more difficult for public companies to implement given the pressure of daily public market scrutiny and quarterly earnings reports.

Expertise and long-term thinking drive private equity returns today

When PE firms establish positions, it is incumbent upon them to realize significant value from the transactions for their investors. But the days of levering up and slashing costs are (largely) over. Instead, managers today rely much more on leveraging their in-house operational and sector expertise to drive growth at portfolio companies. The fact that PE managers have the flexibility to plan and act long-term makes this possible and helps explain why PE has been able to outperform public equities. With this dynamic unlikely to change, the potential performance benefits of a private equity allocation should endure.

Kunal Shah is Managing Director, Head of Private Equity Solutions, iCapital Network