In the 1990s, a wholesaler could walk into an advisor’s office with a pack of golf balls, a factsheet and a high Morningstar rating, and easily sell a mutual fund.

“It would be the doughnuts and coffee in the morning, it would be the pizza delivered at the end of the day, there would be sandwiches at lunch,” says Bill Connolly, co-head of global distribution at Putnam Investments. “Those were the three prime opportunities for someone to get up and pitch a product.”

But times change. Advisors are less focused on transactional business; they often have their own independent research groups at the home office. They don’t need product information, they simply look up any data they need on their desktop.

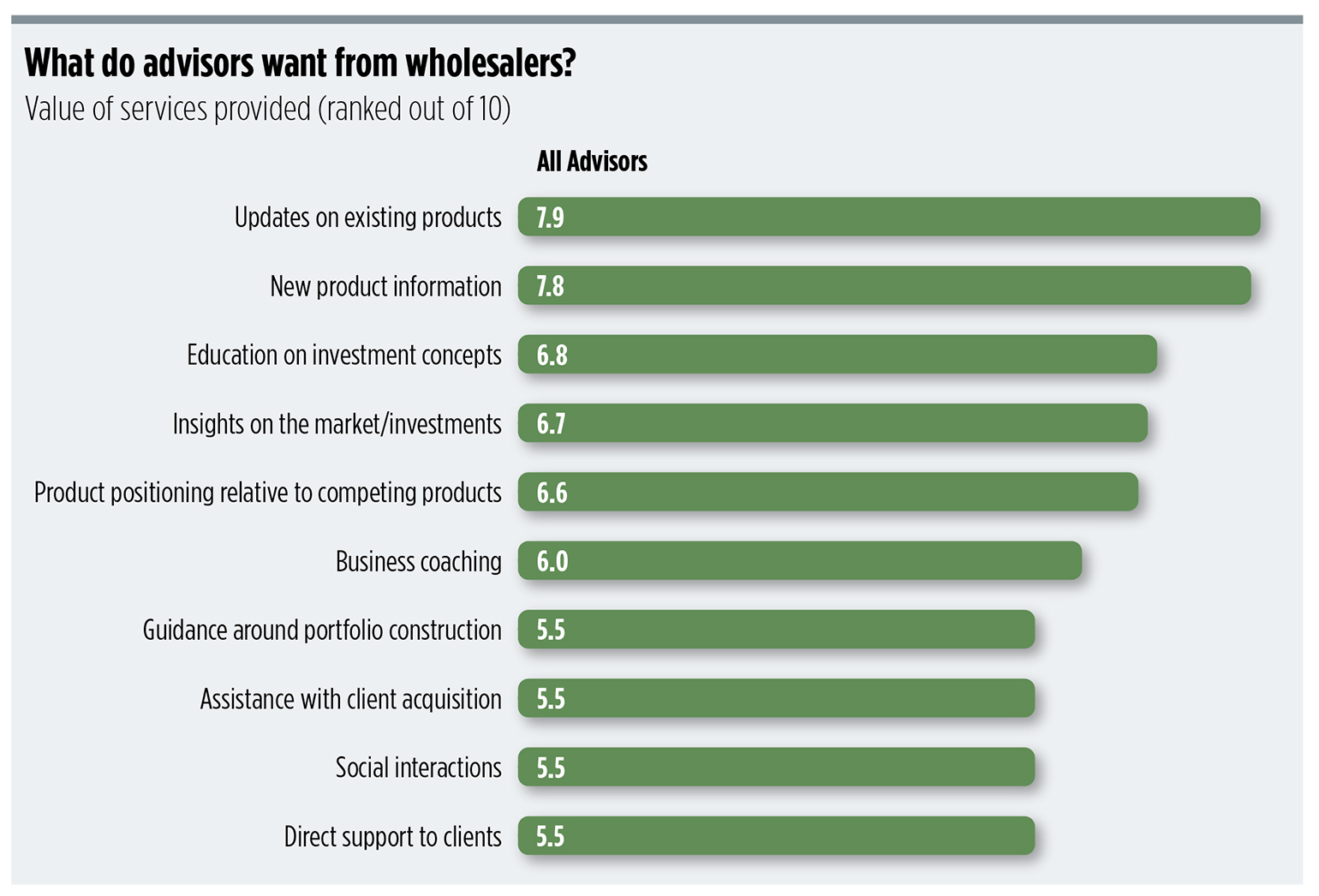

Add to this the rise of passive investment funds, a proliferation of niche investment products for retail advisors, and more demands on advisors’ attention from non-investment focused pieces of the business, it’s no wonder advisors said in a recent survey that they only want to meet with their top two or three wholesalers. And only then about twice a year.

These dynamics are converging to bring significant change to the wholesaling business. DST kasina, a research and consulting firm, expects wholesaling ranks to shrink by five to 10 percent this year, driven by a combination of attrition and consolidation among asset managers.

Neil Bathon, founder and partner of FUSE Research Network, has an even darker view on the future of distribution: in three years, wholesaling teams will be cut in half and the numbers will continue to fade from there, he says.

“There are very few things I’m more certain of than the fact that there are limited opportunities for wholesalers to influence buying decisions, and it gets more and more limited every month,” Bathon says. “I had a woman come up to me after one of my presentations and she said, ‘I’ve consistently been the top wholesaler at our firm and I think I have about a three-year window to try to figure out how to reinvent myself in order to be relevant.’”

Asset managers are already starting to cut the cost of expensive “road warriors” in favor of smaller numbers of home-office distribution teams focused on big data and analytics to target the advisors with whom they have the best chance of success.

To stay relevant, wholesalers will need a broader skillset to help advisors with facets of their business beyond product selection — including portfolio construction, asset allocation, and even financial planning and practice management.

Data and Analytics

The largest asset managers have invested heavily in building out their business intelligence functions to help them make more informed data-driven decisions, says Lee Kowarski, vice president, DST kasina.

“They are really arranging wholesaler coverage, territory design and the advisors that they call on based on an analytics-driven assessment of the opportunity,” Kowarski says.

Managers will allocate sales resources based on advisors’ preferences and the profitability of those relationships. For example, advisors who outsource portfolio management decisions to their home office require a different type of support than those who maintain discretion, he says.

Firms pool this data from different sources, including their own internal CRM systems, marketing automation tools and web analytics. Third party research firms, such as DST kasina and Discovery Data, also serve up plenty of data. Some broker/dealers will even provide asset managers with data packs — either at a cost or for free — to give greater context around the advisors that work at the firm.

“To have a large (wholesale) field force spread around the United States, or in some cases around the world, it's a pretty expensive proposition,” says Jim Jessee, president of MFS Fund Distributors and co-head of global distribution at MFS Investment Management. “To make sure that their time allocation is based on more information and data, as opposed to just gut instinct, makes an awful lot of sense. I think the good thing is, over the last decade, the data that's available to help us with those decisions is better.”

For instance, MFS looks at daily sales data and the type of funds being bought to gauge the likelihood that a certain advisor would be ready to place more business.

But the problem is that everyone has access to largely the same data, so wholesalers from different firms end up approaching the same advisor, Bathon says.

“Thirty firms come across that same advisor, and they send all of their wholesalers to go meet with them because they meet the profile,” he says. “A person only really wants a relationship with four or five firms, so the other 26 are just noise and a waste of time.”

Internal Wholesaler

Internal Wholesaler

According to Discovery Data, there are 106,000 branches with just one rep in them. There are 21,000 independently owned retail RIA firms. In 10 years, that’ll grow to 40,000 firms with some 150,000 advisors.

“How do you cover that? You can’t do it with boots on the ground,” says Bob Herrmann, president and CEO, Discovery Data. A response to an email-marketing message can yield more discussions with a far lower acquisition cost than having sales reps blanket the country and knock on doors.

Internals can have 15 to 25 good conversations with advisors a day, says Jessee. That would be impossible for external wholesalers. That’s why MFS has about twice as many internal folks than they did a decade ago.

The Skillset

Wholesalers who still interact with advisors have to offer more than just a product pitch, says Craig Pfeiffer, president and CEO of the Money Management Institute.

To help explore that idea, the group hosted its inaugural Distribution Leadership Forum in February, where top wholesalers could share what has worked for them.

“We’ve got to come in and not only help [wholesalers] think about the investment management side, but also the conversation with the client side. How do we engage a client, how do you tell that story, how do we manage this across our book,” says John Moninger, national sales director at Eaton Vance and co-chair of the Distribution Leadership Forum.

The truth is there is a growing mismatch between advisors’ priorities to focus on client engagement, and in many cases financial planning and the wholesalers, who still want to talk about investment products and markets, he says. The best wholesalers in the business are “end-client-savvy." They understand the issues clients are facing, such as the impact of taxes or generational shifts driving Environmental, Social and Governance investing.

Wholesalers are also trying to prove their value by bringing a deeper understanding to an advisors’ overall portfolio construction, including asset allocation and portfolio management, and how the pieces work together, Bathon says.

Technology has enabled Eaton Vance’s wholesalers to customize equity and bond portfolios through its suite of separately managed accounts. A firm can customize the portfolio to emphasize tax loss harvesting, or tilts towards client-specific priorities like, perhaps, socially responsible investing.

Putnam’s Portfolio Navigator modeling tool can identify and track dozens of investment risk factors in a portfolio. The advisor will receive a customized report showing the breakdown of current risks, the impact on returns over time, historical scenario analysis and stress testing.

“The wholesaler who's going into the branch needs to know a broad range of his or her products,” Jessee says. “They're not going to have a portfolio manager with them that often, so they've got to be able to carry that conversation and they have to be able to pivot.”

Emphasizing the level of skill and knowledge wholesalers need today, about 40 to 50 percent of MFS’ wholesalers hold either the CFP or CIMA designations — each of which come with fairly rigorous continuing education requirements that are pretty rigorous.

“[Advisors] will find the time for the people that they find are truly exceptional and build barriers to entry for average or worse, in terms of the skillset,” he said. “So, I think it is a challenge to the wholesaling community that you better be viewed as exceptional because those people will be granted the audience; the others will probably be blocked by their administrative assistants, or they'll end up leaving lots of voicemail messages.”