According to Preqin’s 2020 Private Equity & Venture Capital Report, there are now more than 18,000 private equity funds, with assets under management exceeding $4 trillion. A combination of factors has led to the dramatic growth: The low interest rate environment experienced from 2008 through 2021; the potential for PE to enhance portfolio returns from an illiquidity risk premium; the shrinkage in the public markets, especially for small stocks (the Sarbanes-Oxley Act of 2002 dramatically increased the costs of being a public company, causing many to stay private longer; there are fewer public companies than there were 40 years ago, and current listings are on average much larger than 20 years ago); and the potential for alpha through the active selection and assistance to companies not accessible in public markets.

For all those reasons, PE firms are pushing for a place in defined contribution (DC) retirement plans.

Investors that use private equity believe that the benefits outweigh the unique challenges not present in publicly traded assets, such as complexity of structure, capital calls, illiquidity, lack of transparency and high costs. The fact is that many portfolio companies held by private equity buyout funds would be characterized as small-cap value stocks if they were publicly listed. The decline in public listings and growth of PE over the past two decades represents a shift in the ability of retail investors to diversify, and as buyout and growth equity PE funds increasingly focus on innovative health care and technology companies, investors willing to assume the higher risk can get exposure to sectors that offer potentially higher returns.

Gregory Brown, Keith Crouch, Andra Ghent, Robert Harris, Yael Hochberg, Tim Jenkinson, Steven Kaplan, Richard Maxwell and David Robinson, authors of the study “Should Defined Contribution Plans Include Private Equity Investments?,” published in the fourth quarter 2022 issue of the Financial Analysts Journal, evaluated the pros and cons. While their analysis focused primarily on PE buyout funds, much of their qualitative analysis applies equally to other types, such as real estate, infrastructure, natural resources, venture capital and private credit.

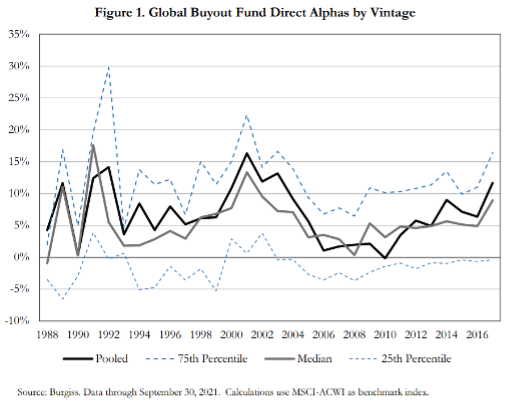

They began by looking at the performance of all 2,399 buyout funds in the Burgiss Manager Universe with vintage years from 1987 to 2017. The figure below plots quartile breakpoints as well as the pooled estimate for all funds using the MSCI All Country World Index (ACWI) as the benchmark index. Alpha was positive for the median and pooled estimates (solid lines) for almost all vintage years. However, the dashed line shows that typically the bottom-performing quartile of funds had negative alpha in a typical vintage year. In contrast, the top-performing quartile funds have direct alphas in excess of 10%. There has been substantial cross-sectional variation in fund performance, suggesting that investors may need to hold many funds to diversify the risk and that there may be differences in the levels of market risk between buyout funds and the broader public market indexes.

Keep in mind that the alpha here is not adjusted for risk, just benchmarked against the MSCI-ACWI Index. Those risks include not only their lack of liquidity but also their high leverage, higher betas than the market, high volatility of returns (the standard deviation of private equity is in excess of 100%), and the extreme skewness in returns—the median return of private equity is much lower than the mean (the arithmetic average) return. Their relatively high average return reflects the small possibility of a truly outstanding return combined with the much larger probability of a more modest or negative return. In effect, private equity investments are like options (or lottery tickets), providing a small chance of a huge payout but a much larger chance of a below-average return.

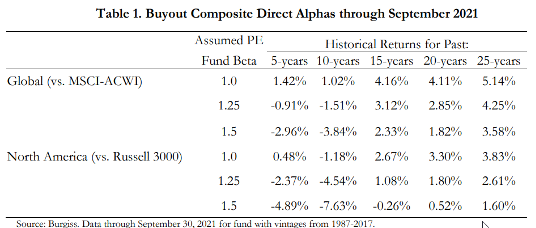

With these differences in risk in mind, the authors also reported the alphas, assuming betas of 1.25 and 1.5. Their benchmark for North American funds was the Russell 3000 Index, and the benchmark for global funds was the MSCI-ACWI.

While buyout fund historical returns for 15-, 20- and 25-year horizons were better than the public benchmark by roughly 2 to 4 percentage points per year, the performance for the more recent five- and 10-year periods was below the levered benchmark. This finding is consistent with those of the authors of the 2017 paper “How Persistent Is Private Equity Performance? Evidence From Deal-Level Data,” who concluded: “Overall, the evidence we present suggests that performance persistence has largely disappeared as the PE market has matured and become more competitive.”

The authors note that there is another potential benefit for retail investors who are prone to behavioral errors: “Precisely because private funds are illiquid, institutional restrictions on portfolio redemptions could prevent some investors from panic selling during a market downturn.” Another potential benefit they cite is that the inclusion of PE funds in DC plans could have a positive impact on liquidity in the secondary market that would benefit all participants; PE funds in the secondary market come with significant price discounts—an increase in activity from investors in DC plans could help alleviate the price discount.

But There Are Potential Drawbacks

- Lack of liquidity, and the need for liquidity backstops.

- High fees relative to public markets. In addition to their higher expense ratios and performance fees, private investments require additional due diligence as well as more complex monitoring and internal accounting. While these costs may be effectively outsourced to a specialized manager or fund of funds, they ultimately must still be borne by investors. It is not guaranteed that excess returns in PE would cover additional costs.

- The flood of capital into the industry has increased competition and may have pushed deal prices higher, lowering future returns.

- Research has found that institutional investors exhibit a “home bias” and that these local investments tend to underperform.

- Imposing requirements for quarterly liquidity and perhaps other liquidity provisions could lead to costs for liquidity guarantees or fire-sale price effects.

- Plan providers must contend with the timing and uncertainty of fund capital calls—once capital is committed, enough of a liquid position must be kept to make the capital calls. That means actual returns for the retail investor may end up blending lower cash-like returns with PE fund returns, resulting in a lower return profile. The costs of liquidity could offset the PE illiquidity premium.

- Another complication is undertaking portfolio rebalancing of the DC plan given the illiquid secondary market for funds, especially during times of large market moves when actual PE allocations may exceed benchmark allocations; holding illiquid securities in DC plans prevents plan participants and plan sponsors from easily rebalancing their portfolios.

- PE funds typically provide quarterly estimates of their net asset values. These estimates are provided with a lag and are not suitable for higher-frequency value reporting. Any systematic bias in value reporting has the potential to benefit one plan participant over another.

- Plan providers would need a way to deal with benefit distributions from portfolios as participants withdraw from the plan (as they do in target date funds, for example).

- Educating investors about the risks of PE investing will increase plan costs, and investors will bear those costs.

- To achieve effective PE diversification, important with the high volatility and skewness of returns, manager selection will be pivotal. Again, costs will be involved. And smaller plans are not likely to have access to the best performing funds.

Investor Takeaways

There are some benefits to allowing DC plans to invest in private funds. As PE becomes an increasingly greater component of the overall economy, retail investors may need access to this market to be fully diversified. Private funds may be the only way for retail investors to obtain meaningful exposure to higher-returning assets that are increasingly closed to them, including growth companies in technology and health care as well as small value companies. Even if the higher returns are only fair compensation for the higher risk (rather than an excess risk-adjusted return), PE funds still can provide the plan participant greater diversification.

Yet weigh the potential benefits against the many challenges and costs that arise from creating this broader access to private funds. The complicated structure and uncertainty around providing the required liquidity backstops may bring increased fees, which may negate the higher return benefit, and thus the incentive, for including the plans.

Finally, plan administrators, sponsors and advisors would need to ensure that retail investors understand the risks of private fund investments and create appropriate structures and incentives for plan providers, in light of litigation or other unanticipated risks. It’s not clear that many sponsors would find the benefits worth the effort.

Larry Swedroe is head of financial and economic research for Buckingham Wealth Partners.

All opinions expressed are solely his opinions and do not reflect the opinions of Buckingham Strategic Wealth or its affiliates. This information is provided for general information purposes only and should not be construed as financial, tax or legal advice.