By Elizabeth Dilts and Michelle Price

Aug 7 (Reuters) - A key Democratic state regulator and consumer groups on Tuesday blasted a proposed rule by a U.S. regulator, saying it does not go far enough to protect investors from brokers who may have a conflict of interest, while industry groups backed the changes.

The opposition from Massachusetts’ influential Secretary of the Commonwealth William Galvin and U.S. Senator Elizabeth Warren could delay the finalization of the U.S. Securities and Exchange Commission’s proposed Regulation Best Interest by pressurizing its two Democratic commissioners to block it.

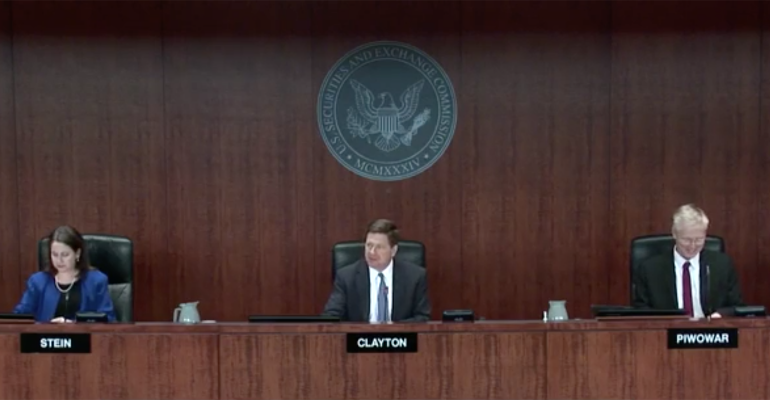

Without support from Robert Jackson and Kara Stein, SEC Chairman Jay Clayton would be forced to wait until Elad Roisman, the Republican nominee for the fifth Commission seat is in place, to finalize the proposal.

Clayton’s office, Jackson and Stein did not immediately respond to requests for comment.

The SEC on Tuesday wrapped up its three-month public comment period on the proposed Regulation Best Interest, sparking Galvin to warn his state would adopt its own rules to raise standards for brokers if the SEC proposal goes through in its current form.

Consumer group Better Markets also said the proposal should be overhauled to require brokers to eliminate, rather than only disclose, potential conflicts when recommending products.

While Democrats and consumer groups came out against the regulation, key trade groups such as the Investment Company Institute (ICI) and the Securities Industry and Financial Markets Association (SIFMA) said they backed the proposal.

The SEC’s rule would require brokers to act in the best interest of customers at the time a recommendation is made, and to provide greater disclosure about conflicts of interest.

In its letter, SIFMA applauded the SEC saying its proposal “significantly strengthens and materially exceeds the existing ... suitability standard.”

Currently, brokers are required to make suitable recommendations for a client.

The ICI also praised the SEC’s rule but said it should “clarify when and how a broker-dealer must address conflicts of interest.” The group recommended the SEC adopt the approach outlined in former President Barack Obama’s fiduciary rule.

The Obama administration’s polarizing fiduciary rule, which would have required brokers to adopt a fiduciary duty when advising on some retirement accounts, was vacated by the U.S. Fifth Circuit Court of Appeals earlier this year.

Industry insiders said Clayton will likely have to hold off proceeding with the rule until Roisman and a replacement for Stein, whose term ends this year, are in place - a process that could take some months.

Reporting by Elizabeth Dilts in New York; additional reporting by Michelle Price in Washington; editing by David Gregorio and Lisa Shumaker