Denver-based retirement management software provider Income Lab said advisors can now subscribe to their "Life Hub" financial visualization tool without signing up for the company's entire retirement planning platform.

The announcement was released at the Technology Tools for Today (T3) Conference, which takes place this week in Las Vegas.

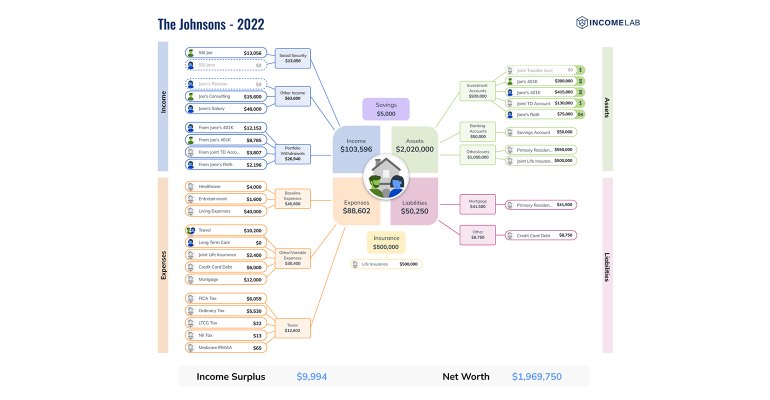

In June 2022, Income Lab introduced Life Hub, an interactive tool for financial advisors used to give clients a "one-page visualization" of their financial life, including specific details around income, assets, expenses and debt.

Income Lab’s cloud-based, white-labeled software most recently was made available on Osaic's advisor platform, a spokeswoman said, but declined to say how many advisors are using the software. The firm has integrations with Schwab, Fidelity and Altruist, according to the company's website.

Income Lab is one of several providers arming advisors with tools to help clients with their financial plans and solve the so-called "retirement income" problem. They help advisors create "maximized" retirement income plans for clients through combinations of fine-tuning asset allocations across accounts, plotting drawdown strategies in retirement, and making better use of tax planning, among other factors. IncomeConductor, another platform, is used mostly by planners and registered investment advisors, while Income Discovery has pursued larger enterprises, including independent broker/dealer platforms. Income Solver is a decumulation strategy overlay application for financial planning software like eMoney, Money Guide Pro and Right Capital.

Jeff Bauer, vice president of sales at Income Lab, said its platform was unique in the market because it is designed to be client-facing.

The full Income Lab Suite is $159 per month per seat, with price breaks for larger teams.

Now, the Life Hub component is a standalone product priced at $49 per month or $399 annually.

Dudzik said the strategy to license part of the platform was made to make it easier for advisors to add to their tech stacks.

Chief Innovation Officer Justin Fitzpatrick and CEO Johnny Poulsen co-founded Income Lab in 2018. The firm introduced a beta version of its cloud-based software in early 2020 for the financial advisory and planning market.

In September 2021, Income Lab raised $1.7 million from industry executives and investors in a seed round.

In May 2023, Income Lab debuted its Retirement Stress Test tool, designed to show financial advisors how clients might adjust their plans and spending when markets drop or inflation soars. It has the option to run a client's plan through real-life historical scenarios, including the Great Depression of the 1930s, the post-war boom period, the stagflation era in the 1970s, the 1990s dot-com bubble and the 2008 financial crisis.