Investors felt better about their advisors in 2023 than the prior year, according to an annual study conducted by J.D. Power.

However, millennials with money are uncertain about whether to stay put with their current advisor; 36% of respondents in this group indicated they "probably or definitely" will switch firms in the coming year.

Investor happiness often parallels stock market performance, as it seems to do with the current survey, but J.D. Power Global Head of Wealth Craig Martin cautions firms to “build a deeper level of engagement” with clients to be ready for the eventual downturn.

“This is especially true among the younger segment of investors who show lower levels of client loyalty than investors in other generational groups,” he said. “Advisors will need to adjust their approach to meaningfully connect with younger investors or risk a major outflow of assets in coming years.”

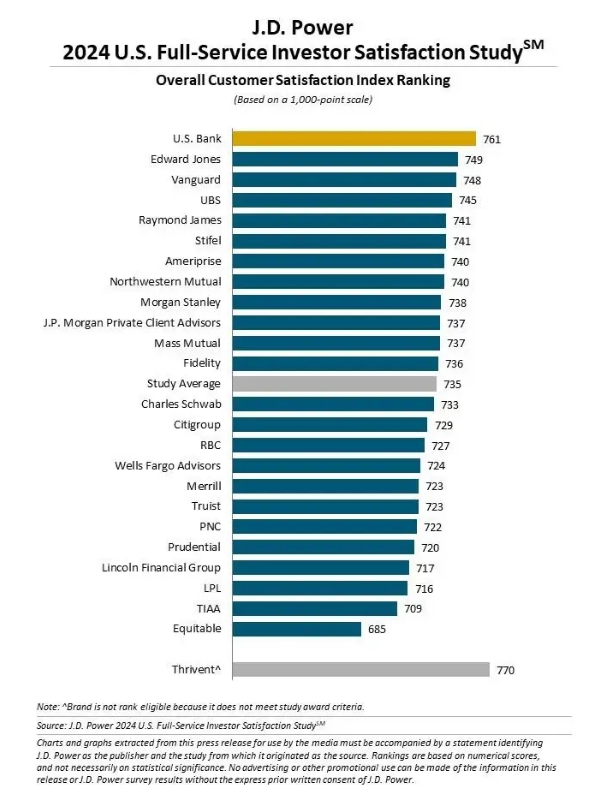

Overall investor satisfaction with their advisors jumped eight points from the prior year’s survey to 735 (on a 1,000-point scale). U.S. Bank ranked the highest in “overall investor satisfaction,” with a score of 761. Edward Jones ranked second at 749, barely beating out Vanguard at 748. UBS and Raymond James rounded out the top five at 745 and 741, respectively.

This is the survey’s 22nd year; J.D. Power received 9,951 responses between Jan. 2023 and Jan. 2024 from investors working directly with an advisor or advisory team.

Nearly nine out of ten investors reported they’d logged into their account via a firm’s website in the past year, while six out of ten did so through a mobile app.

Attrition is mostly low among Gen X and older clients, but for millennials with more than $1 million in investible assets, 36% said they’d likely change firms within the year. J.D. Power speculated that this could be partially due to the fact that seven out of ten affluent Millennials reported they have a secondary investment firm, far higher than older demographics.

In last year’s study, J.D. Power found 27% of millennial and Gen Z respondents reported they’d definitely or probably change firms in the next 12 months, with nearly half saying they worked with a secondary investment firm.

Investors’ satisfaction in the 2022 survey dropped 17 points from 2021 (in the previous year, the score climbed from 732 to 744). Like this recent survey, the movement mirrored the market, which suffered its worst performance in 15 years in that timeframe.