I’ve been getting lots of questions lately from investors who have concerns about the U.S. dollar losing its status as the world’s reserve currency—“dedollarization.” Typically, the questions come because investors have been reading articles and listening to some financial guru warning them about a coming apocalypse and urging them to sell their equities.

In my more than 25 years of advising investors, I’ve heard many of these clarion calls, and they are almost always from some “salesperson” trying to panic investors into buying what they are selling—often gold and now, perhaps, cryptocurrencies. These “gurus” know that not only are investors risk averse, but they also are highly subject to confirmation bias—the tendency to search for, interpret, favor and recall information in a way that confirms or supports one’s prior beliefs or values. Thus, investors already worried about, for example, the U.S. debt-to-GDP ratio, inflation, a banking crisis, the potential for a default on U.S. debt and any number of other issues, will have their fears “confirmed,” giving them the urge to want to do something, which is typically to panic and sell when all the evidence suggests that doing nothing is likely the best course. The reason is simple: Everything that they are worried about is already well known by the market and built into prices. Let’s look at an example.

If the market thought the dollar was in danger of losing its role as a reserve currency, the dollar would be collapsing in value. The following chart shows that while the dollar rises and falls with economic cycles, it is, nonetheless, about the same value as it was 25 years ago.

The dollar’s sharp rise in 2022 was caused by the Federal Reserve’s aggressive tightening of monetary policy, raising rates at the fastest pace ever while taking action well ahead of other central banks. The recent fall in the dollar is likely related to the fact that other central banks are now tightening faster than the U.S., and the market’s expectation is that the U.S. is likely to start cutting rates in the latter part of 2023, while other central banks are still tightening.

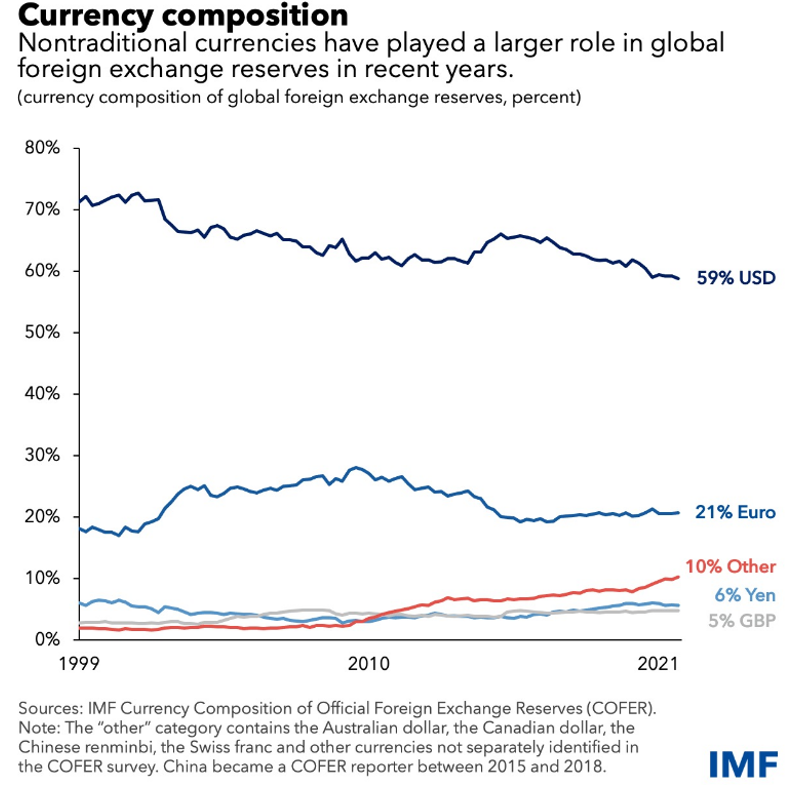

That said, it is worth noting that, as can be seen in the following chart, the dollar’s share of global foreign-exchange reserves, currently at 59%, has declined modestly from its level of 67% 20 years ago.

Note that the U.S. dollar has long played an outsize role in global markets and continues to do so even as the American economy’s share of global output declines (due to faster growth from countries such as China and India). This status quo will likely continue for the foreseeable future, as there are few alternatives. Note that the reduced role of the dollar hasn’t been matched by increases in the shares of the other traditional reserve currencies: the euro, yen and pound. While the Chinese renminbi has gained share, much of that growth (about one-third) comes from Russia’s increased holdings.

While it’s certainly possible that the dollar’s share of world reserve currencies will continue a gradual decline, it’s highly unlikely that the dollar will lose its status as the leading reserve currency. The reason is that important attributes of a reserve currency include economic weight, financial depth and transparent and predictable policies (China has none of these, and neither does India)—the stability of the economy and policy decisions matter for international acceptance. And it should be freely convertible: There really are no alternative currency markets that meet all of these criteria, especially the depth and breadth of financial markets. The currencies that come closest are the euro and the yen. However, Japan and the countries in the eurozone face many of the same economic issues as the U.S. (such as high debt-to-GDP ratios).

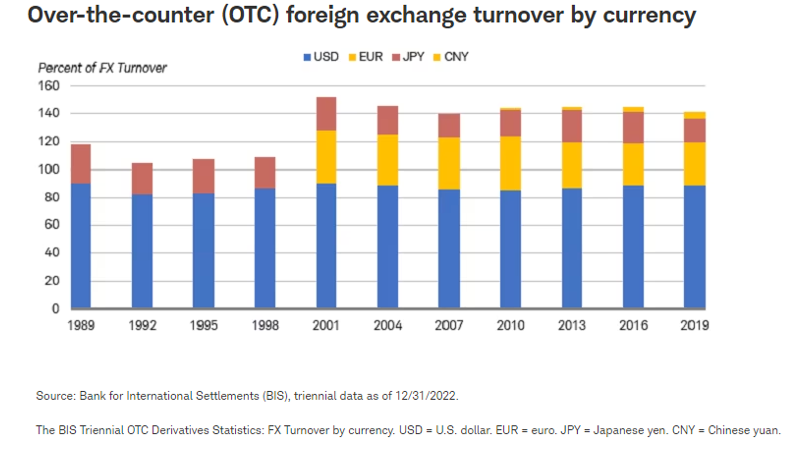

Another indicator of the dollar’s continued importance is that dollar demand for transactional purposes has remained steady—accounting for more than 80% of financial market transactions. (Foreign exchange turnover adds up to 200% because there is a currency on each side of the trade.)

That all said, because investors should never make the mistake of treating the unlikely as impossible, let’s see if history can provide us with any lessons on the impact of a currency losing its status as the leading reserve currency.

History’s Lessons

While investing via the rearview mirror isn’t generally a good idea, as it leads to performance chasing—buying what has done well (at relatively high prices) and selling what has done poorly (at relatively low prices)—used correctly, a look back still can provide us with valuable lessons. As Spanish philosopher George Santayana warned: “Those who cannot remember the past are condemned to repeat it.” With that in mind, we’ll go to our trusted “videotape.” Prior to the dollar taking that role, the British pound was the world’s reserve currency. In the mid-1920s, the dollar overtook the pound as the leading reserve currency. During World War II Britain’s industrial capacity was devastated. In 1940, the British pound was pegged to the U.S. dollar at $4.03. In 1949, the pound was devalued by 30% to $2.80. A second devaluation followed in 1967. As I write this piece, it was trading at about $1.25. With that perfectly clear crystal ball, which none of us has, would you rather have owned U.S. stocks or U.K. stocks?

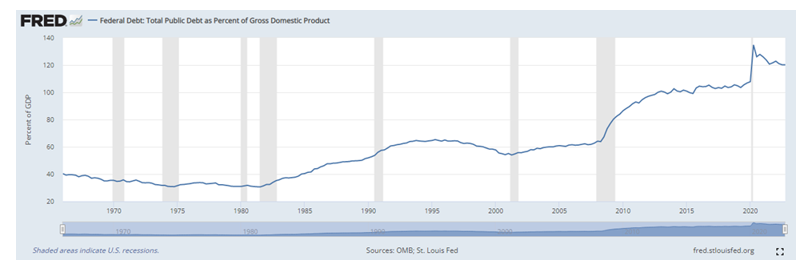

We have data on the FTSE All-Share Index going back to February 1955. Given these conditions, it’s likely you would have chosen to invest in U.S. over U.K. stocks. And you’d be dead wrong. From February 1955 through March 2023, the FTSE All-Shares Index returned 11%, outperforming the S&P 500 Index, which returned 10.4%. It’s also worth noting that over the first 52 years of this period, from February 1955 through December 2007, the FTSE All-Shares Index outperformed the S&P 500 by an even wider margin of almost 2% (12.7% vs. 10.8%). However, over the period since the global financial crisis, when I first began to hear fears that the U.S. would lose its status as the world’s reserve currency because of the extremely easy money policy implemented by the Fed and our debt-to-GDP ratio exploding due to expansionary fiscal policy (see chart below), the S&P 500 outperformed the FTSE All-Shares Index by almost 4% per annum (9.2% vs. 5.3%). All those who panicked because of virtually the same type of concerns I am hearing today missed out on an equity risk premium of 8.5% per annum as one-month Treasury bills returned just 0.7%.

There Are Negatives to Being a Reserve Currency

There is a flip side. The higher value of the dollar makes it more difficult for U.S. companies that must compete with cheaper imports, and it also makes their exports more expensive to foreign buyers. In other words, all else equal, dedollarization would benefit U.S. companies that compete with foreign producers.

On the other hand, dedollarization, and the resulting decline in the holdings of U.S. debt held by foreigners, would lead to interest rates being higher than they would be otherwise, raising the cost of financing our $31 trillion in debt, with negative consequences for fiscal deficits and economic growth. Research, including the 2011 study “The Real Effects of Debt,” the 2012 study “Is High Public Debt Always Harmful to Economic Growth?,” the 2013 study “Does High Public Debt Consistently Stifle Economic Growth?,” the 2020 study “Debt and Growth: A Decade of Studies,” and the 2021 studies “The Impact of Public Debt on Economic Growth” and “Public Debt and Economic Growth: Panel Data Evidence for Asian Countries” have all found that beyond a certain level, about 90%, government debt as a percent of GDP is a drag on growth.

Investor Takeaways

First, investors who are concerned about dedollarization can hedge some of that risk by making sure that their international equity investments are not hedged against the dollar.

Second, the lesson the rearview mirror teaches us is that what may seem painfully obvious at the time may turn out to be wrong. Another lesson is that paying attention to economic and market forecasts is a recipe for likely failure because research demonstrates that there are no clear crystal balls, only very cloudy ones. Finally, as there will always be something to worry about, investors are best off “tuning out” the noise created by Wall Street and gurus. Investors are best served to remember this advice from Wall Street Journal columnist Jason Zweig: “Whenever some analyst seems to know what he’s talking about, remember that pigs will fly before he’ll ever release a full list of his past forecasts, including the bloopers.”

As Warren Buffett advised, investing is simple (it’s just not easy)—ignore the noise and adhere to your well-thought-out plan—rebalancing along the way—one that includes the virtual certainty that we will have to live through difficult times. You can do that by being sure to not take more risk than you have the ability, willingness or need to take.

Larry Swedroe has authored or co-authored 18 books on investing. His latest is Your Essential Guide to Sustainable Investing. All opinions expressed are solely his opinions and do not reflect the opinions of Buckingham Strategic Wealth or its affiliates. This information is provided for general information purposes only and should not be construed as financial, tax or legal advice.