In the financial world, Bitcoin continues to be a hot topic of debate that fosters a wide array of viewpoints. Many of these differing outlooks even come with colorful monikers—HODLer, FUDster, Shill, Whale and Diamond Hand. While opinions may vary, there is one aspect of Bitcoin that remains constant and irrefutable …taxes. When you sell Bitcoin for a profit, there will be tax consequences.

Taxation

Bitcoin is classified as property by the IRS and is taxed as such. As with the sale of stocks, the applicable capital gains tax rate depends on the duration that the investment is held. A sale within a year of purchase will be taxed at the ordinary income rate (greater than 50% in certain high-tax states), but if more than a year, the lower, long-term capital gains rate applies (20% plus the state income tax rate).

Quick note: Both the ordinary income tax rate and the long-term capital gains tax rate are projected to increase for wealthy Americans as part of the 2021 year-end tax legislation.

While the meteoric rise of Bitcoin over the past 10 years has created remarkable wealth for its owners, it has also generated significant tax bills. For example, let’s use the case study below to highlight the effects taxes have on performance …

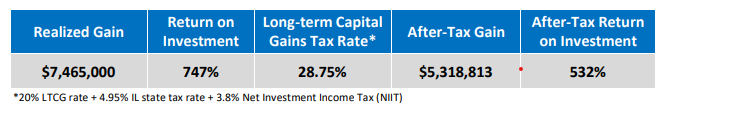

Case Study: A high-net-worth individual in Illinois makes a $1 million Bitcoin investment in January 2019 (BTC-USD $3,798) and then sells the entire investment in January of 2021 (BTC-USD $32,150) for $8,465,000.

As the table illustrates, the impact that taxes can have on Bitcoin returns is substantial; yet, oftentimes, it is overlooked.

Mitigating Tax Exposure

One way to manage tax exposure with Bitcoin is to “tax harvest” losses when they occur. Unlike equities, Bitcoin does not have a “wash sale” rule in place. This gives investors the opportunity to lock in a Bitcoin loss and then simply buy it back again. Executing this type of “wash sale” allows the investor to essentially retain the same Bitcoin position while generating a desirable tax loss. Unfortunately, this strategy serves only as a short-term solution with the benefits eventually canceling out over time. The harvesting simply lowers the overall basis of the Bitcoin investment which will actually increase the future tax obligation following any subsequent sales at appreciated prices.

A more effective tax-mitigating strategy, and one that has only recently been made available, is to place a Bitcoin-like investment into a private placement life insurance (PPLI) wrapper. PPLI is an investment-oriented life insurance solution that can be an effective tool for estate planning and wealth accumulation. Assets housed within a PPLI wrapper grow tax-free and offer tax-advantaged distributions through withdrawal of basis, policy loans and/or the tax-free death benefit. Investment options within a PPLI strategy are limited to insurance dedicated funds (IDFs). These funds are exclusive to insurance policies and subject to strict guidelines regarding diversification and investor control. Recently, NYDIG, a leading Bitcoin custodian, launched a Bitcoin-tracking IDF that is designed to deliver a 1-for-1 Bitcoin return. Due to the diversification requirements, a direct investment in Bitcoin would not be permissible so this type of synthetic tracker is necessary.

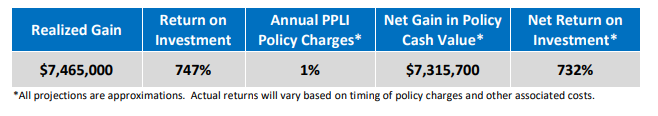

When comparing a PPLI investment with a taxable equivalent, advisors must weigh the tax benefits against the cost of the insurance wrapper. As a general rule, PPLI carries a charge of approximately 100 bps/year on average. Thus, lower-yielding/minimal-return assets that might not exceed the cost hurdle are not ideal candidates. However, assets with greater upside and the potential for strong performance (like Bitcoin) may be better suited.

Using the aforementioned case study as an example: If the same investor were to have purchased $1 million of a Bitcoin equivalent IDF within an existing PPLI policy, the net rate of return would have been significantly higher (as shown in the table below).

The structuring of an asset can play a critical role in its overall performance. For those advisors and investors who believe that there is still room for significant gains in Bitcoin, placing the asset (or a tracking equivalent) in a tax-advantaged vehicle can effectively increase returns.

Jason Chalmers is a director at Cohn Financial Group.