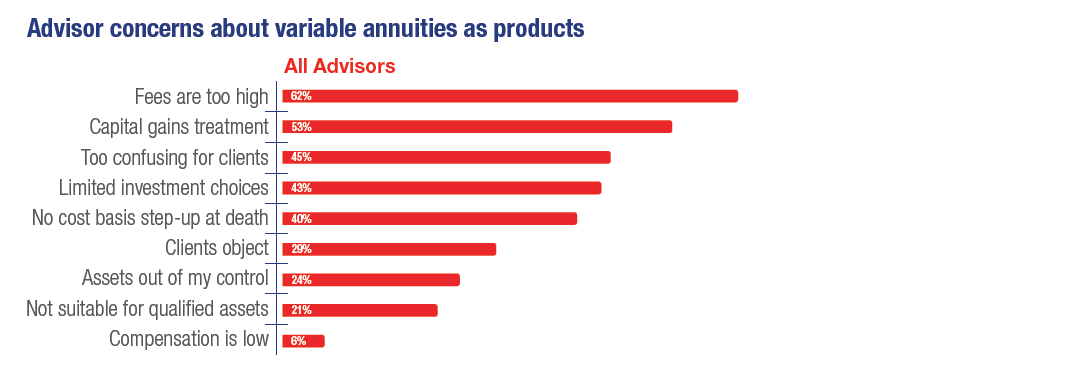

Advisors largely agree on the factor that limits their use of variable annuities: Nearly two-thirds of advisors surveyed (62%) report that high fees are an obstacle to investing more heavily in the product. Meanwhile, a little over half (53%) are deterred by the unfavorable tax treatment that results from the conversion of capital gains into ordinary income when clients draw income from their annuities. The fact that clients find annuities too confusion is the third most common limitation, cited by 45% of the advisors surveyed.

These three reasons are the top objections across all advisor groups. That said, advisors from large firms and advisors who have less than 10% of client assets invested in variable annuities are more likely to emphasize their clients’ potential confusion (58% and 57%, respectively) than the unfavorable tax treatment of capital gains.

Meanwhile, clients tend to have similar objections about variable annuities as their advisors—at least according to the advisors. Advisors say their typical client invests in a variable annuity in his mid-50s using approximately 13% of his $1.7 million portfolio. Clients most commonly object to variable annuity’s high fees and relative complexity.

By comparison, advisors say that clients most often appreciate the guaranteed income and peace of mind that variable annuities provide. “Clients who are beginning their income distributions with a living benefit like the fact that they cannot outlive their money,” says one registered investment advisor who works at an independent broker dealer.

Download the full Variable Annuities: A Tool for Retirement Income Planning Investment Trend Monitor report

Click to Enlarge

Click to Enlarge