In 2020, the pandemic naturally affected investor confidence and behavior. Many took a wait-and-see approach for the short term, as potential impacts on varying sectors revealed themselves.

Additionally, changes in day-to-day habits, including an increased reliance on technology for communication and commerce, contributed to the acceleration of certain investment trends – and these have proven to have influenced how capital is raised, perhaps for the long term.

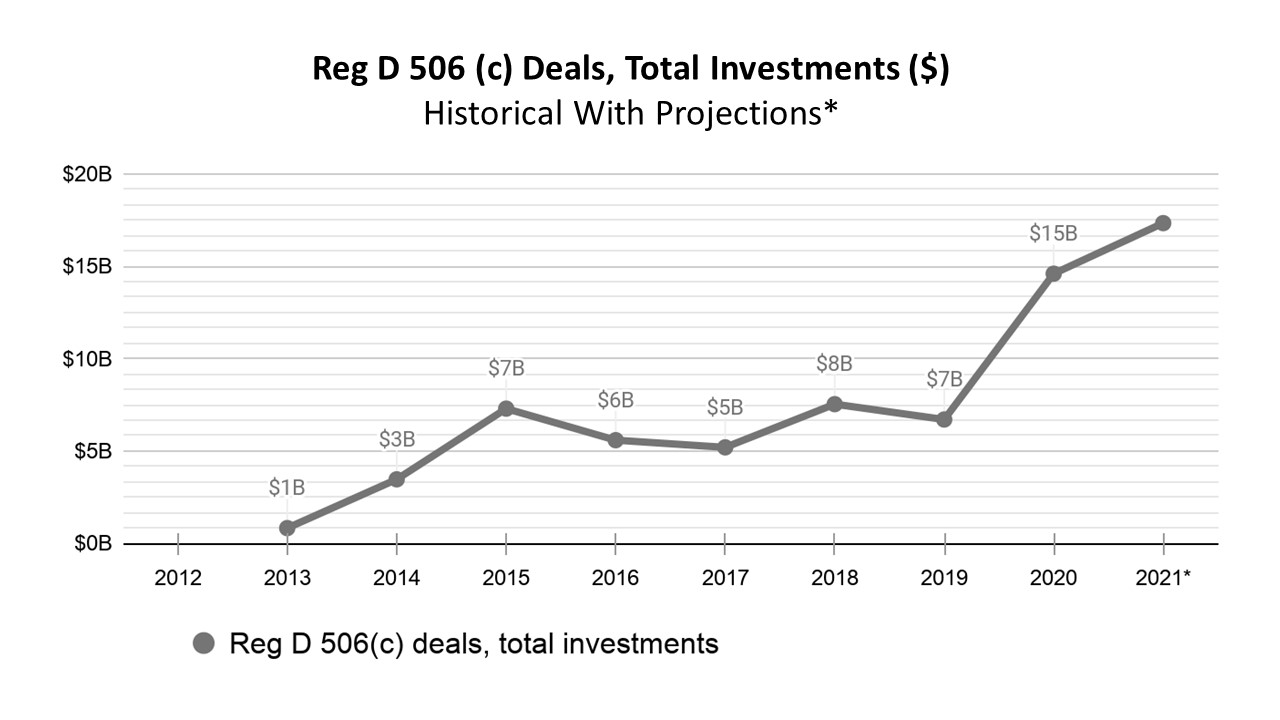

One significant shift that occurred was in the crowdfunding space. For example, within the real estate industry, crowdfunded transactions more than doubled last year – increasing from $7 billion in 2019 to $15 billion in 2020.

This was especially significant because, at the same time, traditional capital raises decreased to $48 million from $51 million the previous year – reinforcing the disruptive nature of crowdfunding.

Below, we’ll explore how new data affirms that advisors should take note of this previously niche capital-raising method, which will likely only become more prevalent going forward – as its legitimacy is continuously proven and the next generation of investors inherits and grows wealth.

Crowdfunding is Rapidly Becoming a Major Player

Crowdfunding experienced slow, steady growth as a form of capital raising in certain sectors for several years. Then, in 2020, there was a significant jump.

We see clear evidence of this by looking at the commercial real estate industry. The trajectory – based on analysis of more than 18,000 real estate projects that have raised capital since 2012 (when The JOBS Act allowed crowdfunding for the sector) – can be seen on the graph below, which looks at total investment dollar volumes:

In addition to more than doubling in volume, we found that during 2020 alone, crowdfunding increased from approximately 12% of commercial real estate syndicated equity raises at the beginning of the year to nearly 25% of all raises by the end of the year.

So what were the factors behind these increases?

The unease created by the pandemic understandably resulted in a decrease in traditional capital sources, at least for a brief time.

Simultaneously, more people were utilizing new ways of connecting virtually for daily tasks related to work, shopping, and other tasks – or simply spending longer amounts of time online for entertainment and leisure.

These changes laid the groundwork for crowdfunding to thrive.

Sponsors are Seizing Opportunities

A lack of traditional capital, combined with a more widespread recognition of positive online factors, drove forward-thinking sponsors to bring more deals to the market directly this past year.

As there was a rise in the number of offerings on crowdfunding platforms, such as industry leader CrowdStreet, investors responded enthusiastically to the increased number of assets available to them.

In the early weeks and months of the pandemic and stay-at-home orders, sponsors had a particularly captive audience to market to, as potential investors often had more time and incentive to research and explore new investment options on their own.

And while the pandemic was the catalyst for the accelerated adoption of crowdfunding for capital raising by a wider group of sponsors and investors, this period of increased activity and growth has also allowed for the method to further prove its legitimacy.

Savvy Advisors Should Take Note Now

We anticipate that crowdfunding will continue to make private equity real estate investments available to an ever-increasing community of investors going forward, especially as wealth transfers from baby boomers to younger generations.

Millennials who have grown up tech savvy are naturally attracted to, and more comfortable with, these direct methods available through online platforms.

We also expect that as new entrants to the industry will continue to elect crowdfunding options, and that within just a few years, the number of sponsors choosing to crowdfund their deals could exceed those going through the more traditional, in-person routes.

As it becomes clear that crowdfunding is no longer a ‘sideshow’ in the world of real estate finance, forward-looking advisors should stay on the pulse of the evolving industry.

Where necessary, they can carve out new roles for themselves as the method still remains at the early stages of its development and widespread adoption.

Through cultivating a deep understanding of the industry and its growth, staying updated on which sponsors are active in the sector, and implementing best practices to approaching and vetting these offerings, advisors can be best positioned to fully realize the opportunities it affords their clients – and themselves.

Instead of viewing crowdfunded deals as fringe, advisors should look at how they can remain competitive and best stay abreast of crowdfunding and its offerings – in turn, guiding their clients through the wider breadth of what is out there as the sector expands.

While direct access to deals may have its appeal, it can also be overwhelming. There will always be a need for the guidance, financial planning, and portfolio management services that only qualified advisors can provide, even in a changing climate.

The Way Forward

What was once a small, niche part of the industry has now proven its resiliency during periods of market volatility, as well as its ability to bring liquidity when other sources of capital dried up.

This proof is attracting more sponsors as they realized that crowdfunding is a legitimate alternative to traditional sources of capital – and will go beyond a pandemic phenomenon.

While accredited investors explore this brave new world, they will benefit from and continue to seek out advisors who truly understand all opportunities that could suit them – including those that utilize crowdfunding.

Adam Gower, Ph.D., the nation’s premier source on real estate crowdfunding, is a 30+ year real estate veteran with over $1.5 billion of investment and finance experience who today builds digital marketing systems for real estate professionals who want to raise more money.