Cambridge Associates, a private investment firm that works with institutions and family offices, says mega-wealthy families should ramp up their allocations to private placements and build portfolios more akin to those of endowments and foundations.

"Families with multigenerational wealth may be particularly well positioned to consider allocating 40 percent or more of their assets to private investments," according to a survey of 132 endowments and foundations by the money manager. "Assuming these families have the requisite long-term time horizon, patience and ability to act quickly, they stand to benefit not only from the potential for higher returns but also from the tax-advantaged nature of private investments. Life could get better after 40 percent!"

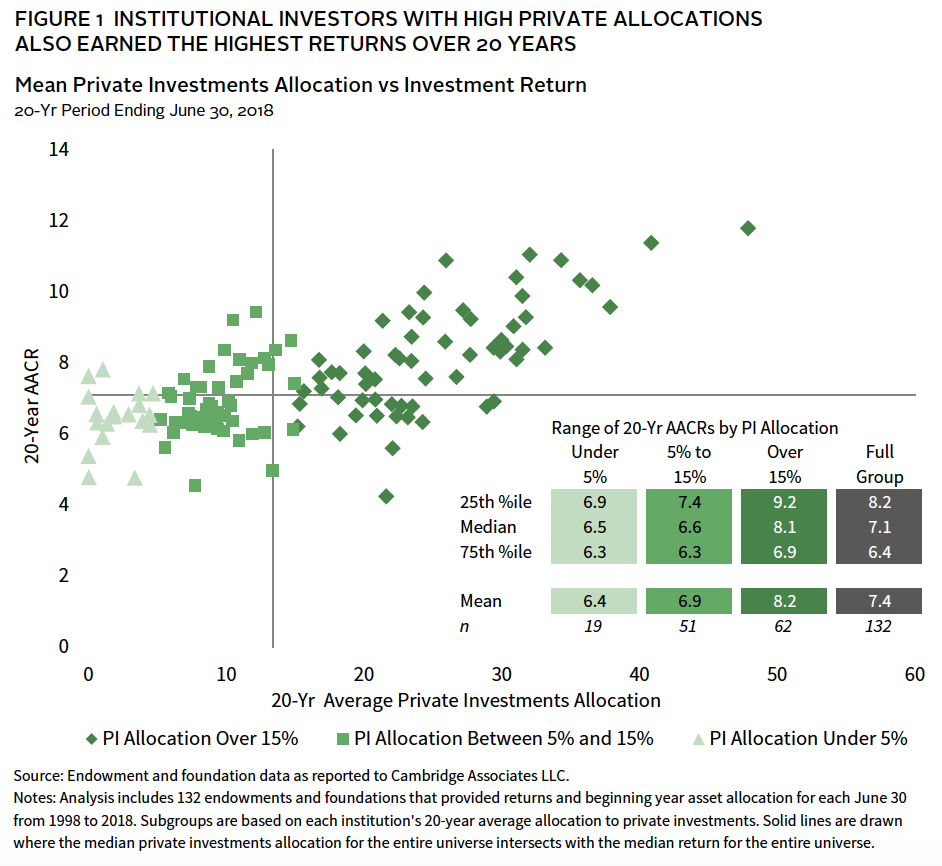

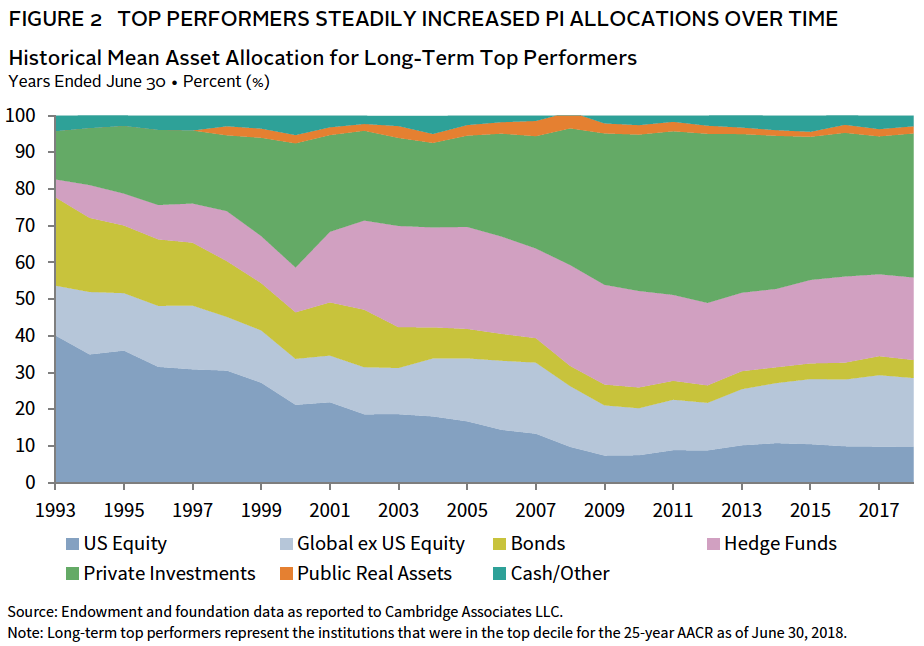

The report found the greater the allocation to private placements, the higher returns over 20 years. "Our data also show that top-decile performers have steadily increased their allocations over the past two decades, pushing well beyond this 15 percent frontier to allocations, in many cases, north of 40 percent," a note in the February report said.

Still, while there are tax advantages, allocating 40 percent or more of a portfolio to private placements is a jarring recommendation. The vast majority of investors may not be in a position to invest that much in private placements, given the structures' lock-up periods and relatively high expenses. The firm concedes the recommendation makes sense only for the "mega wealthy" with the financial latitude to make the recommendation work.

Want The Daily Brief delivered directly to your inbox? Sign up for WealthManagement.com's Morning Memo newsletter.