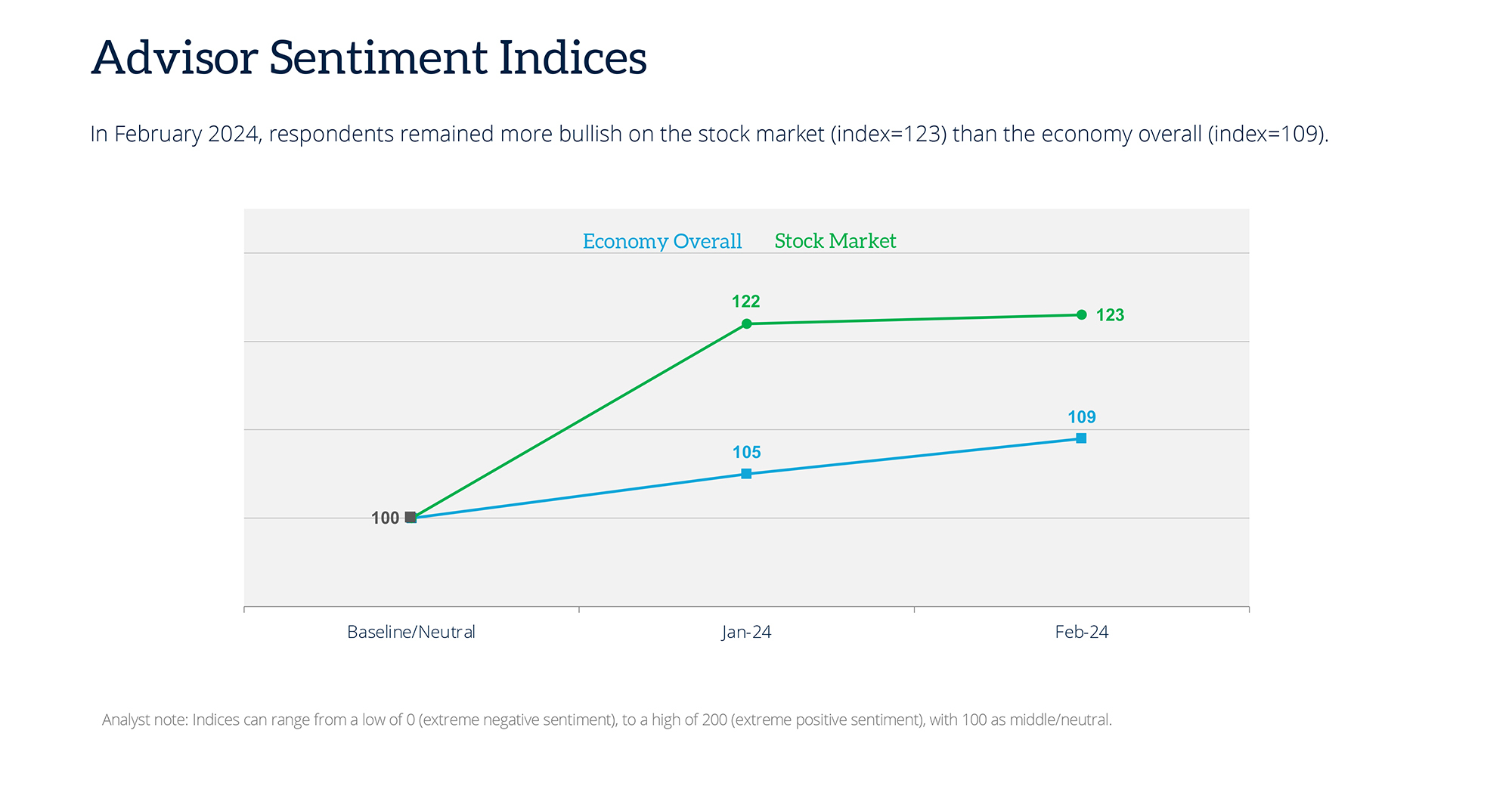

Financial advisors remain largely optimistic about the near-term direction of both the economy and the financial markets.

Sentiment around both ticked up marginally in February, according to Wealthmanagement.com’s Advisor Sentiment Index, a monthly gauge of advisor’s views on the markets and the broader health of the economy.

Optimism over the state of the markets ticked up one point over January, from 122 to 123. (A reading of 100 reflects a neutral view.) While advisors take an overall more cautious view of the economy, sentiment on that front rose by four points, from 105 to 109.

The Advisor Sentiment Index is a monthly poll of over 120 retail-facing financial advisors meant to gauge their current views on the state of the economy and the stock market and where they think both are headed—over the next six months and at this time next year.

When asked about their current view on the state of the economy, 40% of advisors have a favorable view while another 40% are “neutral.” Only 20% consider the current economy in a negative light.

The economy is not the stock market, however, and optimism over the current state of the markets is considerably higher - perhaps driven by ever-higher valuations as frothy growth stocks push prices higher. Some 69% of advisors consider the state of the market to be positive. According to the survey, only 5% of advisors have a negative view.

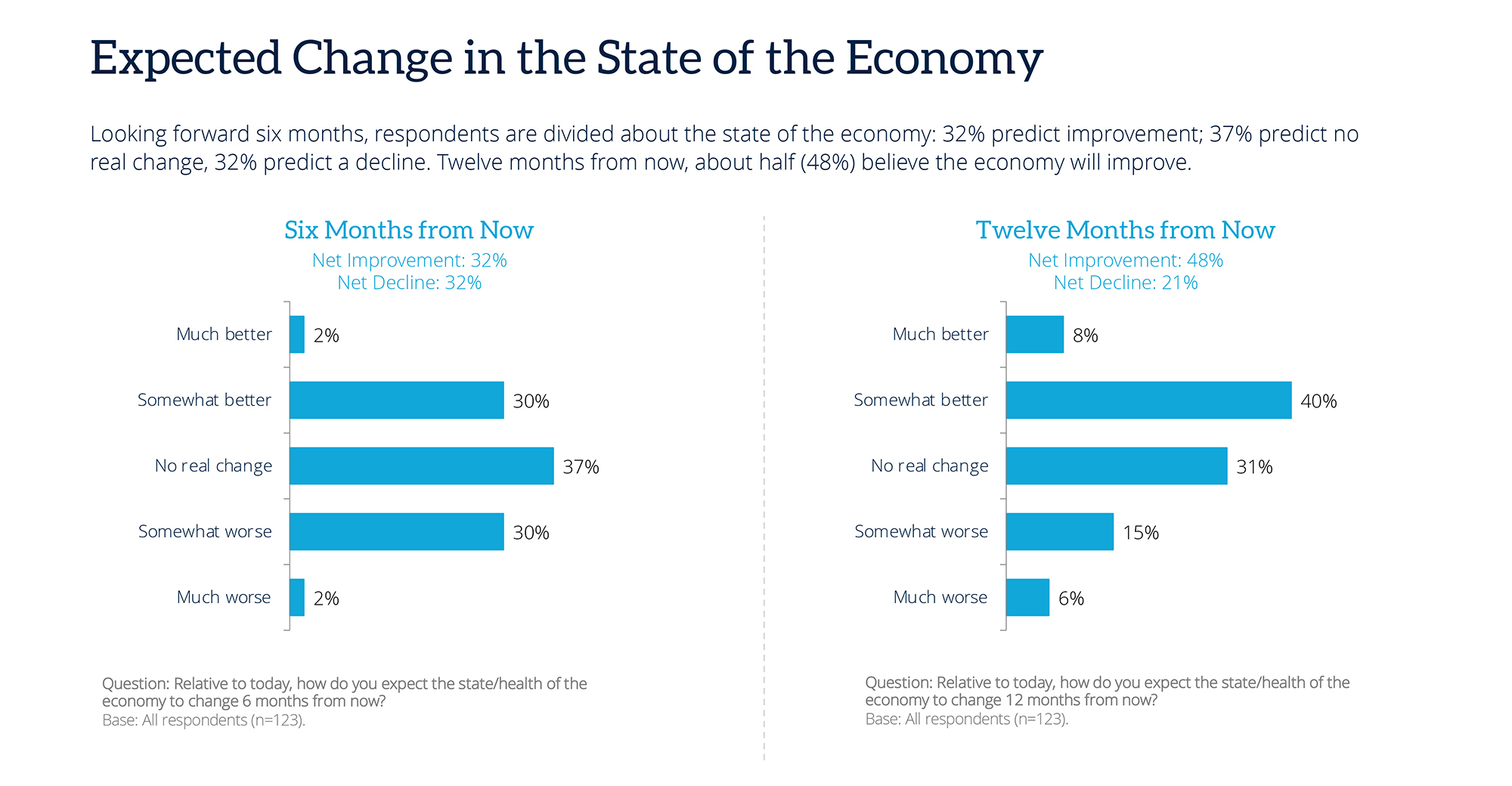

Looking into the future, more advisors expect a slightly gloomier picture on the economy to emerge over the next six months, perhaps reflecing uncertainty leading up to what is sure to be divisive national elections. Some 32% predict a decline, and an even percentage see the opposite. Those sentiments turn much more optimistic when looking to February 2025, with almost half expecting a healthier economy to emerge.

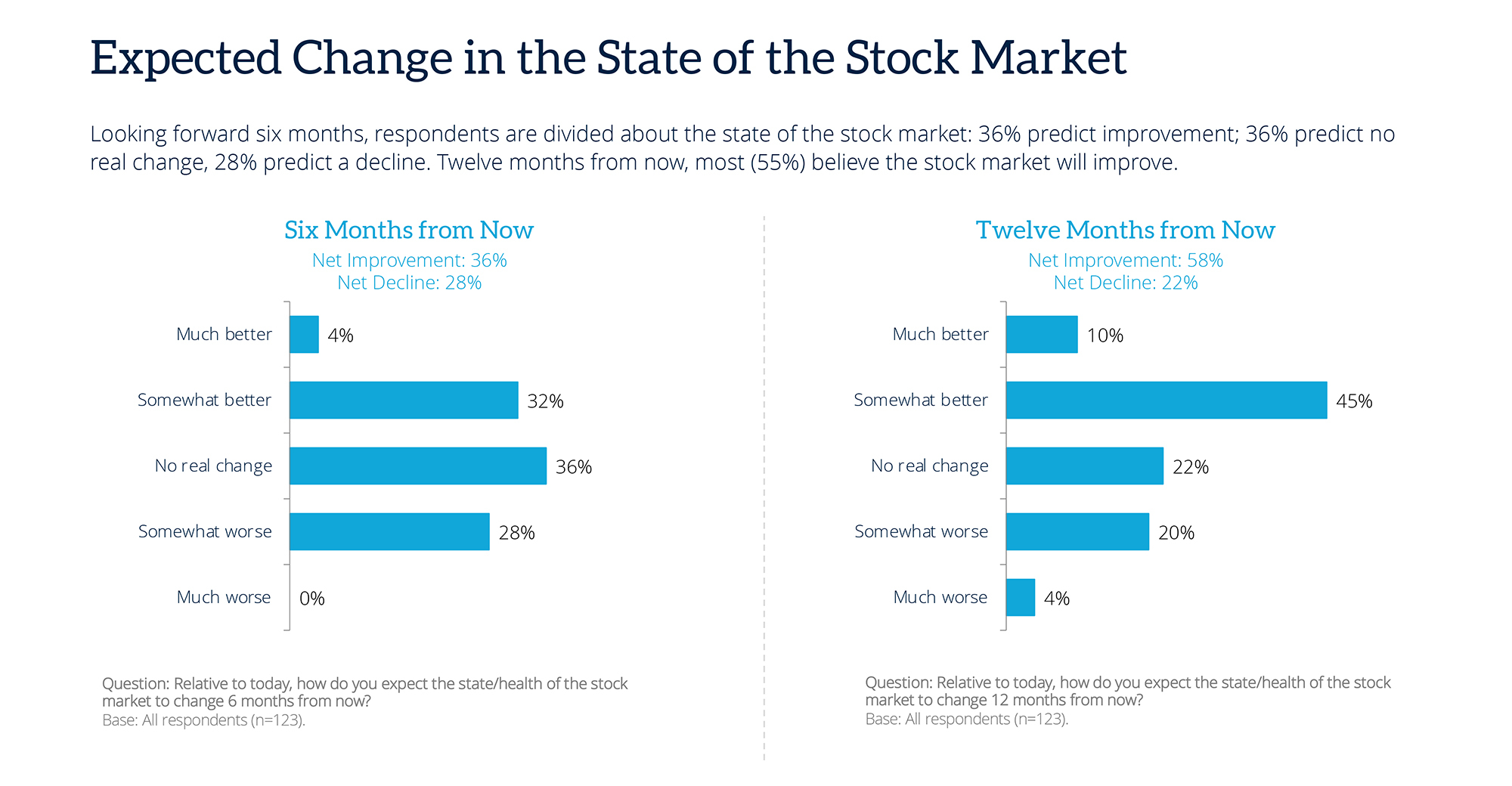

Advisors' sentiment around the markets takes a parallel track, with over a quarter expecting a net decline in six months. Yet when asked for their views on the markets looking toward February 2025, as elections recede into the rear-view mirror, almost six out of 10 have a positive expection on market health.

Methodology, data collection and analysis by WealthManagement.com and Informa Engage. Data collected February 22-28, 2024. Methodology conforms to accepted marketing research methods, practices and procedures. Beginning in January 2024, WealthManagement.com began promoting a brief monthly survey to active users. Data will be collected within the final ten days of each month going forward, with a goal of at least 100 financial advisor respondents per month. Respondents are asked for their view on the economy and the stock markets both currently, in six months and in one year. Responses are weighted and used to create an index tied to a neutral value of 100. Over time, the ASI will provide directional sentiment of retail-facing financial advisors.