In the current context of negative public market performance and elevated volatility, many investors might be tempted to take a tactical pause in their allocation to private equity. While timing obviously can and does impact PE fund performance, it is a fool’s errand for even skilled investors to attempt to actively time investments in the asset class.

The impossibility of timing an investment in PE stems primarily from the interaction between its investment mechanics and the unpredictability of the economic and business environment. Here is an explanation in simple terms why it makes sense to diversify across PE vintages by committing steadily over time.

Investment Mechanics Make Market Timing Impractical

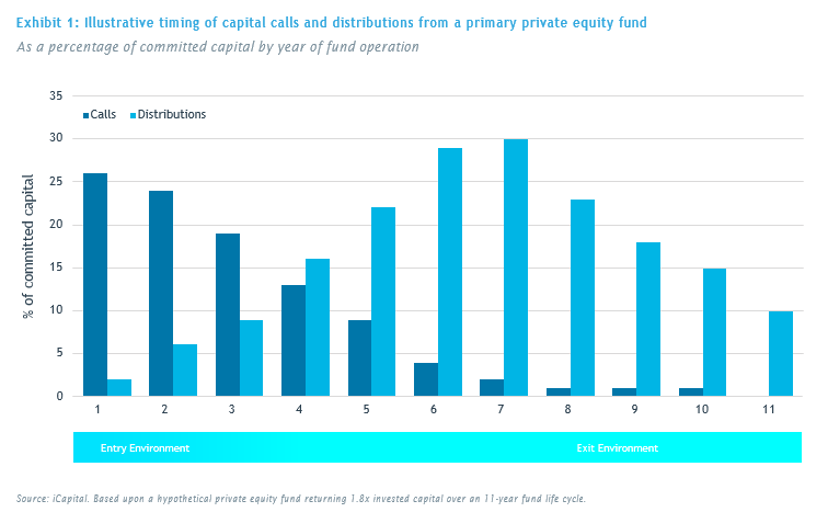

A vintage year—the year in which a PE fund first draws capital—effectively signals the start of a 10-plus-year process. Fund lifecycles are split into an investment period that typically lasts up to three to five years and a subsequent harvesting period that can last as long as four to seven, or even longer with extensions (See Exhibit 1).

At least a small share of capital committed today to a primary PE fund may not be invested until 2027. So, an investor may be confident that they have a good read of today’s entry environment, but given the lag between committing capital and its deployment, and the flexibility that managers have as to when precisely they then deploy that capital, only some of an investor’s capital will be invested in something resembling the current environment. And as the COVID-19 pandemic has reminded us, circumstances can change quickly and dramatically.

The further out we attempt to forecast market conditions, the less likely we are to be accurate. Which means attempting to predict the conditions in which the fund will look to exit its investments is even more futile.

The mechanics of the PE model therefore mean that trying to cherry-pick vintage years would require exceptional market foresight and macro timing. However, it should be noted that the latitude granted to managers to time investment decisions—both in terms of entries and exits—has been a meaningful contributor to returns, and may help mitigate against adverse performance in more challenging environments.

Buy When There’s Blood in the Streets

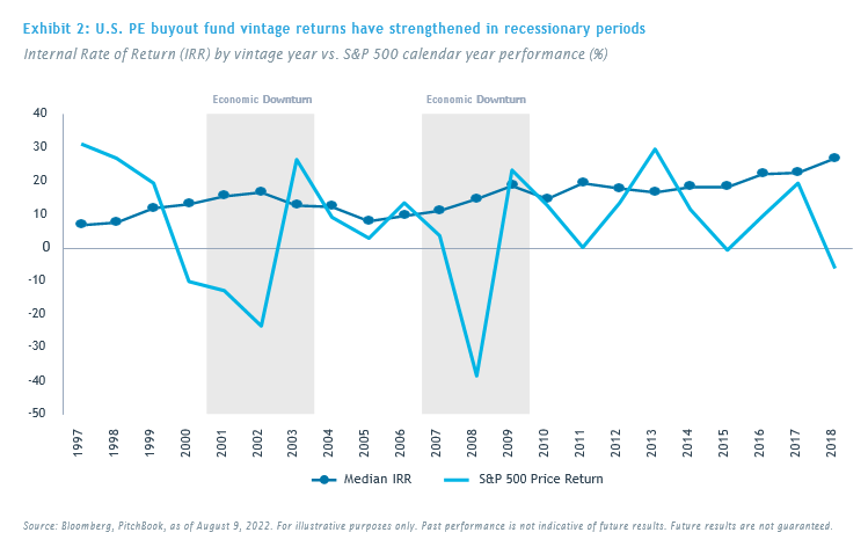

The performance of PE funds over more than two decades reinforces the idea that pausing allocations in adverse public markets and/or during economic downturns would be a bad idea (See Exhibit 2). As Baron Nathan Rothschild once famously said, “Buy when there’s blood in the streets, even if the blood is your own.”

Having just argued that you cannot time the PE market, it may seem odd to connect historical market cycles to performance. History is not circular, and there is no guarantee that buyout fund returns will again improve during a market downturn—though there are many reasons to expect these funds to find value in a more favorable acquisition environment and benefit from a medium-term economic recovery. The more important point is that there is no compelling argument to be found in the data to not invest in PE funds because of an economic downturn.

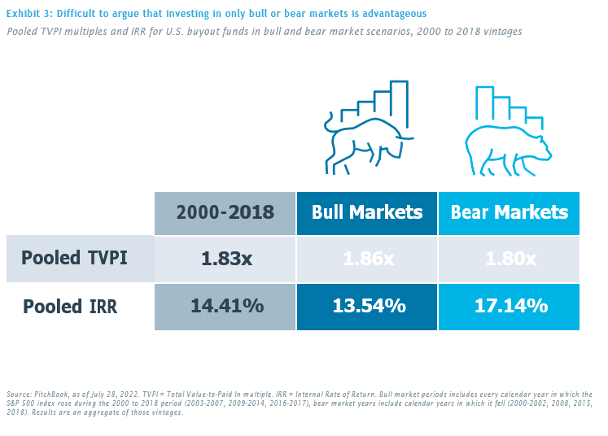

Exhibit 3 illustrates and compares the hypothetical investment outcomes of committing capital to U.S. buyout funds only during bull markets—defined as calendar years in which the S&P 500 was up—or bear markets. Putting aside the impracticality of such an approach, which would require exceptional foresight and lead to uneven allocations that would create an unsustainable private equity program, the data show that the pooled IRR was higher for bear market vintages, while the TVPI was slightly higher for bull market ones.

The discrepancy between IRR and TVPI principally reflects a complicated mix of entry and exit timing and investment holding periods that form part of the private equity valuation process. Fundamentally, the only sensible conclusion to draw is that the difference in performance is insignificant.

While committing to buyout funds during a downturn has historically produced better returns than allocating to the vintages that directly preceded that decline (as Exhibit 2 shows), committing to vintages when stocks are rising does not necessarily produce weaker outcomes. For example, the 2009 to 2014 and 2016 to 2017 bull market vintage groups have so far produced pooled TVPIs of 2.05x and 1.91x, respectively.

Consistent Commitment to a Diversified PE Portfolio

Investors can help mitigate the impact of vintage performance volatility by allocating across multiple vintages and selecting high-quality investment managers. Manager selection is far more important than vintage selection in PE and has the added virtue of being a feasible exercise.

Furthermore, a steady allocation pace across vintages adds critical diversification, helping to mitigate risk in a similar fashion to dollar-cost averaging, and allows an investor to build out a systematic PE program that eventually becomes self-funding by producing distributions they can reinvest. Skipping a vintage can make maintaining allocation targets difficult by disrupting this virtuous circle of distribution and reinvestment.

Timing the markets in the context of performing fundamental analysis on individual, liquid stocks is difficult enough. Given the nature of PE fund investing, a vintage selection approach that attempts to predict both market conditions and the performance of specific strategies far into the future has a slim chance of consistent success. This underscores the basic need to construct PE allocations that are diversified across as many dimensions as your resources can sustain, including by manager, strategy, geography, and vintage.

Kimling Fink is senior vice president, research and due diligence at iCapital.