I have been experimenting with several financial technology (fintech) platforms since 2011 to see for myself if their promises for substantial returns and a positive user experience were warranted. Five years later, I am able to report mature returns from three such companies: the peer-to-peer lending sites Lending Club and Upstart, and Acorns, a micro-investing site that sweeps spare change from every personal credit card transaction and places it in an age-appropriate portfolio of low-cost ETFs. Consider it a kind of “robo advisor” for the loose-change-in-a-jar crowd.

Two major factors have come together to make fintech platforms so popular. First, the rise of smartphones puts the apps right into the hands of millions of users who feel alienated by slow-moving traditional banks. Second, the financial crisis of 2008 eroded the borrowing ability of many middle-class individuals and small business owners as banks curtailed unsecured lending and other high-risk loans. Millions of Americans have taken to fintech platforms because they are simple to use, usually cheaper and come with benefits that the traditional financial industry often ignores.

Fintech is a catch-all term describing a dizzying variety of technology-enabled disruptions of personal and, increasingly, commercial finance. From 2010 to 2015, investment in fintech has grown from $1.8 billion to $22.3 billion, according to Accenture. The first generation of sites took market share from banks and trading companies. The newest generation of tools in mobile banking, digital wallets, robo advisor sites, and money management threaten to make many traditional financial institutions and professionals obsolete.

I was an early adopter of some of these platforms. I could have opened dummy accounts, but I knew that if I wanted a real test I would have to put some of my hard-earned earnings at risk. This is just what I did and can now report what I encountered.

Lending Club

Lending Club is the largest peer-to-peer lending company. It essentially creates a marketplace between individuals who need unsecured loans and investors who are willing to fund those notes, usually on a fractional basis. Lending Club does all the underwriting and offers sophisticated tools for slicing and dicing notes to manage risk. (Identifiable information about particular borrowers is never revealed to the investor.) The basics are pretty simple: some borrowers come with lower risks of default than others (Grades A-C), but their notes command interest in the 5-8 percent range. Notes of some borrowers (Grades D-G) command rates of 5-20+ percent, but the risks of default are much greater.

I started investing in Lending Club in 2011. My experience is limited to being an investor. I am a fractional owner in a total of 3,167 notes (see Figure 1). Each note represents a borrower who has promised to repay the loan at a designated interest rate, generally from 5-21 percent, often to retire higher interest credit card debt. I have a fractional interest in each of these notes. So, if any one note defaults, my downside is generally limited to $25. Of those notes, 1,387 are current (that is, the individual borrowers are current in their payments), 1,269 notes have been fully paid off, and 432 notes have defaulted and been charged off. The default rate I experienced so far is predictable for the overall risk exposure I selected.

Figure 1. My Lending Club Account Summary Page

My 12.97 percent net annualized return will probably be reduced by 1 to 2 percentage points given the predictable defaults, but I’m very satisfied with the results to date.

To open the curtain even more let’s look at the workings of a particular portfolio. Over the years, I have created portfolios of notes from very conservative (weighted average interest rates of 5-8 percent) to moderately aggressive (12-15 percent). In 2013, I assembled a portfolio of 36-month notes that are now mostly matured or close to it (Figure 2). This summary shows dollar values of 642 performing notes. Grades B-C make up 69 percent of this conservative portfolio yielding returns of a weighted average rate of 14.18 percent.

Figure 2. Details of a Portfolio of Notes from 2013.

I faced two major issues in managing a P2P account. First, how to select notes. Second, how to manage the small amounts of cash that accumulate every day. The Lending Club website lists tens of thousands of notes available for investment at any time, each with details about the underlying borrower such as income, credit score, whether he or she owns or rents, state of residence, purpose of loan, etc. At first, I inspected each note and selected the ones that appealed to me, but that can be a full-time job and is probably counterproductive. It’s much easier, and probably more reliable, to trust the Lending Club automated investment system. It lets you determine a risk profile, then the algorithm automatically purchases a note as soon as interest in the account reaches the amount I want to invest.

For investors who object that Lending Club notes are not liquid, there actually is a secondary market. There are still some states that do not allow citizens to participate in P2P platforms. For those investors, Folio partnered with Lending Club to create an auction marketplace for buying and selling notes. Some investors try to offload notes with late payments at a discount to buyers willing to take the risks. Some of these have effective yields of upwards of 200 percent if the borrower gets back on track and pays off the debt. It’s rare, but it happens. When I needed to raise some cash, the Folio platform allowed me to quickly and easily liquidate hundreds of Lending Club notes on agreeable terms.

Upstart

Upstart is another P2P platform, but with a twist. Almost all Upstart borrowers are recent college graduates at the beginning of their careers. This population has a much thinner conventional credit history, so Upstart developed an algorithm that looks beyond traditional credit data such as earning potential and employability. To invest with Upstart, you must be an accredited investor.

Upstart does not charge any investor fees. Its business model depends solely on fees from borrowers. Even better, should a borrower default, Upstart commits to refund the origination fees to investors in the loan. This means that Upstart does not profit from a loan that defaults.

When I started investing in Upstart in late 2013, it was possible to cherry pick loans. I felt I was doing something virtuous by investing in the future of promising young professionals. (Again, none of the borrowers could be identified by name). It was fun to see what school the borrowers attended, what they majored in, and what their SAT scores were. But lately, the platform is encouraging investors to determine a risk grade then automate the selection. Risk grade notes run from AAA to D. Almost every borrower signals that they intend to use Upstart funds to consolidate high interest credit card debt.

I have funded on a fractional basis 140 three-year notes from exclusively Grade B borrowers. Eight notes have matured. One borrower has defaulted. The value of my account is $13,933. I’ve made $452 in interest and my annualized IRR is 7.24 percent (Figure 3). Based on Upstart’s performance statistics (Figure 4), my performance of 7.42 percent is apparently better than the average across all notes (5.72 percent).

Figure 3. My Upstart account has returned 7.24 percent with only one default so far.

Figure 4. Upstart’s performance statistics as of Jan 24, 2017.

Acorns

Maybe like me you have a practice at the end of the day of throwing spare change into a jar then, at some point during the year, raiding the jar for a special night out. The fintech app Acorns serves the same function but with the extra benefit of investing the spare change until you need it. I easily linked Acorns with my checking and credit card account more than a year ago. Since then, it has been systematically rounding up my purchases to the next dollar and investing the difference in a diversified portfolio of ETFs.

Acorns is very easy to setup and with no minimum balance requirements. Thus, making it very attractive to first-time investors. Acorns sweeps money from a checking account. That means if I buy a $4.75 latte at Starbucks, my checking account is charged $5; $4.75 goes to pay Starbucks and the 25 cents in roundup funds is swept into my Acorns account where it is invested. Acorns uses a robo advisor that considers client data—age, income, investing goals—and based on client preference invests in one of six portfolios that range from conservative to aggressive. The portfolios have low (0.05-0.20%) expense ratios.

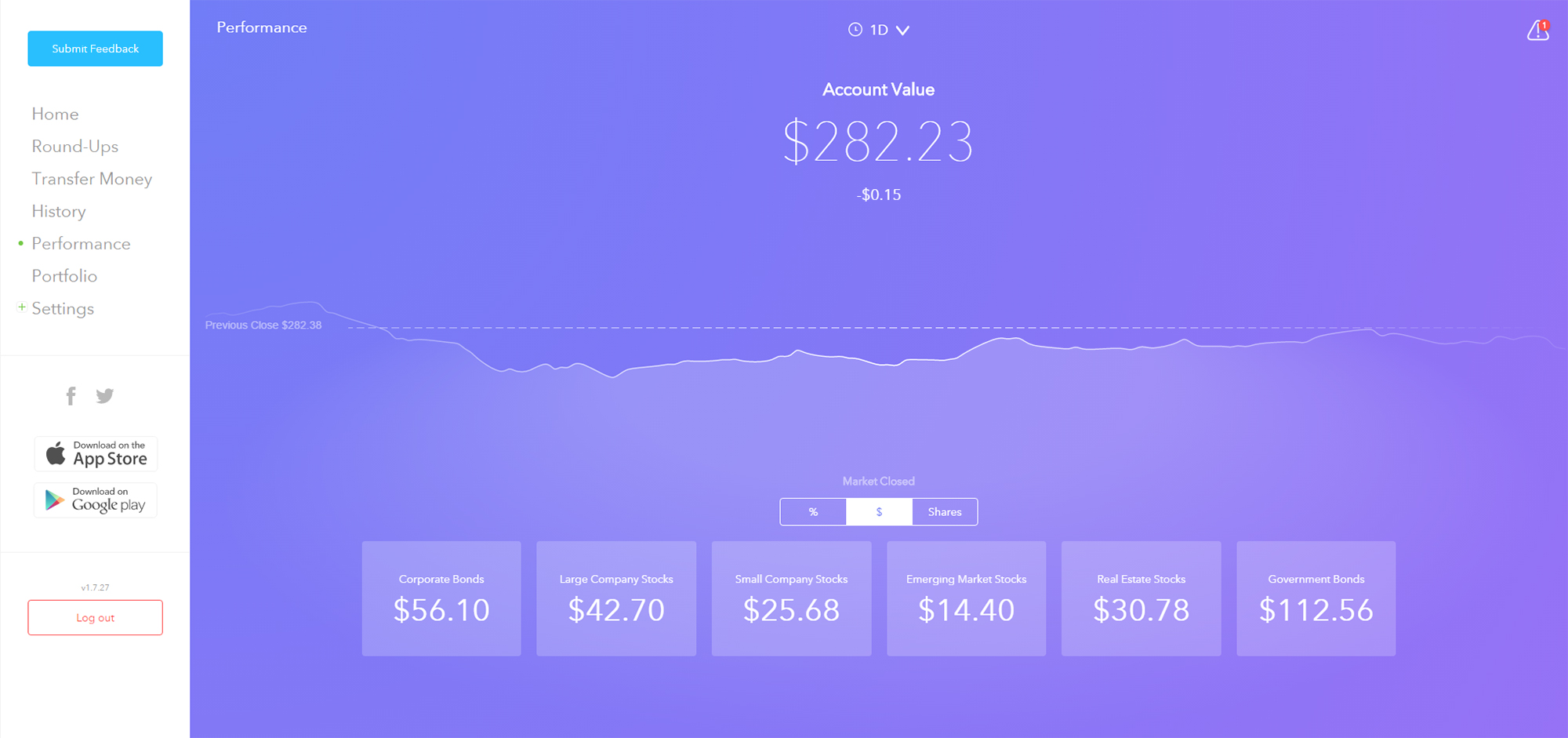

At the end of a year, I had contributed a total of $283.57, and earned $3.17 in dividends. I’ve paid a total of $8 in fees. The current value of my account is $282.23—not too great of a return until you consider I chose the “conservative” balanced portfolio with 39 percent in government bonds and 18 percent in corporate debt. Figure 5 shows the distribution of funds in my account and that essentially flat performance.

Most people will not notice Acorns at work; I certainly don’t. Especially if you contribute funds above and beyond roundups, Acorns can be an easy and inexpensive way to access the market on a low-risk basis. Fees are $1 per month or 0.25% per year, depending on your balance. The app is free and fees are waived to college students for four years.

Figure 5. My Acorns account after a year shows an account value of $282.23. The value of an Acorns account fluctuates as a function of the market.

Conclusion

I’m satisfied with the performance of these three fintech services. Yields are much better than I could get from CDs or T-bills. Of course, these accounts represent much higher risk. Yet, it seems to me that the risk-reward balance is wholly appropriate. I have confidence in the continued viability of these services. The best part about investing in these fintech platforms is I feel much more in control of my money. That counts for a lot.