Digital engagement between asset managers and financial advisors is on the rise, according to a new study from J.D. Power analyzing asset managers’ digital engagement with advisors from this year.

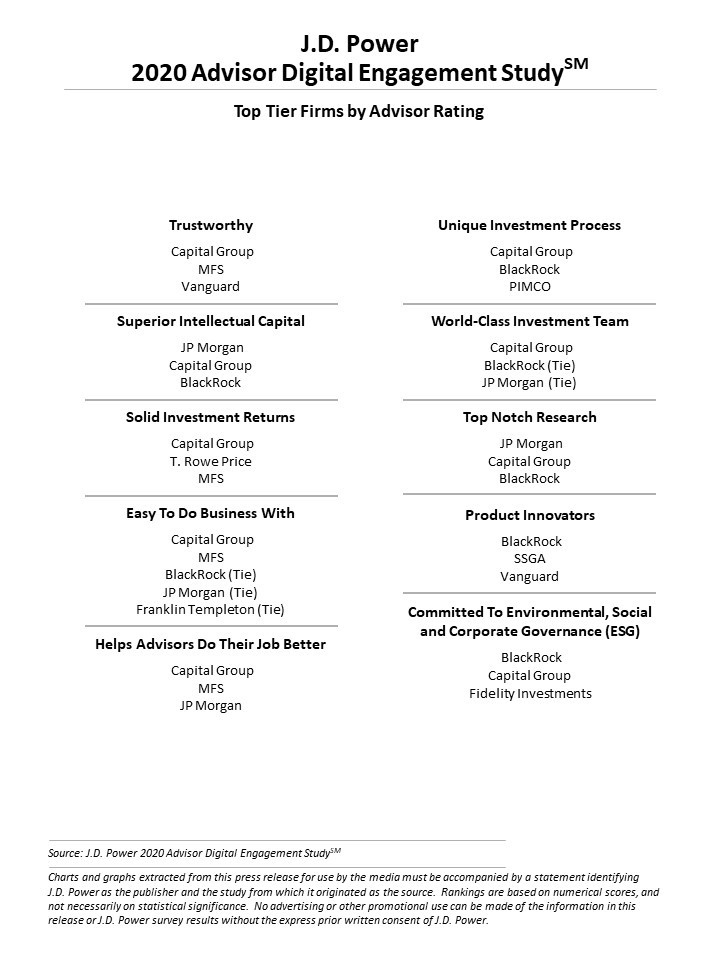

The second annual “Advisor Digital Engagement Study” also indicates that the asset managers investing in digital relationships with advisors, including BlackRock, JP Morgan, Capital Group and MFS, were also the firms seeing the highest amount of investment inflows from advisors. According to Mike Foy, senior director of wealth and lending intelligence with J.D. Power, asset managers’ ability to build relationships with advisors requires investment in digital engagement and has only become more important during 2020.

"That trend has been occurring for some time, but it has really ramped up during the pandemic, with wholesalers unable to meet face to face and advisors citing higher levels of stress and increased workloads,” he said. “Against this backdrop, asset managers need to provide easy access to relevant content and resources across multiple digital channels, including content that can help them do their job more effectively and build their practice.”

The study was based on 26,174 brand evaluations among 1,330 financial advisor respondents between May and July 2020, with the digital engagement studied including email, apps, podcasts, social media, webinars and websites. Because of the pandemic, advisors feel like they’re under greater pressure; according to the study, 58% said they had higher stress and anxiety, while 25% reported an increased workload. Therefore, advisors were particularly pleased with any digital engagement that made accessing content from asset managers easier.

Webinars proved to be the most effective form of engagement, with 56% of advisors responding that they’d attended a webinar by their primary asset manager at some point in the past six months, a 22% boost from the year before. While 55% of advisors said they would be more likely to invest in those brands that are more highly committed to ESG, advisors were uncertain of asset managers’ commitment to ESG issues, with advisors reporting that only 15% of the brands they worked with were genuinely interested in ESG concerns.

Interestingly, those advisors with 16 years or more of experience in the financial services industry were more likely to report that they relied on digital engagement with their asset managers, as opposed to advisors with five years or less of industry experience. And independent brokers were more interested in engaging with asset managers digitally, as opposed to brokers in one of the wirehouses.