(Bloomberg Gadfly) --It’s time for financial professionals to become a profession in substance, not just in name.

The Securities and Exchange Commission proposed new rules for brokers and financial advisers last week. Observers have understandably focused on the big change, which requires brokers to disclose their conflicts and look after clients’ best interests.

But a more modest proposal deserves discussion. Namely, the SEC would subject financial advisers to continuing education requirements.

It’s a wise move. Financial innovation is happening at a dizzying pace. More investment options are available today than ever before, spanning many different types of assets, geographies and investing styles, and new products are coming to market all the time.

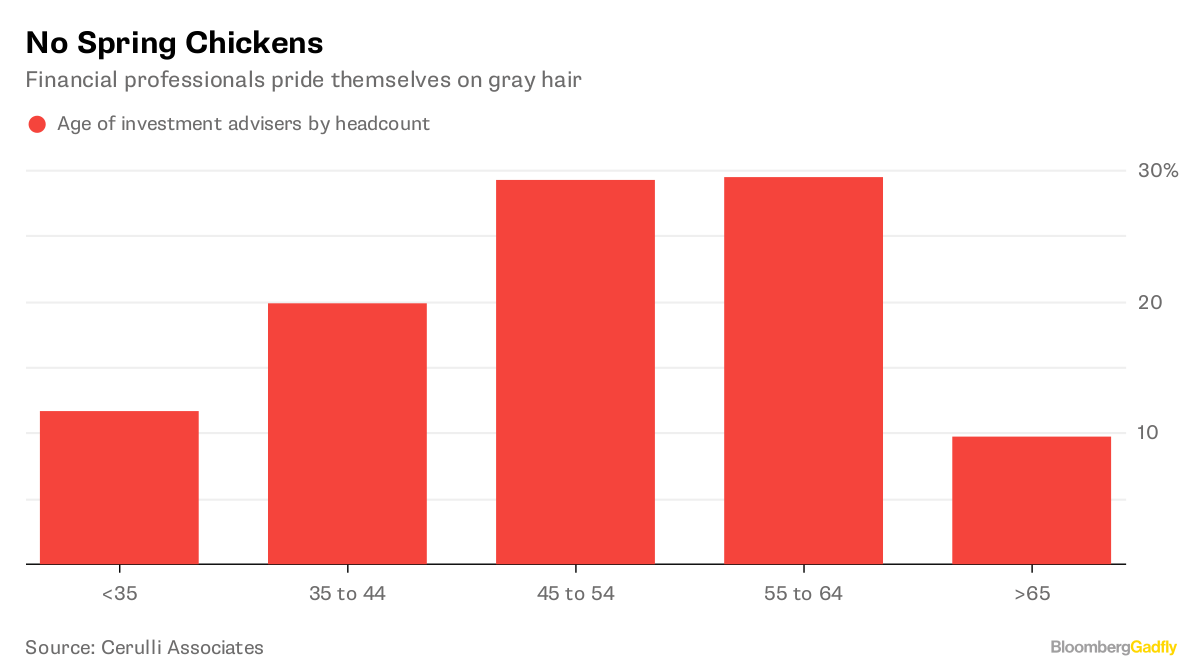

That’s a challenge for an aging industry. The average age of financial advisers is 50, according to Cerulli Associates, and just 11.7 percent of advisers are younger than 35. Whatever advisers learned when they were trained for the job decades ago is most likely outdated.

It’s not even clear how much advisers knew to begin with. Investors would be aghast if they realized how easy it is to become a financial “professional.” Investment advisers must simply take a three-hour exam and answer just 72 percent of the questions correctly.

Brokers have a slightly higher hurdle. They’re generally required to pass two exams, and they’re already subject to continuing-education requirements.

Compare those barriers with the demands of any other profession. Doctors, lawyers and accountants are subject to multiyear formal education, famously rigorous licensing exams and continuing education. The work of financial professionals is just as important. Why do investors demand so much less of them?

One of the SEC’s stated objectives is to apply “consistent principles” to advisers and brokers. This would be a good place to start. In a column I wrote in March 2016, I said that, in addition to continuing-education requirements, advisers and brokers should have to “complete a minimum amount of undergraduate or graduate-level course work in finance, accounting or economics and pass a multiday comprehensive exam that covers -- at a minimum -- law and regulation, economics, financial statement analysis and portfolio management.”

I received a mountain of passionate emails at the time, much of it from advisers and brokers. Readers pointed out that many financial professionals are well-meaning practitioners that “make a positive difference in the lives” of their clients and that no amount of education and training would deter unscrupulous actors. That's all true, but it shouldn’t be an excuse for holding financial professionals to a lower standard than other professions.

And it would be easy to raise the bar because the necessary pieces are already in place. Finance, accounting and economics -- and given the industry’s turn to quantitative investing, let’s add statistics -- are widely taught in colleges and universities. Organizations such as the CFA Institute and the CFP Board have administered rigorous and comprehensive multiday exams for financial professionals for decades. (Full disclosure: I’m both a financial adviser and CFA charterholder.) All that’s needed is the willingness to hold the industry to a higher standard.

Granted, it’s probably unrealistic to impose new educational and exam requirements on the current crop of advisers and brokers. But those requirements can be adopted for the next generation, and everyone should commit to keeping their skills current through continuing education.

If regulators won’t compel financial professionals to reach higher, they ought to do so voluntarily. Investors are handing ever more of their money to index funds, robo-advisers and other computer-based alternatives to human professionals. It’s only a matter of time before investors turn their financial planning over to the bots, too. If professionals are serious about competing, they’ll have to persuade investors that they know as much as the machines.

The SEC is right to demand that financial professionals look out for investors’ best interests. But that’s not enough. They must also have the tools to live up to that lofty standard.

Nir Kaissar is a Bloomberg Gadfly columnist covering the markets. He is the founder of Unison Advisors, an asset management firm. He has worked as a lawyer at Sullivan & Cromwell and a consultant at Ernst & Young.

To contact the author of this story: Nir Kaissar in New York at [email protected]