We are a pretty low-tech company, overall. We still maintain some paper binders for our clients. We also have digital records for everything. A lot of us still like to do reconciliation by hand. We use technology for our tools, but we do like to think of it more as a tool rather than a guide.

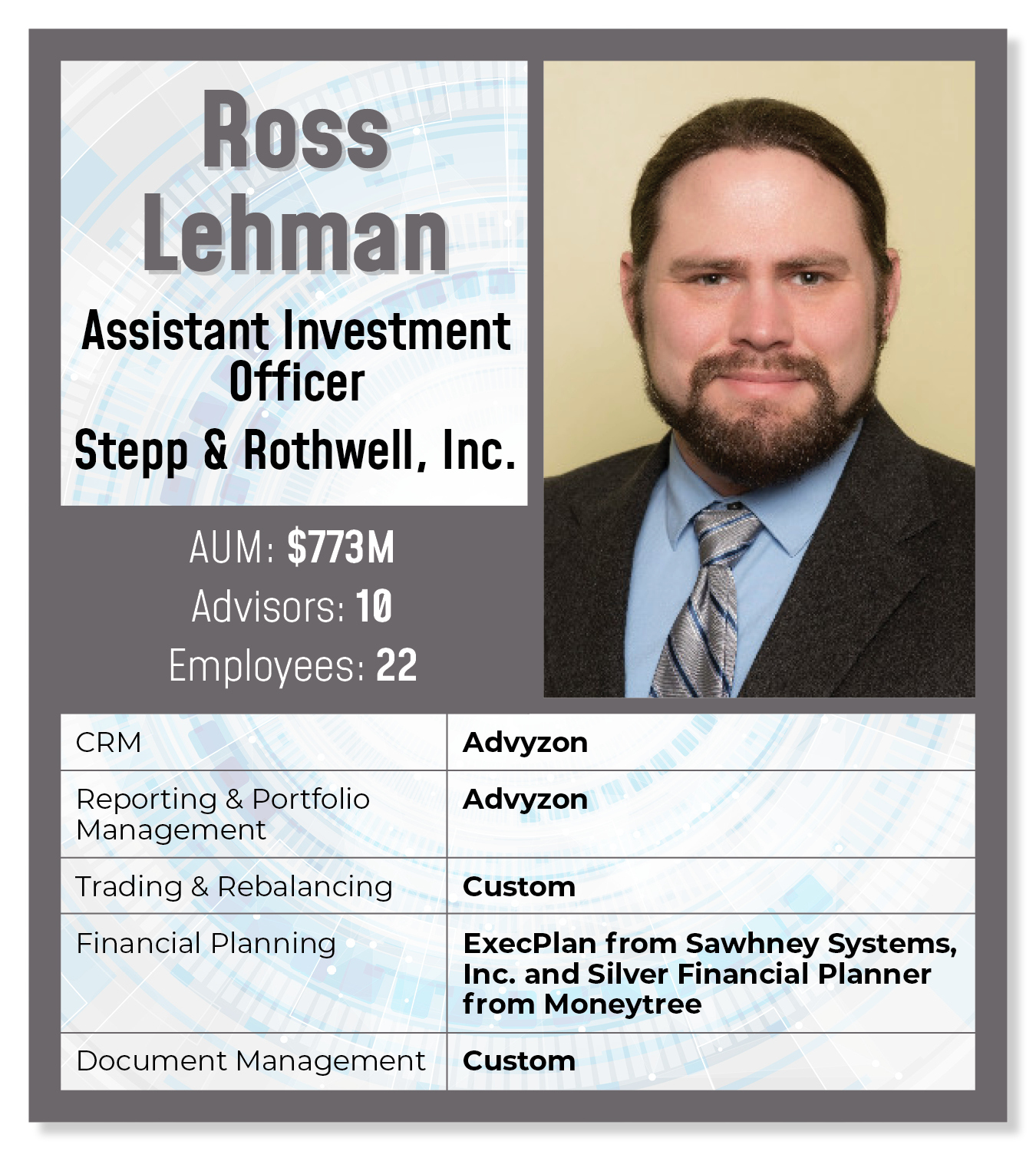

CRM/Portfolio Management/Tracking: Advyzon

We switched over to Advyzon this year. We like it. We’re still working on using some of its capabilities and figuring out what we want to do with it. We had been using PortfolioCenter, which was getting less and less support. It was getting worse and worse to use.

In particular with the transfer from PortfolioCenter, one of the big frustrations that we have had was that we felt as if it was hard to find products that did what we wanted and met our needs that weren’t changing constantly. PortfolioCenter was bought out by Tamarac from Schwab in 2019, and it changed with that. That’s been frustrating for us.

In particular with the transfer from PortfolioCenter, one of the big frustrations that we have had was that we felt as if it was hard to find products that did what we wanted and met our needs that weren’t changing constantly. PortfolioCenter was bought out by Tamarac from Schwab in 2019, and it changed with that. That’s been frustrating for us.

I’m hoping that Advyzon doesn’t go the way of several other services and suddenly disappear. It took us so many man-hours to switch over to this from PortfolioCenter because we were unhappy.

Financial Planning: ExecPlan Sawhney Systems, Inc. and Silver Financial Planner from Moneytree

Everything we do for our clients is so custom-tailored to their family situation that we haven’t found a one-size-fits-all, mass-market financial planning software to do everything we want. Everything is manual. That has worked for us.

For income tax planning and short-term cash flow planning, we use ExecPlan.

ExecPlan is great for what it does. It’s also an extremely finicky, un-user-friendly program. But it’s the only thing that does what we need it to do. With how we do comprehensive planning, we’re looking out five years or so with taxes. We value customizability a lot, and programs that will continue to do what we want them to do without getting revamped with massive changes to their capabilities.

ExecPlan, it’s sufficiently old-school software that it is on an island by itself, where we maintain it. We maintain separate plans for all our clients and manually enter some data. We program what we are expecting to happen.

For long-term cash flow projections, we use Silver Financial Planner from Moneytree.

We prepare investment performance reports in Advyzon.

We prepare balance sheets, supplemental cash flow summaries, long-term net worth summaries, estate distribution and many other supplemental reports in Microsoft Excel.

We also use Microsoft Word to create summary pages for all sorts of our clients’ financial data, including loans, businesses, real estate, life insurance, legal documents, employee benefits, etc.

We do things in a relatively bespoke fashion. When we have software that does what we like it to do, we’ll use it for quite a while.

Particularly for any software as a service that we’re looking at, they are frequently trying to do the newest and biggest and best thing. It feels as if they’re chasing new customers more than trying to keep their existing ones. Given that, we don’t want to spend all our time thinking about what programs we’re using, how we’re providing this advice to our clients and how we’re doing our analysis. We want to use the tools and not think about which tools we’re using.

Trading & Rebalancing: Custom, Microsoft Excel

All our investment portfolios are custom-designed and managed for each client’s situation. We do not do any mass trading or mass rebalancing and do not have a software program for this.

We’re often still putting together an Excel spreadsheet, where we have everything linked together such that it’s pulling from a database that we have elsewhere. Then we have a spreadsheet that’s being maintained and updated. We’re trying to make everything work together and communicate nicely.

One issue we’ve run into a lot is, if everything is super connected in the background and we’re not having any input, we feel as if we’ve regularly gotten burned by programs changing what they’re doing. Then, it’s no longer communicating properly with that program. Or, it changes and it is communicating properly but is communicating slightly differently than what we were expecting before.

One issue we’ve run into a lot is, if everything is super connected in the background and we’re not having any input, we feel as if we’ve regularly gotten burned by programs changing what they’re doing. Then, it’s no longer communicating properly with that program. Or, it changes and it is communicating properly but is communicating slightly differently than what we were expecting before.

There’s a lot of analog communication between programs, where we’re physically using spreadsheets and uploading a spreadsheet to a different program to update data. Not too high-tech.

Internal Communications: Microsoft Teams

We’re trying to make use of Microsoft Teams for our internal coordination, keeping track of schedules and knowing what’s going on. That one is one where we’re curious. We feel as if there are a lot of good capabilities and ways of tracking and collaboratively keeping databases updated with memos.

We’re also very wary that any of these tools might be dropped at some point in time because Microsoft decides it’s not sufficiently profitable.

Any tech company that is a sufficiently big name that we feel confident that it is not going to just go out of business the next day, we’re then worried that they are then going to completely drop this project that we put so much work into making use of it as a tool.

As told to reporter Rob Burgess and edited for length and clarity. The views and opinions are not representative of the views of WealthManagement.com.

Want to tell us what's in your wealthstack? Contact Rob Burgess at [email protected].